After Thursday’s and Friday’s market moves courtesy of the Swiss National Bank, the weekend came as a bit of a relief. I think we have had enough FX news for the whole of 2015 already in the past fortnight. Of course, the fall-out from the Swiss National Bank’s decision to end its floor arrangement in EUR/CHF will have further reaching consequences for the Swiss and European economies through the coming year than just a couple of sessions of FX volatility. This week’s central bank news is expected to be no less interesting than the moves from Zurich a couple of days ago.

This is the week for the euro. By the time I write next Monday’s Morning Update we will know whether the European Central Bank has delighted or disappointed market participants at its Thursday afternoon policy meeting and what the latest Greek government should look like following Sunday’s elections. The single currency was sideswiped aggressively from the Swiss National Bank’s decision – as I highlighted here to the BBC on Friday – and we expect the European Central Bank to continue the downturn.

According to Bloomberg, 93% of respondents to an opinion poll carried out towards the tail end of last week are expecting some form of quantitative easing from the European Central Bank at Thursday’s meeting. Weight of consensus that strong is normally reserved for questions such as ‘will the Bank of England hold rates again?’ and ‘does the sun rise in the East?’

Of course, the devil remains firmly within the detail. I am looking for the ECB to announce a plan that will see anywhere between EUR500bn-700bn of assets bought by the European Central Bank although without an explicit time frame that these purchases need be completed by. The target is to raise inflation and inflation expectations. I believe that the European Central Bank will signal that it is happy to continue buying assets until both of these measures recover. The tightrope of expectation is a very difficult path to walk; too few purchases and the plan will be viewed as a disappointment, far more than expected and critics will say that it absolves governments of the need for fiscal changes.

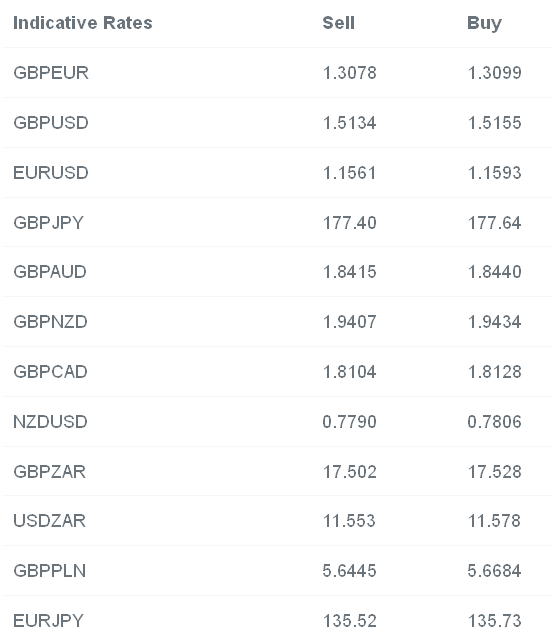

As to how the euro trades in the run-in to the announcement, we have to continue our thoughts that the weight of betting will see the single currency slip into the meeting. GBP/EUR remains above the 1.30 level this morning, while EUR/USD is a cent above the fresh nine-year lows it carved out on Friday afternoon.

The Greek elections are next Sunday and opinion polls continue to show the Syriza party leading the ruling New Democracy party by around three percentage points. While that may be a win for Syriza, it would only give the party the slimmest of majorities in government with decisions needing to be made within days of any party taking power. Greece’s current aid program is due to expire at the end of February, which would leave the country running out of funds by the summer if a new agreement with its international creditors cannot be sought. Plans to leave the euro and reschedule/reengineer the country’s debt pile will provide some serious volatility if the Syriza party makes waves next Sunday.

Between now and then, we have a fair amount of important data including the latest run of unemployment news from the UK. As we have seen in the United States in recent months, falls in the unemployment rate are by no means guarantees of rising wages. The hope is that Wednesday’s jobs report from the UK will show that wages are increasing at around 1.7%, definitive real gains with CPI running at 0.5% at the moment. Friday’s UK retail sales announcement is likely to follow the US measure as well, with falling demand in December following the import of Black Friday and the hideous behaviour that comes with it.