Incorporated in 1978, FLIR Systems, Inc. (NASDAQ:FLIR) is an Oregon-based corporation, which specializes in designing, manufacturing and marketing of thermal imaging systems. Its products are used in a wide variety of applications in commercial, industrial and government markets, both international and domestic. The company offers a variety of system configurations to suit specific customer requirements.

FLIR’s core strength in providing reliable and effective imaging and threat-detection technologies has been bolstering its growth momentum. This apart, the company’s “Commercially-Developed, Military Qualified” (“CDMQ”) model has been quite popular in government and military markets over the past couple of quarters, and is expected to drive earnings in the to-be-reported quarter as well.

FLIR Systems’ financials have been hurting from waning consumer spending and capital investments over the past few quarters. Sluggish economic growth in many of its key markets and intensifying competition in retail channels are expected to add to FLIR Systems’ challenges.

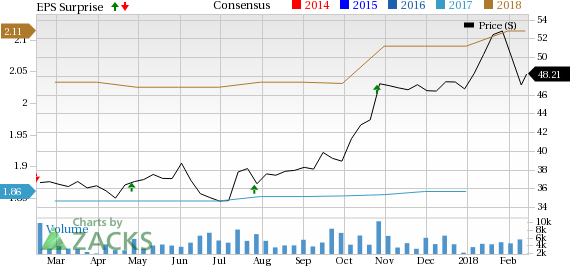

FLIR has had a modest earnings surprise history, with two beats and one in-line earnings over the trailing four quarters, for an average positive surprise of 1.3%.

Currently, FLIR has a Zacks Rank #3 (Hold) but that could change following its fourth-quarter 2017 earnings report which has just released. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

We have highlighted some of the key details from the just-released announcement below:

Earnings: FLIR’s adjusted earnings per share came in at 58 cents, beating the Zacks Consensus Estimate of 56 cents.

Revenue: Revenues of $494.8 million were lower than the Zacks Consensus Estimate of $503 million.

Key Stats: At the end of fourth-quarter 2017, FLIR's backlog of firm orders for delivery within the next twelve months stood at $652 million, reflecting an increase of 10% from the tally at the end of year-ago quarter. Four of the company’s six segments registered year-over-year revenue increase.

Stock Price: FLIR’s shares were up 0.01% in the pre-market trading following the release.

Check back for our full write up on this FLIR earnings report later!

Don’t Even Think About Buying Bitcoin Until You Read This

The most popular cryptocurrency skyrocketed last year, giving some investors the chance to bank 20X returns or even more. Those gains, however, came with serious volatility and risk. Bitcoin sank 25% or more 3 times in 2017.

Zacks’ has just released a new Special Report to help readers capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 4 crypto-related stocks now >>

FLIR Systems, Inc. (FLIR): Free Stock Analysis Report

Original post