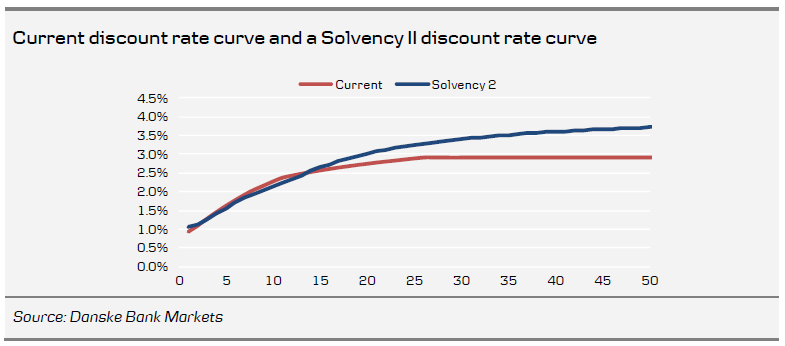

After the plunge in long-term interest rates in mid-2012, Denmark and the Netherlands introduced Solvency II (S2)-type discount curves for their insurance companies and pension funds, resulting in solvency relief as well as drastically reduced interest rate risk and convexity for the liabilities. In Sweden the FSA introduced the discount rate floor. This temporary floor is set to expire in June this year, and the question is, what will the effect from a S2 discount rate curve be if implemented instead?

We assume that such an S2 discount curve (if introduced) would be based on swaps and that the last liquid point would be the 10y swap, as outlined in the QIS5. This would result in a delinking of market and discount rates beyond the 10-year. The major differences between the two discount rate mechanisms are the changes to the dynamics of interest rate hedging, specifically the convexity as well as the volatility of the hedge ratio. From the perspective of the reduced convexity, this would to a larger extent involve linear instruments (e.g. swaps) rather than non-linear instruments. The hedge ratio is set to almost double from 35% to 60% if an S2 curve is introduced (this is an estimated effect on our “model company”, which approximates the whole sector). Although we doubt that such a high hedge ratio is desired given the low interest rates, we nevertheless assume that companies will accept a slightly higher hedge ratio, say 40%.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Focus Sweden: What If A Solvency II Style Curve Is Introduced?

Published 01/29/2013, 03:34 AM

Updated 05/14/2017, 06:45 AM

Focus Sweden: What If A Solvency II Style Curve Is Introduced?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.