EUR/USD

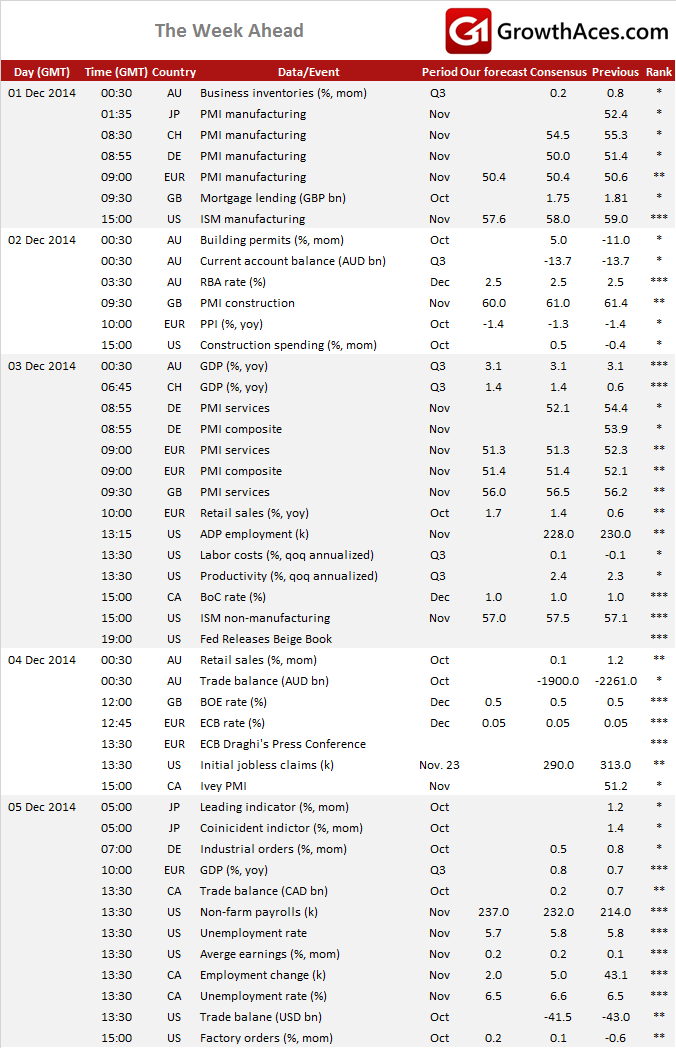

A relatively calm week is behind us and an eventful week ahead of us. Investors will be focused mainly on the ECB meeting (Thursday) and the U.S. non-farm payrolls data (Friday). We have also Eurozone PMI (manufacturing on Monday and services on Wednesday), GDP, retail sales (on Wednesday) and U.S. ISM (manufacturing on Monday and non-manufacturing on Wednesday).

What will the ECB do? It will certainly revise downwards its GDP and CPI projections. Moreover, the ECB President Mario Draghi is expected to drop a hint of additional measures (the most probable scenario). On the other hand, he is likely to say more time is needed to assess the effectiveness of the already announced measures (TLTRO). Draghi may also surprise the markets with an immediate decision to broaden the asset purchase program, but in our opinion it is a less probable scenario. In the next step of the ECB would likely target the non-financial corporate bond market. In the opinion of GrowthAces.com the likelihood of announcing the sovereign quantitative easing this week is very low.

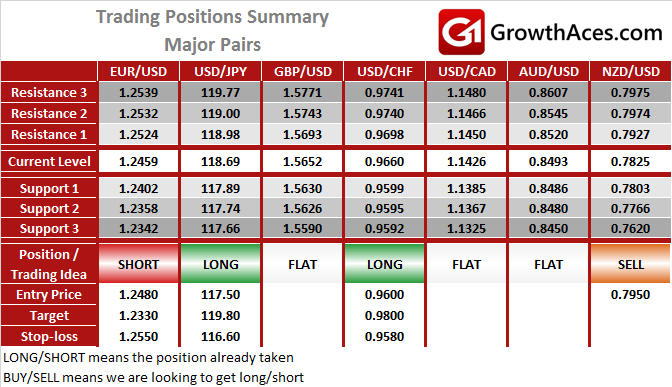

GrowthAces.com stays EUR/USD short. Our short-term target is 1.2330. The medium-term outlook remains bearish.

GBP

The Bank of England’s Monetary Policy Committee meets on Thursday, December 4. It is widely expected that the MPC will keep the rate at 0.5% and its stock of asset purchases at GBP 375 bn. We should notice one very important event last week for the GBP traders. MPC member Kristin Forbes in her testimony to the Treasury Select Committee last Tuesday, put herself at the hawkish end of the majority voting for unchanged rates. She is likely to join two dissenters Weale and McCafferty soon. Nonetheless the BOE will probably wait at least until the May General Election before hiking. The GBP/USD is likely to fall slightly in the short term, but the medium-term outlook is mixed. The GBP is likely to remain relatively strong vs. non-USD major currencies.

JPY

The divergence between monetary policies and pace of economic growth in the United States and Japan is a key factor determining the rise in the USD/JPY rate. A key resistance level is 118.98 (November 20, high). GrowthAces.com stays USD/JPY long with the target at 119.80.

AUD

The Reserve Bank of Australia meets on Tuesday. We expect the cash rate to remain unchanged at 2.50%. The bank will likely maintain its conclusion that the most prudent course is likely to be a period of stability in interest rates. The RBA’s decision will probably not have a direct impact on the AUD/USD. The most important macroeconomic releases for the AUD traders this week will be: Australian GDP for the third quarter, retail sales, Chinese PMI and US employment report. In the medium term the AUD/USD will be under pressure coming from low commodity prices and ongoing verbal intervention by RBA officials.

CAD

The Bank of Canada also meets this week (on Wednesday). The bank is widely expected to keep interest rates unchanged. The most important event for the CAD traders will be rather US non-farm payrolls as well as Canadian employment reports (on Friday). The CAD will be also under pressure of low oil prices.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Focus On Central Bank Decisions This Week

Published 12/01/2014, 03:39 AM

Updated 07/09/2023, 06:31 AM

Focus On Central Bank Decisions This Week

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.