Markets absorbed the hawkish Fed announcement rather quickly as Wall Street staged a rebound overnight. DOW closed 108.88 pts or 0.67% higher at 16331.05 while S&P 500 closed 11.24 pts, or 0.60% higher at 1872.01. Long term yields ended mixed and seemed there was no follow through upside momentum yet. Gold also recovered mildly after diving to as low as 1320.8. Dollar index pared back some gains but is holding well above 80 handle for the moment. In the currency markets, the greenback retreated mildly against other major currencies. Technically, it should be noted that USD/CAD is clearly bullish. However, the greenback is still technically in short term down trend against Euro, Swiss Franc and Aussie. These pairs are holding on to 1.3642 support in EUR/USD, 0.8895 resistance in USD/CHF and 0.8890 support in AUD/USD.

Main focus will turn to Canadian dollar today with some important economic data release. Headline CPI is expected to drop back to 0.9% yoy in February while core CPI is expected to drop back to 1.1% yoy too. Retail sales are expected to rose 0.8% mom in January with ex-auto sales up 0.9% mom. The Canadian dollar was under much pressure this week after BoC governor Poloz's comments. He noted that inflation data to be released today would be softer, due to a sharp movement in February last year. And Q1 growth will be on the soft side. Also, he noted BoC is open to a rate cut "if the balance of risks were to shift so that the risks on the downside for inflation were increased".

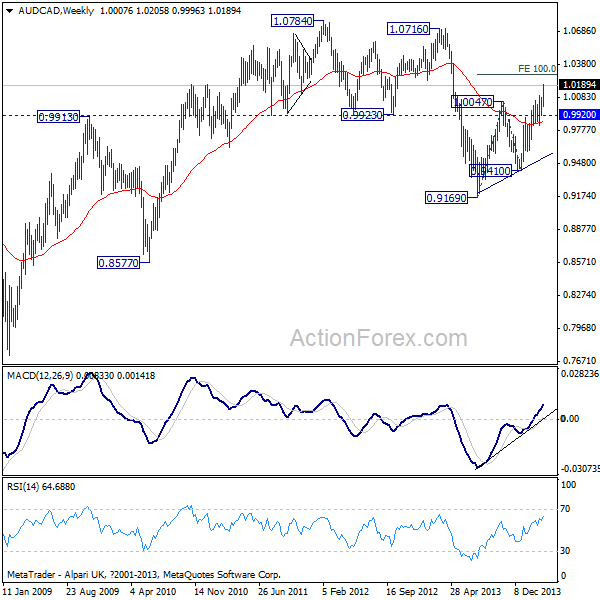

While dollar is strong, AUD/CAD is indeed the biggest gainer this week. The cross is extending the up trend from 0.9410 to as high as 1.0205 so far. Taking a look at the big picture, the cross formed long term double top at 1.0784 and 1.0716. Price objective should be met in the fall to 0.9169, which then formed a medium term bottom. At this point, there is no clear evidence on whether rise from 0.9169 is an impulsive move or a corrective move yet. But in either case, we'd likely see such rally continues to 100% projection of 0.9169 to 1.0047 from 0.9410 at 1.0288 and above. And, we'll stay bullish in the cross as long as 0.9920 near term support holds.

AUD/CAD Weekly" title="AUD/CAD Weekly" align="bottom" border="0" height="242" width="474" />

AUD/CAD Weekly" title="AUD/CAD Weekly" align="bottom" border="0" height="242" width="474" />

Elsewhere, Australian conference board leading indicator rose 0.2% in January. Eurozone current account, consumer confidence, UK public sector net borrowing will be released today.