FMC Corp. (NYSE:FMC) will release its third-quarter 2016 results after the bell on Nov 2.

The chemical maker’s adjusted earnings for second-quarter 2016 topped the Zacks Consensus Estimate (a 2.99% positive surprise). However, revenues fell year over year, and missed expectations.

Let’s see how things are shaping up for this announcement.

Factors to Consider

FMC Corp., in August, raised its earnings guidance for 2016. The company now expects adjusted earnings in the band of $2.60-$2.90 per share (up from the prior view of $2.55-$2.85 per share) for the year.

The company expects third-quarter earnings for its Agricultural Solutions division in the band of $80-$90 million. For the Health and Nutrition segment, earnings for the quarter are expected to be between $44 million and $48 million. Moreover, FMC Corp. expects earnings for its Lithium unit in the range of $13-$17 million for the third quarter.

FMC Corp. faces challenging agriculture market fundamentals. Conditions in Brazil still remain weak, evident from a decline in volumes due to lower demand. Reduced acreage is affecting demand for crop protection products in the country. The agricultural market conditions are also expected to remain challenging in North America through 2016 due to elevated channel inventory levels and expected lower farm incomes.

FMC Corp., in August, lowered the revenue expectation for its Agricultural Solutions unit to roughly $2.2-$2.4 billion for 2016 from the previous guidance of $2.3-$2.5 billion.

The global crop protection market continues to face several woes, which has resulted in a difficult operating environment. FMC Corp. expects the global crop protection chemical market to decline by a mid to high single-digit clip in 2016 due to weak conditions in North America and Brazil.

Moreover, FMC Corp. is exposed to currency headwinds, stemming from a strong U.S. dollar. Currency hurt sales and earnings in the company's Agricultural Solutions segment in the second quarter and may continue to affect the division’s results in the third quarter. The company’s health and nutrition business is also susceptible to currency headwinds due to its significant euro exposure.

Nevertheless, FMC Corp. should gain from strategic investments, Cheminova A/S acquisition and new product launches. The company remains committed to expand its market position and strengthen its portfolio. Acquisitions and development agreements are also adding strength to the company’s agricultural business. In its lithium business, the company is seeing strong demand across specialty end markets.

The company is also making a good progress with the integration of the acquired operations of Cheminova A/S. The buyout reinforces FMC Corp.'s core agriculture business and expands its access in major agricultural end markets. The company expects to deliver $60 million to $70 million of Cheminova-related cost savings in 2016.

Earnings Whispers

Our proven model does not conclusively show that FMC Corp. is likely to beat earnings this quarter. That is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. That is not the case here as you will see below.

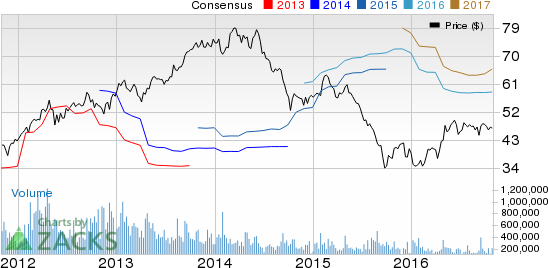

Zacks ESP: The Earnings ESP for FMC Corp. is +1.72% as the Most Accurate Estimate stands at 59 cents while the Zacks Consensus Estimate is pegged at 58 cents. Please check our Earnings ESP Filter that enables you to find stocks that are expected to come out with earnings surprises.

Zacks Rank: FMC Corp. currently carries a Zacks Rank #4 (Sell). We caution against stocks with a Zacks Rank #4 or 5 (Sell-rated stocks) going into the earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks That Warrant a Look

Here are some stocks in the basic materials space that you may want to consider, as our model shows they have the right combination of elements to post an earnings beat this quarter:

The Chemours Company (NYSE:CC) has an Earnings ESP of +25.71% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

LyondellBasell Industries N.V. (NYSE:LYB) holds a Zacks Rank #2 and has Earnings ESP of +0.87%.

International Flavors & Fragrances Inc. (NYSE:IFF) has Earnings ESP of +1.42% and carries a Zacks Rank #2.

Confidential from Zacks

Beyond this Analyst Blog, would you like to see Zacks' best recommendations that are not available to the public? Our Executive VP, Steve Reitmeister, knows when key trades are about to be triggered and which of our experts has the hottest hand. Click to see them now>>

FMC CORP (FMC): Free Stock Analysis Report

LYONDELLBASEL-A (LYB): Free Stock Analysis Report

INTL F & F (IFF): Free Stock Analysis Report

CHEMOURS COMPNY (CC): Free Stock Analysis Report

Original post

Zacks Investment Research