On Nov 29, we issued an updated research report on Wilsonville, OR-based FLIR Systems Inc. (NASDAQ:FLIR) . FLIR Systems designs, manufactures and markets thermal imaging and broadcast camera systems for applications in the commercial and government markets. The company currently carries a Zacks Rank #3 (Hold).

Year to date, FLIR Systems’ shares have recorded an average return of 25.7%, slightly lower than that of the Zacks categorized Electronics-Military Systems Market industry average of 28.5%. The company has a dismal track record characterized by consecutive earnings misses in the four trailing quarters, largely due to rising operating costs and intensifying competition in retail channels.

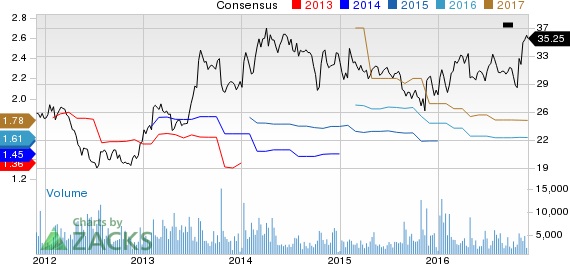

Further, the company’s earnings estimates have moved south over the past one month. Analysts have revised the Zacks Consensus Estimate for 2016 earnings slightly downward over the past 30 days, from $1.62 to $1.61 per share, which is a bearish sign.

FLIR Systems’ business is vulnerable to political uncertainty and currency volatility across the globe, especially given the recent strength in the U.S. dollar. These apart, macroeconomic woes are also pressurizing certain end markets of the company, thus adding to its woes.

Particularly, the company’s gross profit is vulnerable to a host of factors, including product mix changes, manufacturing cost absorption, adjustments in inventory and rise in competitive pressure in security retail channels. During the recently reported third quarter 2016 results, the company booked a $2 million charge for its defective SkyWatch surveillance towers, which have hurt profits. The company is still working to trace all the faulty units, and this poses a huge risk to profits as the liability could rise as high as $20 million. Thus, the profitability of this company depends on its ability to check the rise in costs in the coming quarters.

Presently, the company is focusing on improving operating efficiency and cost structure to bring margins back to the growth track. As a result of these cost-control measures, operating profit margins in third quarter 2016 expanded 380 basis points sequentially.

FLIR SYSTEMS Price and Consensus

Meanwhile, the company’s Security segment is grappling with stiff competition in its retail channels and will most likely hurt its growth prospects. We believe that these short-term headwinds might limit the company’s growth momentum in the near term.

On the positive side, FLIR Systems is optimistic about its solid bookings and backlog during the recent quarters and believes it will fuel future growth. The company’s fundamental business strength and growth prospects are reflected in its solid backlog levels, as it finished the year with total 12-month order backlog of $644 million, representing 13% sequential growth and the highest backlog level since 2008. We believe strategic restructuring activities and solid backlog levels indicate the company’s resiliency, which will help it sail through difficult economic times and drive growth. Also, the company’s improved working capital utilization is resulting in robust cash flow, which adds to its strength.

Furthermore, FLIR Systems has consistently pursued acquisitions to boost its core and non-core businesses. In the third quarter, the company’s commercial product revenues benefited significantly from the newly acquired products of DVTEL and Armasight.

Also, last month, FLIR Systems inked an agreement to buy Point Grey Research, Inc. for about $253 million. Point Grey develops machine vision cameras used in industrial automation systems, medical diagnostic equipment, intelligent traffic systems, people counting systems, military and defense products, and advanced mapping systems. The addition of Point Grey’s capabilities will add to FLIR Systems’ OEM cores and components business, and expand its range of visible spectrum machine vision cameras and solutions. This can translate into bright prospects as machine vision and retail people counting are attractive end-markets and represent somewhat underpenetrated application spaces for thermal imaging technology.

We believe that the company has numerous strengths to build upon, coupled with great growth prospects, which will help it tide over short-term headwinds.

Stocks to Consider

Other favorably placed stocks in the broader sector include Arotech Corp. (NASDAQ:ARTX) , Northrop Grumman Corp. (NYSE:NOC) and Engility Holdings, Inc. (NYSE:EGL) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Arotech Corporation makes zinc-air batteries for military and homeland security applications. It also provides advanced high-tech multimedia training systems for law enforcement and paramilitary organizations. The company has beat earnings twice in the past four quarters and has a whopping average positive surprise of 265.3%.

Falls Church, VA-based Northrop Grumman Corp. supplies a broad array of products and services to the U.S. Department of Defense (DoD). The company has managed to beat earnings each time in the trailing four quarters, boasting an average surprise of 8.3%.

Engility Holdings is engaged in providing government services in engineering, professional support and mission support to customers in the U.S. Department of Defense, Federal civilian agencies and allied foreign governments. The company has a striking earnings surprise history over the trailing four quarters, beating estimates all through. It boasts an average positive surprise of 23.2%.

Zacks' Top Investment Ideas for Long-Term Profit

How would you like to see our best recommendations to help you find today’s most promising long-term stocks? Starting now, you can look inside our portfolios featuring stocks under $10, income stocks, value investments and more. These picks, which have double and triple-digit profit potential, are rarely available to the public. But you can see them now. Click here >>

NORTHROP GRUMMN (NOC): Free Stock Analysis Report

FLIR SYSTEMS (FLIR): Free Stock Analysis Report

AROTECH CORP (ARTX): Free Stock Analysis Report

ENGILITY HLDGS (EGL): Free Stock Analysis Report

Original post

Zacks Investment Research