F.N.B. Corporation (NYSE:FNB) plans to further strengthen its consumer banking businesses. With this in mind, the bank announced a couple of plans, which are expected to improve efficiency and growth prospects.

Plan Details

F.N.B. has accelerated its branch optimization initiative, with the consolidation announcement of up to 20 branches of its retail banking subsidiary, First National Bank of Pennsylvania, this year. This strategy has been in place for past several years and will likely support its retail banking subsidiary to boost operating efficiency as the customers’ preference for technology-based services is on a rise.

Nonetheless, the bank remains committed toward its branch network, and the ongoing initiative includes opening branches in new markets.

Further, F.N.B., as part of its efforts to focus on core operations, will divest its consumer finance subsidiary, Regency Finance Company to Mariner Finance, LLC. As of Mar 31, 2018, Regency Finance had total assets worth $170 million and operated from 77 branches located in Pennsylvania, Ohio, Kentucky and Tennessee.

The deal, still subject to regulatory approvals and other customary closing conditions, is expected to close during the second half of 2018.

Strategic Objectives to Achieve

F.N.B. anticipates these efforts to further improve its liquidity position and boost the credit risk profile of the consumer loan portfolio. Also, the bank expects to offset costs related to branch consolidation from the gain on sale of its non-core business.

Further, the company believes that these two initiatives to have a “neutral impact to run-rate earnings and capital.”

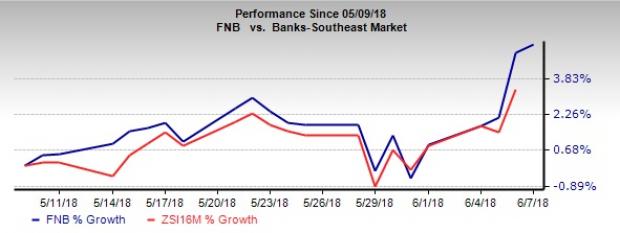

The stock has rallied 5.4% over the past month, outperforming the industry’s rise of 3.4%.

Currently, F.N.B. carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other banks including Wells Fargo (NYSE:WFC) , Bank of America (NYSE:BAC) and JPMorgan (NYSE:JPM) have also undertaken efforts to focus on core operations and consolidate branch network with an aim to improve efficiency.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

JPMorgan Chase & Co. (JPM): Free Stock Analysis Report

Wells Fargo & Company (WFC): Free Stock Analysis Report

Bank of America Corporation (BAC): Free Stock Analysis Report

F.N.B. Corporation (FNB): Free Stock Analysis Report

Original post

Zacks Investment Research