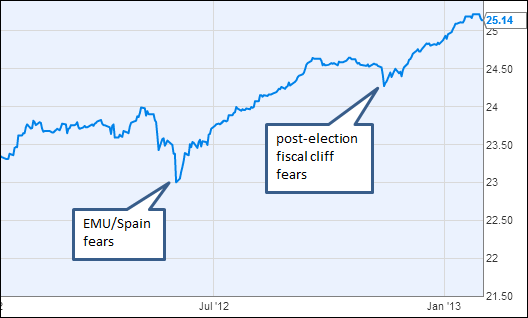

Expectations of rising interest rates in the US are creating demand for traded HY corporate loans (also called "leveraged loans" -- see discussion). These products typically pay LIBOR plus a fixed spread, which means that the coupon will grow if short-term rates increase. As an example, Invesco’s PowerShares Senior Loan fund (ticker: BKLN), which is supposed to track the price and yield of the S&P/LSTA Leveraged Loan 100 Index, has recently reached $1.5bn in assets. The fund's yield is currently below 5% (keep in mind these are sub-investment-grade companies), making it vulnerable to credit shocks.

Source: Ycharts

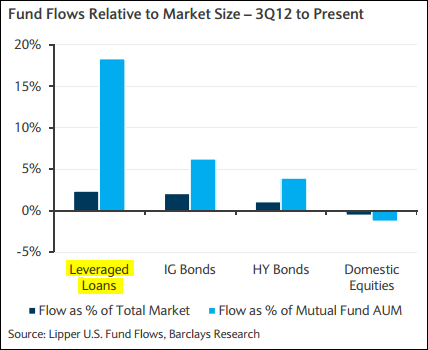

Yet the floating-rate nature of the portfolios keeps investors flooding in, as they become less sure about the timing of the Fed's eventual tightening. In fact, relative to the the market size of each of the asset classes, leveraged loans have seen by far the largest inflows.

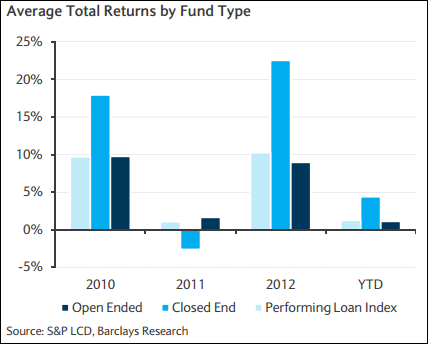

The demand for this asset class can be seen in the outperformance of loan closed-ended funds. These funds can trade at a premium or a discount to NAV, which can result in out/under-performance vs. the underlying index.

With the CLO market booming (CLO's securitize these corporate loans -- see discussion), Barclays remains bullish the loan asset class (in spite of the recent rally). There simply isn't enough floating rate product in the market currently to meet this demand.

Barclays Capital: The insufficient quantity of new loan product has forced investors to continue harvesting the secondary market to avoid accumulating too much cash, as demand technicals continue to be very strong across all major classes of leveraged loan investors. With more than $9bn in new CLOs priced, January was the busiest month for CLO creation since 2007. In addition, loan mutual fund inflows have been robust of late, as investors continue to look for ways to protect against rising interest rates. Cumulative flows for the first four weeks of the year already exceed $3bn. ... Unless rates reverse course and move materially lower, we expect favorable loan flows to continue.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Focused On Leveraged Loans

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.