- Chinese data overnight confirm that activity in Q1 was weak.

- However, the more forward looking indicators still support the case for a growth bottom in Q1.

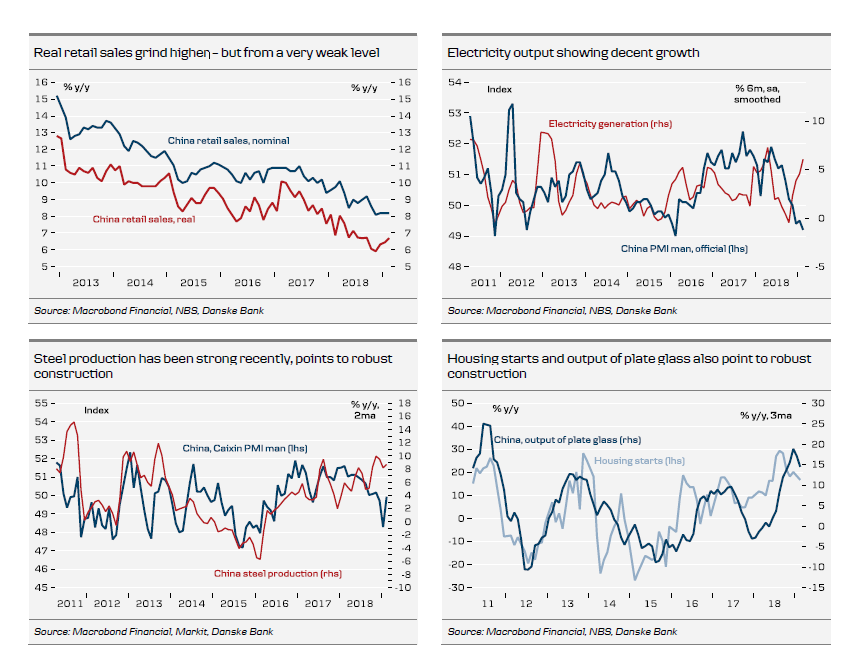

What's new: Overnight we received Chinese data for industrial production, retail sales and fixed asset investments. Industrial production fell to 5.3% y/y for January/February from 5.6% y/y in December. This is the lowest level since the financial crisis. However, details in the report showed decent growth in both electricity and cement, which have tended to be better gauges of the Chinese business cycle in recent years. Retail sales growth was stable at 8.2% but in real terms ground a bit higher as inflation has come down in the past few months. Fixed asset investments for January/February increased slightly from 5.9% y/y to 6.1% y/y. The biggest surprise came from the surveyed unemployment rate, which rose from 4.9% in January to 5.3% in February. This is the highest rate since the first release in 2016.

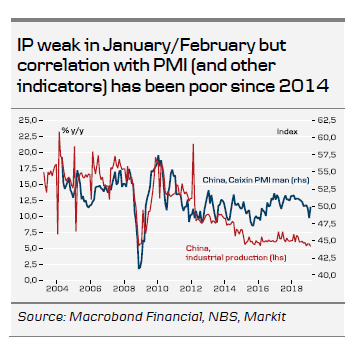

Comment: Overall, this was a very mixed bag of data, which shows that some sectors are weak while others recovering. We generally do not put too much weight on the overall industrial production data, as the series started to correlate poorly with other business cycle indicators from around 2014.

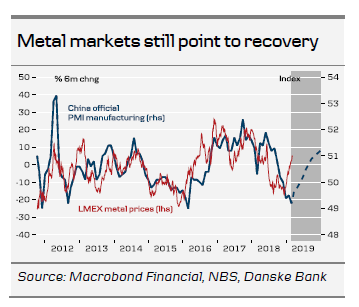

Some of our favourite indicators for China are PMI manufacturing, metal price inflation and some of the subcomponents in the industrial production report like electricity and cement, which have a higher correlation with PMI and other business cycle signals. Judging from these, the Chinese economy started 2019 on a very weak note but is showing signs that the worst may soon be behind us. The jump in the unemployment rate may be distorted by Chinese New Year but it probably also reflects that employment is under pressure from the slowdown. We look for further monetary easing soon, through a further reduction in the Reserve Requirement Ratio, as signalled by Premier Li Keqiang at the National People's Congress.

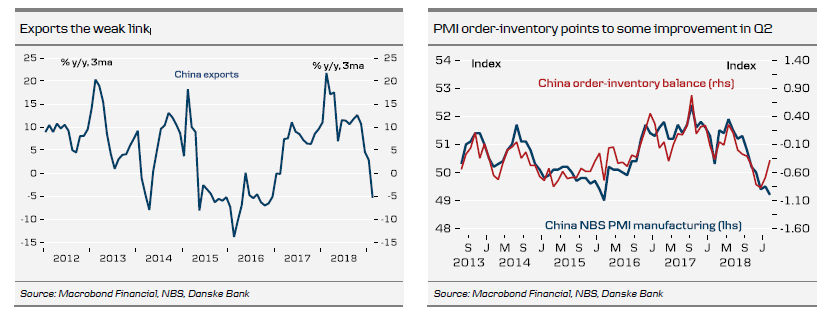

Indicators related to construction (housing starts and production of steel, cement and plate glass) are generally strong, while exports and retail sales have been soft - not least car sales and mobile phone sales. However, we look for exports to improve following a trade deal. In addition, we expect consumption growth to come off the lows due to household tax cuts and incentive measures aimed at car sales and home appliances. Mobile phone sales should also get a lift later this year from new 5G mobile phone models coming onto the market.

To sum up, the data confirms that Q1 was weak but we see signs that this may be the bottom. We still look for a moderate recovery from Q2, driven by stimulus measures, a trade deal with the US and an end to reductions in inventories.