Fluor Corporation (NYSE:FLR) recently announced that its joint venture with partners including Kazakh Institute of Oil and Gas JSC, Engineering Company KAZGIPRONEFTETRANS LLP, and WorleyParsons has been sanctioned by Tengizchevroil LLP (TCO). Fluor will book its share value of this contract in third quarter of 2016.

Details

The joint venture named KPJV will offer engineering, procurement and construction management support services to Tengizchevroil’s Future Growth Project and Wellhead Pressure Management Project.

In 2011, Tengizchevroil offered KPJV a front-end engineering design (FEED) and engineering, procurement and construction management activities contract for Tengiz oil field. Now Tengizchevroil is working on the next phase of expansion of the Tengiz oil field in western Kazakhstan and will be working in partnership with the joint venture, as per the latest contract.

While the Future Growth Project is eyeing to expand Tengiz’s production capacity to roughly 39 million tons of oil per year, Wellhead Pressure Management Project is designed to lower the “flowing wellhead pressure” and boost pressure to Tengiz’s processing pants. The projects are expected to employ 20,000 construction workers.

Fluor along with its joint venture partners is supervising execution plans for commissioning and safe startup of the facilities that will ultimately lead to higher capital efficiency of the project. The company along with its joint venture partners spread across the globe including regions like Farnborough, Atyrau, Almaty, New Delhi, India and Houston.

Flour and its partners believe that this project will open up wide-ranging opportunities for local workforce and supply chain of the region, thereby contributing to the sustainable development of Kazakhstan. Also, this project expands Fluor’s scope of work in the area ever since it began operations in the region way back 1982.

Challenges

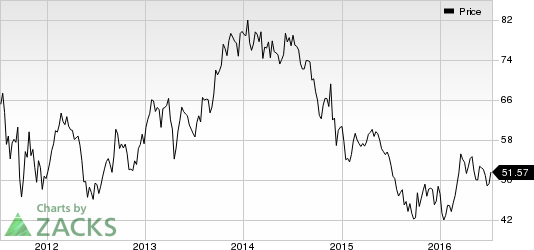

Despite a solid track record of contract wins, Fluor’s near-term prospects look dull as clients in energy, chemicals and mining segments will maintain a cautious approach while taking investment decisions. Also, majority of Fluor’s projects including Sasol, Pemex and Kitimat have delayed their projects on account of macroeconomic uncertainties, adding to Fluor’s concerns.

Moreover, volatility in commodity prices pose a significant challenge to Fluor’s financials. Since Apr 2015, the company has been witnessing a downward movement in the prices of crude oil and certain metals, which in turn, is proving to be a drag on its financials. Further, lower commodity prices continue to impact the cash flow of Fluor’s customers, which in turn affects their ability to fund new projects.

Fluor currently holds a Zacks Rank #4 (Sell). Better-ranked stocks in the same space include Willdan Group, Inc. (NASDAQ:WLDN) , EnerSys (NYSE:ENS) and Midstream Partners, LP (NYSE:DM) . All the three companies carry a Zacks Rank #2 (Buy).

FLUOR CORP-NEW (FLR): Free Stock Analysis Report

WILLDAN GROUP (WLDN): Free Stock Analysis Report

DOMINION MIDSTR (DM): Free Stock Analysis Report

ENERSYS INC (ENS): Free Stock Analysis Report

Original post

Zacks Investment Research