Flowserve Corp. (NYSE:FLS) reversed its recent earnings beat trend as its second-quarter 2017 adjusted earnings of 22 cents per share missed the Zacks Consensus Estimate of 44 cents by half.

On a reported basis, the company’s earnings per share plunged 31.3% to 32 cents on a year-over-year basis. Precipitous top-line decline, owing to macroeconomic volatility, as well as foreign currency headwinds, proved to be major drags for the bottom line.

Quarter in Detail

Revenues fell 14.6% year over year to $877.1 million and also missed the Zacks Consensus Estimate of $926 million. Sluggish progress of the Industrial Product Division turnaround, customer delays in product pick-up, and significantly high tax rate, proved to be a drag on the revenues. Also, foreign currency headwinds eroded sales by $10 million.

The company’s bookings totaled $971 million in second-quarter 2017, up 0.8% year over year at constant currency (cc). After-market bookings totaled $458 million and were down 3.7% at cc, while original equipment bookings were up 5.15% at cc to $514 million. Growth in bookings came on the back of modest recovery in the oil & gas industry, and higher original equipment bookings.

Operating income of the company came in at $126.1 million, up 34.5% from the year-ago period. Foreign currency headwinds and lower sales acted as major dampeners for operating income performance. Also, adjusted gross margin expanded 360 bps to 31.5%.

Segmental Results

Engineered Product Division revenues were down 16.6% year over year to $427.7 million in the quarter. Negative currency translation effects, along with lower original equipment sales in the Americas and Africa, crippled the sales of this segment. However, bookings were almost flat year over year at $465.1 million.

Sales at the Flow Control Division declined 13.2% year over year to $275.4 million, marred by currency headwinds and soft customer original equipment sales in key end markets.Bookings of this segment totaled $316.2 million, up 1.1% year over year.

Moreover, Industrial Product Division sales were down 10.8% year over year to $191.8 million. Foreign currency headwinds, along with low original equipment sales, resulted in the decline across all main geographies. Furthermore, bookings totaled $213.3 million, up 0.5% year over year.

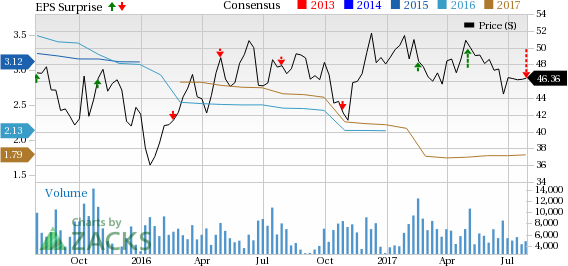

Flowserve Corporation Price, Consensus and EPS Surprise

Restructuring Initiatives

Currently, the company is following its $400 million multi-year investment, which is anticipated to result in savings of $195 million in 2017. In 2018, savings from the full annualized program are projected at $230 million. These investments are aimed at streamlining management structure, reducing manufacturing costs and implementing cost-saving measures for the overall optimization of the cost structure.

The company also expects to trim its workforce by 15–20%, and manufacturing footprint by 30% compared with the 2015 level, as well as shift manufacturing to lower cost regions, under this $400 million worth of restructuring initiative. Flowserve will announce all facility closures by year-end 2017.

In relation to the restructuring efforts, Flowserve spent about $32 million in first-quarter 2017, which, in turn, led to incremental savings of $21 million. It remains optimistic about completing the $400-million program in 2017.

Also, under the restructuring program, Flowserve completed the divestiture of the Gestra AG business unit to Spirax-Sarco Engineering plc for €186 million ($198.4 million). The sale is part of Flowserve’s broader strategy to improve focus on core business, and optimize its product portfolio and manufacturing footprint.

Balance Sheet & Cash Flow

Flowserve ended the quarter with cash and cash equivalents of $505.2 million compared with $367.2 million as of Dec 31, 2016. On Jun 30, 2017, the company’s long-term debt totaled $1,501 million, up from $1,485.3 million as of Dec 31, 2016.

Flowserve’s net cash flow provided by operating activities came in at $46.6 million at the end Jun 30, 2017, up significantly from $10.7 million recorded in the prior-year period.

2017 Outlook

Flowserve reduced its 2017 guidance and now expects adjusted earnings per share guidance to lie in the band of $1.30–$1.50 (previous guidance: $1.55–$1.85). It estimates revenues to decline in the range of 6–10%.

The company does not anticipate any major turnaround in the current geopolitical environment and end markets for 2017. Factors including currency rates, commodity prices, expected bookings and market volatility are likely to put pressure on both the top- and bottom-line performances for this year. However, in light of the continued stability of the company’s bookings and modest sequential improvement in operations, Flowserve anticipates its performance to improve in the second half of the year, particularly in the fourth quarter.

To Conclude

Flowserve had a choppy first half of the year. Its biggest challenge comes in the form of capital spending constraints and aftermarket push outs. In the recent past, the company’s operations have suffered from project delays, rolling maintenance deferrals, and extended timelines for both order placement and delivery acceptance. We believe Flowserve will continue to witness challenging times in the second half of the year.

On the other hand, relative stability of oil at around the level of $45–$50 over the past couple of quarters is a major positive for the company. It appears that Flowserve’s orders are finally showing signs of bottoming out, signaling brighter days ahead. Going forward, we believe stabilization in core aftermarket activities bode well for long-term growth of the company.

Other key strengths include strong operational model, solid productivity, and considerable aftermarket content and geographical diversity. In particular, the diligent restructuring efforts are starting to manifest themselves in substantial savings. Despite these positives, there is no denying the fact that the company’s waning top-line performance remains a major concern.

Zacks Rank & Stocks to Consider

Flowserve presently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader space include Barnes Group Inc. (NYSE:B) , Eaton Corporation, PLC (NYSE:ETN) and Regal Beloit Corporation (NYSE:RBC) , each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Barnes Group has a solid earnings surprise history for the trailing four quarters, having beaten estimates each time for an average of 8.9%.

Eaton also has a decent earnings surprise history, with an average beat of 3.3% over the trailing four quarters, beating estimates thrice.

Regal Beloit generated two beats over the trailing four quarters, for an average positive surprise of 1.5%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaries,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Eaton Corporation, PLC (ETN): Free Stock Analysis Report

Regal Beloit Corporation (RBC): Free Stock Analysis Report

Flowserve Corporation (FLS): Free Stock Analysis Report

Barnes Group, Inc. (B): Free Stock Analysis Report

Original post

Zacks Investment Research