This week, we're looking at some fresh flash economic data: The Markit flash PMIs. Using GDP weights we can construct a "global flash PMI" and the reason for doing so will become obvious very quickly. Also, given the dynamics playing out in global markets right now, this article is particularly timely.

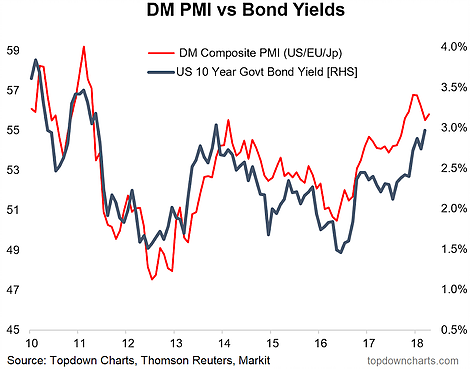

The chart below shows the global flash PMI plotted against the US 10-Year government bond yield, and it certainly puts some of the recent movement in bond yields into context.

The economic logic behind the relationship comes down to what drives bond yields (and by the way, whenever you see 2 lines plotted together which profess to show some sort of correlation, you always want to think about what the economic logic is, if any). Basically, higher growth and inflation drive higher bond yields. And as the chart above shows, the US 10-year bond yield has basically just been following the data.

On the actual data, it was America first with the US manufacturing PMI +0.9 to 56.5, then Japan +0.2 to 53.3, and eurozone continuing to decelerate, -0.6 to 56.0 - which is still a decent reading. This places the April flash global manufacturing PMI +0.3pts to 55.8, and if you took that chart literally, then US 10-year bond yields should be trading a notch above the psychologically important 3% mark.

It's important to note the impact that monetary policy plays on this. Better economic growth in Europe and Japan means their respective central banks are likely to pullback on QE purchases - and we've already seen this start to happen. Meanwhile, the Fed is already moving into QT (quantitative tightening) and with the better growth/inflation outlook in the US, the market is slowly but surely reassessing the likely neutral Fed funds rate - another key factor for long term bond yields.

So, along with the reset in sentiment, the macro data and monetary policy backdrop continue to support the case for higher bond yields, and as those psychologically important levels get breached it could pave the way for a larger move.