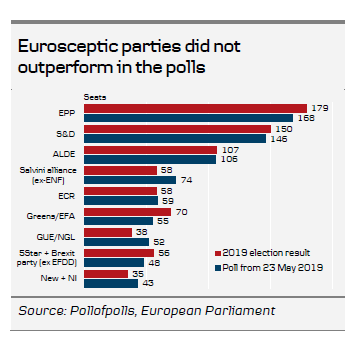

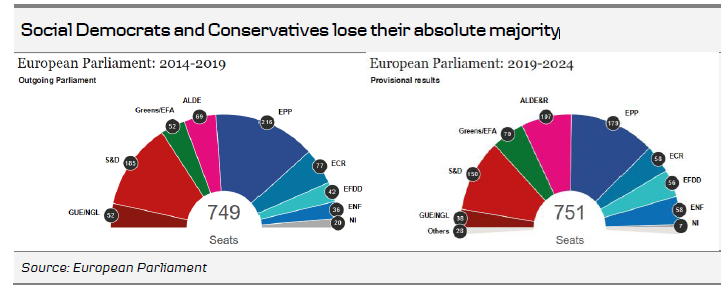

Although the EU elections saw shrinking support for established parties in many countries, the influence of Eurosceptic groups in terms of policy-making will remain limited with a vote share of 23% (from 20.6% previously). Losses for the Social Democrats and Conservatives - which lost their absolute majority for the first time since 1979 - were amply offset by gains for the Greens and Liberals, meaning that overall sentiment in parliament will remain pro-EU.

Still, in France, President Macron's party En Marche lost the race against the far right Rassemblement National, calling into doubt his grand plans for domestic reforms and further EU integration. Similarly, in Germany, critical voices in the grand coalition are getting louder after another heavy defeat for the SPD party. In Italy, despite a strong result with 33.6% of the votes, Lega leader Salvini is mulling over changes to the governing coalition with Five Star or the possibility of a snap vote. However, in light of the fractious state of the two coalition partners, the risk of an election in H2 19 continues to linger in our view, especially if another budget row with Brussels breaks out in the autumn.

While national governments will digest the repercussions of the election results in the coming days, the focus in Brussels reverts to coalition building. Both an alliance of the S&D, EPP and the Greens or Liberals would be possible, but in light of the parties' differing views on trade, social and environmental policies, we expect talks to drag out into the summer. A prolonged period of political 'horse trading' has now started. The first task for the new parliament - which comes together for the first time on 2 July - will be to elect a successor to Jean-Claude Juncker as Commission president. The EU heads of state will come together in Brussels on Tuesday, 28 May to discuss the outcome of the vote and start the nomination process for a range of top EU positions. If the political process is smooth, the election of a new Commission president could already occur in July, but in light of the increased fragmentation of the political centre, a decision in September or October seems more likely in our view. Although it is the EU heads of state who will nominate the candidate for Commission president, they must do so by taking into account the election results, as the EP can veto the appointment (for the exact process, see 2019 EU Parliament elections: Setting the scene for the 'European Game of Thrones '). The nationality of the next EU Commission president is also important when it comes to choosing Mario Draghi's successor as ECB president.

Limited impact on EU fixed income markets

The EU elections have rarely been a major market mover for the European fixed income market. However, as mentioned above, they could have implications for the choice of successor to Draghi. If the German ‘Spitzenkandidat’ Manfred Weber fails to secure the Commission presidency, Germany could make a renewed push for a German candidate to succeed Mario Draghi, which would be perceived as ‘hawkish’ by the market. Furthermore, the strong result for Salvini’s Lega in Italy could also point towards a tougher stance in a possible new budget standoff with the EU later this year, though the overall weakening of the populist parties across the EU points in the other direction. However, overall, the EU elections would not set the direction for very long. Soon the fixed income market will fix its attention on the upcoming ECB and Fed meetings in June.