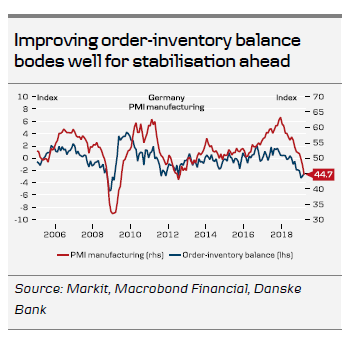

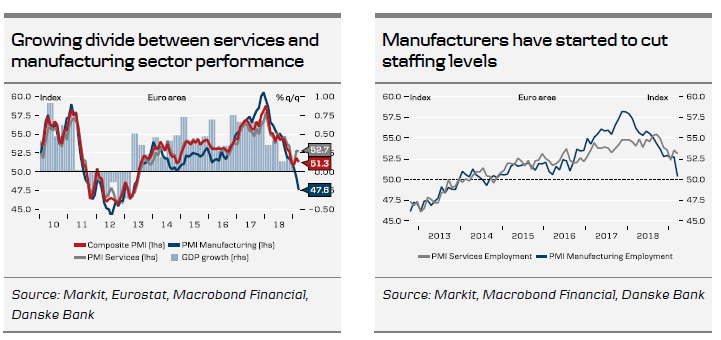

Today's eurozone March PMI survey brought another negative surprise. The outlook for manufacturing in particular is becoming increasingly dark in many eurozone countries. The weakness is still led by Germany, where manufacturing new orders fell to the lowest level (40.1) since the financial crisis and signs are rising that manufacturers have also started to reduce staffing on the back of lower external demand. France saw a similar - though less pronounced - fall back in manufacturing activity from 51.5 to 49.8, led by weaker export business, making it unlikely that the economy has gained much speed from Q4's 0.3% q/q.

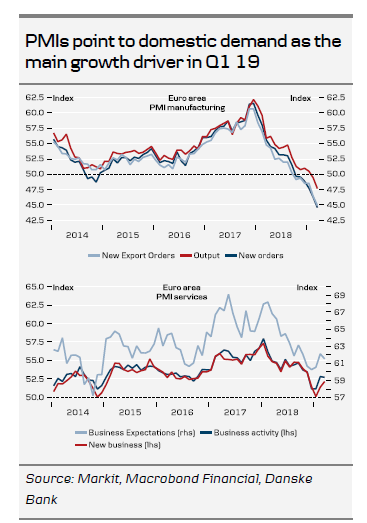

On a positive note the euro area service sector continues to prove relatively resilient to the manufacturing slowdown, with service PMI holding steady at 52.7 in March and incoming new business remaining on an upward trend. Domestic demand hence looks to have remained the growth driver in Q1 on the back of rising real wage growth and fiscal stimulus, while the industrial sector is likely to have been a drag.

Nevertheless, PMIs paint a lacklustre picture of the underlying euro area growth momentum , which is disappointing news for the ECB. The ECB opened the door to further accommodation at the March meeting and today's PMI data on balance strengthens the case for further easing steps ahead. That said, we think it is unlikely that the ECB will react to single data points, and we still think there is some way to go before the ECB would take the next step on the easing ladder by restarting QE.

Looking ahead, we still expect private consumption to drive the eurozone growth rebound - and we are seeing signs of that in the rising service PMIs - but to get euro area activity 'back to speed' manufacturing PMI also needs to break out of its downward spiral - a US-China trade deal, Chinese fiscal and monetary stimulus and an orderly Brexit, remain important ingredients for that . In light of today's figures we revise down our Q1 growth forecast for Germany to 0.2% q/q (was 0.3%). However, we stick to our forecast of annual euro area growth at 1.3% in 2019 and still attach a low probability (c.15%) to the euro area entering a recession in the foreseeable future (see Euro Area Research: Is the euro area heading for recession? , 4 March).