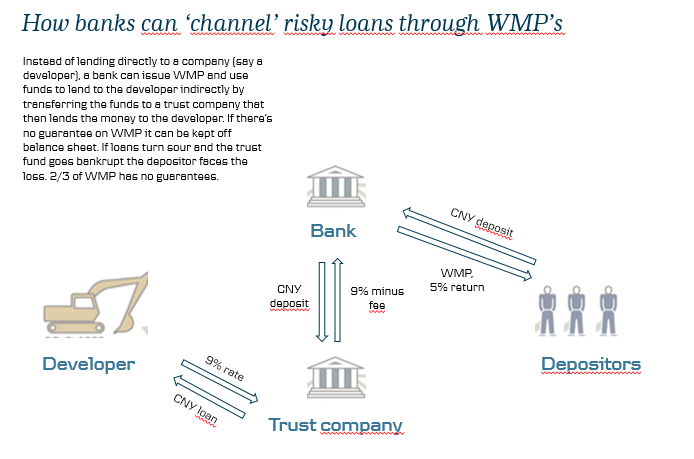

China stepped up the fight on the risks from shadow banking further on Friday announcing tougher rules for asset management companies. The aim is to reduce the off-balance sheet loan growth that is sold through wealth management products (WMP) and channelled via asset managers . The rapid growth of WMP’s has contributed to half of the increase in shadow banking over the past five years and has made the funding of Chinese debt much more fragile due to (see illustration at bottom) the lack of safety net in these shadow banking products.

To avoid too much disturbance the new rules will not come into force until June 2019 but it's likely to dampen growth in so-called "channeling" loans ahead of the deadline. These loans goes through the banks and are channelled on to trust funds and other non-bank financial institutions. If the loans turn sour the losses will be born by the savers (Chinese households) rather than by the banks. This could cause a risk of a 'run' on these shadow banking products if losses would start to increase at some point. It could prove very disruptive and risk setting off a negative spiral of price losses, further redemptions etc. as is often seen triggering financial crises.

The new rules imply:

Financial institutions are not allowed to use asset management products to invest in commercial banks credit assets (typically loans) or provide "channel service" for other institutions to bypass regulations. Comment: This is to avoid the above mentioned risk of high-risk loans being moved to trust funds and sold to households through asset management products (wealth management products).

The guidelines also forbid financial institutions to create asset pools to manage funds raised through asset management products. Comment: Pooling assets increases the risk of contagion in the case of a crisis as was the case with the subprime crisis where high-quality mortages suffered from being pooled with low-quality mortgages when funds had to meet redemptions from investors.

Financial institutions are required to provision 10% of their management fee income as risk reserves. Comment: This introduces some 'capital buffer' in the asset management products that otherwise have very little safety net.

Institutions would be punished for providing implicit guarantees on asset management products. Comment: Most Chinese savers perceive that the WMP’s are guaranteed by the state even though they are not. With little sense of the risk in the products more money go into this universe – and if returns are ultimately not delivered could trigger a public outcry and demand for the state to cover any losses.

Non-financial institutions are prohibited from issuing or selling asset management products. Comment: Another aim to stop savings products that has grown outside the 'normal' financial system.

The rules unify regulations asset management products issued by banks, trusts, funds, insurance asset management companies and is issued jointly by regulators across banking, insurance, securities and FX. This is the first sign that regulatory authorities are now working together on regulation. Lack of coordination has been a big problem before but this summer the Chinese central bank got the role of coordinating a new financial oversight body in order to better coordinate regulations across the financial system.

The new regulation is another sign that China continues its' crackdown on shadow banking that began last year. It also follows very strong warnings of financial risks from China’s central bank governor Zhou Xiaochuan in the past couple of months, see for example Bloomberg 4 November 2017, and his comments have been a clear warning that tougher regulation was coming. It seems clear that the priority of fighting financial risks has moved very high on the agenda of Xi Jinping who also stepped up his warnings this year. At the National Financial Work Conference in July Xi among other things stated that “we cannot neglect any risk factors or hidden dangers”.

The new steps underline that China is well aware of the financial risks from the high leverage and growth in shadow banking and is taking stronger measures to contain these risks. It will likely have a short term cost of lower growth but reduces the risk of a bigger downturn at a later stage. It’s an indication that China may use the current window of a strong global economy and calm around the Chinese economy to take some “short term pain for long term gain” as also advised by the IMF in their Article IV consultation report in August. It does put some downside risk to growth over the coming year, though, and underpins our expectation of a slowdown in China in 2018.

The continued crackdown on shadow finance is most likely behind the recent rise in Chinese bond yields (see chart below). Normally yields go lower when signs of slower growth emerges (as has been the case in China lately, see for example Research China: The housing party is over, 14 November 2017.). During spring we saw the same signs of mini-stress in the bond markets following a crack-down on shadow finance but the bond sell-off paused in the months ahead of the Party Congress in October as China wanted stability around the Congress. But the fact that the sell-off has continued very shortly after the Congress ended is a further sign that China continues to fight financial risks and aims to reduce leverage in high-risk products sold as or perceived as ‘safe’ products.

Apart from the sharp growth in shadown banking in recent years, the sharp rise in debt in State Owned Enterprises (SOE’s) is another element in the danger from financial risks highlighted by Xi Jinping and Zhou Xiaochuan. At the National Financial Work Conference mentioned above Xi Jinping also stated that “Deleveraging at the SOEs is of the utmost importance” and officials must “get a grip on Zombie enterprises”. This is part of the SOE reform agenda and we expect Xi Jinping to use his stronger power to push through more of these reforms in his second term over the next five years.

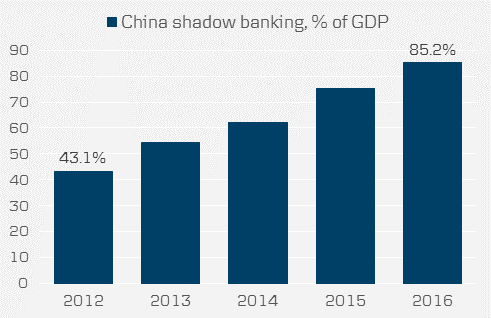

China’s shadow banking has grown sharply over the past five years

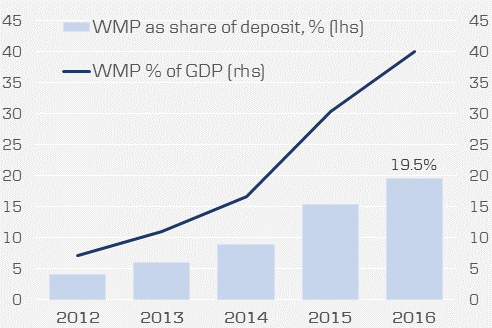

Wealth Management Products is behind a big share of the increase – now constitute 20% of ‘debt funding’ up from 4% in 2012.

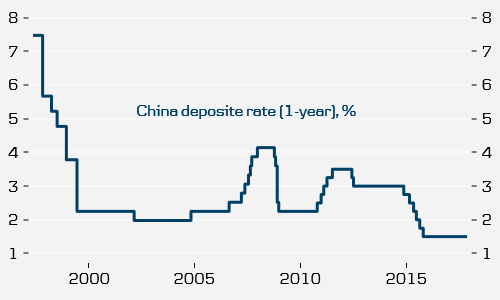

Very low deposit rates have led Chinese households to put money in WMP’s providing around 4-5% returns

China government yields resumed increase after the Congress in sign of further deleveraging taking place in leveraged funds.