After weeks of uncertainty in the stock markets and a relief rally yesterday, investors now have fresh cause for concern.

It seems the US bond markets are flashing fresh warning signs that the economy is about to take a turn for the worse.

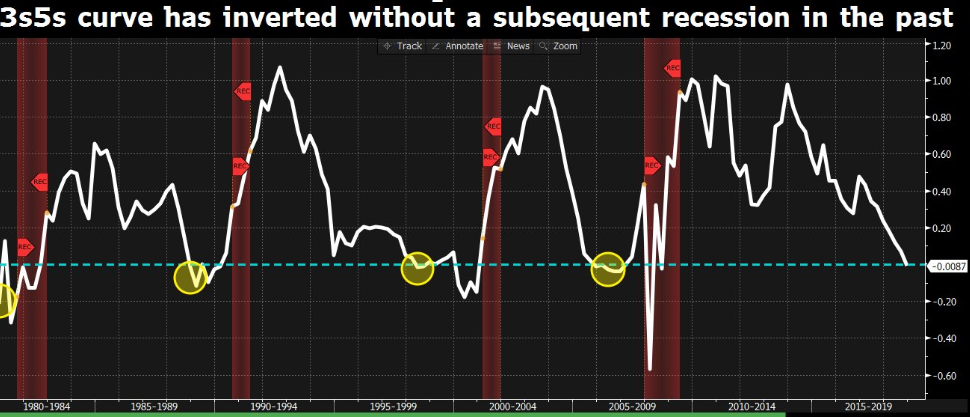

When the yields of the 10-year bonds go lower than the yield on the 2-year, it has in the past been a strong indicator that a recession is coming. Well, that hasn't quite happened yet, but we did get an inversion yesterday of the 3-year and the 5-year for the first time in a decade.

Though the 3-5 spread is not as strong an indicator as the 2-10, it's still not a very good sign. In this graph, we can see that even though a 3-5 inversion doesn't always lead to an immediate recession, it can still be considered as an early indicator.

This should come as no surprise to those who are reading these updates regularly. As we've been saying, just about every stock mogul and their brother have been predicting that we're nearing the end of the bull cycle.

Today's Highlights

More Inversion Markets

Scaling Into Positions

Bitcoin Getting Easier

Please note: All data, figures & graphs are valid as of December 4th. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

In the crypto market, we've seen a fair amount jostling for position among the top three assets by market cap.

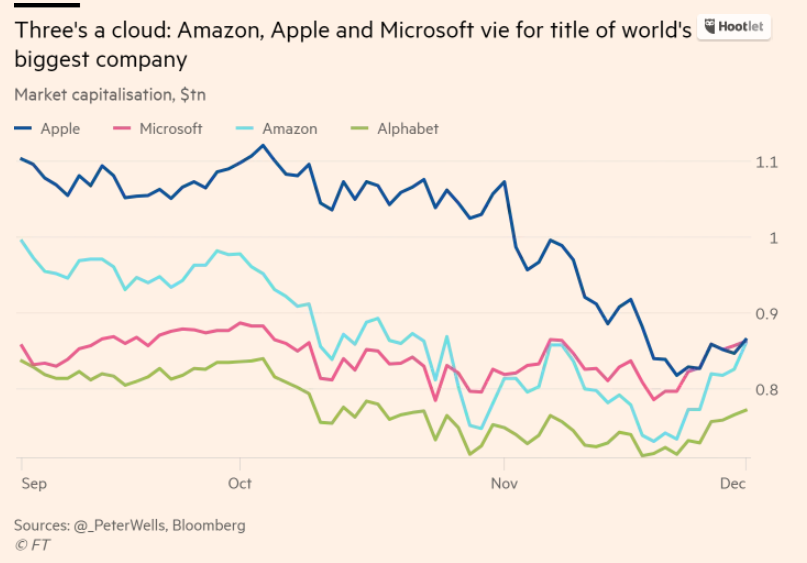

It seems a similar dynamic is now playing out in the stock market as Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), and Microsoft (NASDAQ:MSFT) are in a close running for the top spot.

This chart from the Financial Times shows the respective market caps of the top four tech stocks...

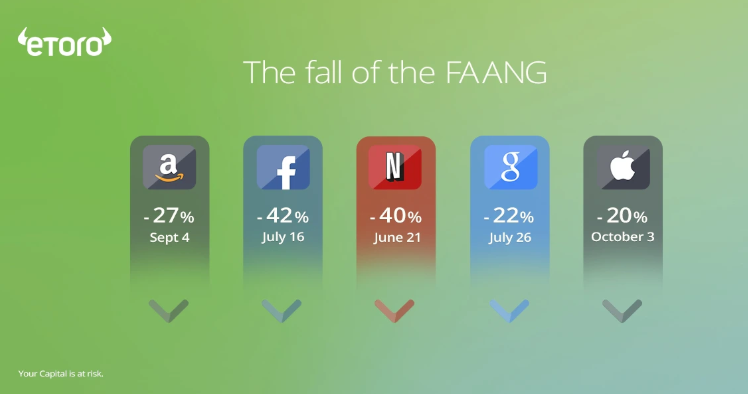

The FAANG stocks have all come down significantly from their all-time highs, with some falling harder than others.

Perhaps this is not surprising as many of these companies were previously priced for perfection, but the question now becomes at what point do they bottom out?

Scaling Into Positions

With the above in mind, and with the recent downturn in crypto prices, I thought it relevant to highlight an old strategy in the market that may now be relevant for investors who are currently sitting on the sidelines and looking to get in.

The problem is that we never really know when the bottom will come and it's impossible to time the markets perfectly, but there are options you can explore to increase your chance of success from your investments.

For your convenience, I've now published a blog on eToro outlining a simple strategy called Dollar Cost Averaging and the advantages of spreading out your orders in order to take advantage of markets that are low now but might go lower.

Feel free to read it here: www.etoro.com/blog/market-insights/a-simple-strategy/

Let me know what you think.

Bitcoin is Getting Easier

There's been a lot of talk lately about the decrease in mining activity in bitcoin and we've discussed it in these updates already. However, it seems this story has taken on a new form that I feel is worth revisiting.

Yesterday, this opinion post was published on Market Watch, which saw the crypto community in an uproar on social media last night.

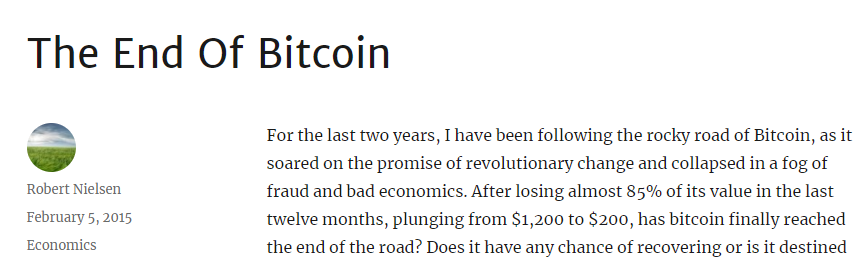

In the article, Economist Atuyla Sarin describes what he calls the Bitcoin Death Spiral, where he predicts that the hashrate of bitcoin could drop so suddenly that it would no longer be profitable for miners to operate and all at once they could shut down, effectively killing the Bitcoin network. This theory isn't new. In fact, here's an article published on February 5th, 2015 that explains the

phenomenon quite well...

The point to note here is that the publish date was almost exactly at the bottom of the last bitcoin cycle, just after it had come down from a high of around $1,200 and was trading at just $220 per coin.

For a full explanation of what the bitcoin death spiral theory is, please see the expert Andrea Antonopolis who has responded to these claims in a video last night.

To be clear, it is extremely unlikely for such an event to occur, simply because any time a miner does shut down their rig it makes it more profitable for all other miners to continue their operations.

In fact, thanks to the recent reduction in hashrate the bitcoin mining difficulty has just been re-adjusted. So anyone who did drop out lost out and those who remained are far better off.

You see, Satoshi Nakamoto wasn't a fool. There are always new people coming into the crypto space and that's why these type of stories tend to re-emerge. When a newcomer grasps a specific concept, they can sometimes fail to consider the wider implications of their line of reasoning.

But that's Ok. Those who are interested will learn and today's newcomers will become tomorrow's experts.

Let's have an amazing day ahead.

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.