Market movers today

- The main data release today is the FOMC minutes from the July meeting, which we get tonight. A lot has happened since the last meeting so the minutes may seem hawkish in the current context.

- Today, PM Boris Johnson is meeting with German chancellor Angela Merkel to, among other things, discuss Brexit. In his letter Monday, Johnson made it clear that the backstop needs to be removed for the withdrawal deal to pass the House of Commons but the EU has repeatedly rejected this, as it sees it as a necessary insurance policy to avoid a hard border. The swift refusal yesterday led to a depreciation of GBP.

- In Scandi, we get Norwegian unemployment and Danish employment figures. The Danish figures will reveal whether the latest slowdown in employment growth is due to the economy reaching full employment or due to the global slowdown beginning to take its toll on the Danish economy.

Selected market news

It has been a mixed session in the Asian equity markets this morning, while we wait for more clarity on a number of political events such as the trade war between the US and China, Brexit and the recent political uncertainty in Italy. On top of this we have the global monetary outlook where central banks are expected to ease.

US Treasuries rallied modestly yesterday as US equities declined, but we are still some 5-6bp above the lows seen earlier in August.

Yesterday, Italian PM Conte resigned on the back of Vice PM Salvini calling for a vote of confidence on the government. Italian government bonds rallied as the market expects a new coalition of a more pro-business and pro-EU government. However, it is now in the hands of the Italian President to explore the possibility of a new government or whether to call for a general election.

US President Trump continues to call for more rate cuts and thus there will be focus on the FOMC minutes tonight and Fed President Powell's speech at the conference in Jackson Hole on Friday. President Trump has cancelled his trip to Denmark as the Danish PM Frederiksen refused to sell Greenland.

Scandi markets

We get labour market data from Denmark and Norway. Norway publishes unemployment for June. Unemployment is expected to be unchanged from May. In Denmark, employment data for June are released.

Fixed income markets

European government bond yields decline as European equity markets again suffer. Hence, bond yields follow US Treasuries down. The political situation in Italy is challenging after PM Conte resigned yesterday, and we are looking at a potentially volatile trading day in Italian government bonds,

Today, we have auctions in Denmark and Germany. Germany is launching a new 30Y Benchmark DBR 0% 08/50. This is the first time ever for Germany to issue a 30Y bond with a coupon of 0%. The German Debt Agency will sell to EUR 2bn at the auction today.

We expect it will be priced 3-4bp above DBR 1.25% 08/48. Given the low yields and the liquidity in the secondary market demand at the auction is likely to be modest. We recommend buying the new 30Y versus swaps as the trade has positive carry and the ASWspread is very tight ahead of the expected reopening of QE.

In Denmark the Debt Office will tap in the DGB 0.25% ’22and DGB 0.5% ’29. We expect to see solid demand for the 10Y benchmark as it is the bond with the least amount of negative carry among Danish government bonds see more in our preview.

FX markets

Among the Scandies, EUR/DKK continues to inch lower and reached the lowest level since last year around 7.4560 yesterday. We think the drop is most likely due to positioning ahead September’s ECB meeting: as expectations rise of aggressive ECB easing, so has the chance that Danmarks Nationalbank will not fully match ECB’s easing package, which would send EUR/DKK lower. Also, yesterday, at the same time as af Jochnick reiterated the Riksbank’s official view on the SEK (“the krona expected to strengthen”), USD/SEK took out a fresh new 17-year high, briefly trading above 9.73 (highest since mid-2002) before falling back towards 9.70 once again. Current sentiment is like poison for the procyclical SEK, with flight from risk and seemingly ever-increasing uncertainties regarding the global economic outlook – not to mention the still attractive USD vs SEK carry, which we argue has played a big part in the trend-wise incline of USD/SEK as of late. As we forecast an even stronger USD in the short term, and in due time expect the Riksbank to abandon their hopes of reaching zero, it is not hard to envisage an even higher USD/SEK in the short-term. Our 3M (NYSE:MMM) forecast currently stands at 9.82.

In majors, focus on FOMC minutes due to release ahead of Powell speaking on Friday at Jackson Hole, but it is more likely to be the latter that can make us wiser on whether we are in for a series of cuts. While we might end there – we look for five more cuts from Fed by early 2020, see also Presentation: Five more cuts from the Fed (chart pack) – it is probably too early for Fed to commit to it which could keep USD strength in place for now.

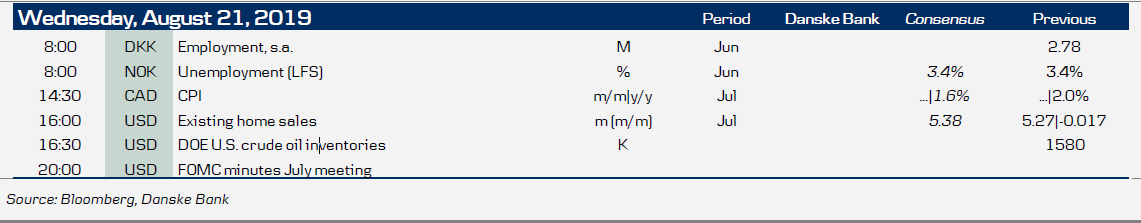

Key figures and events