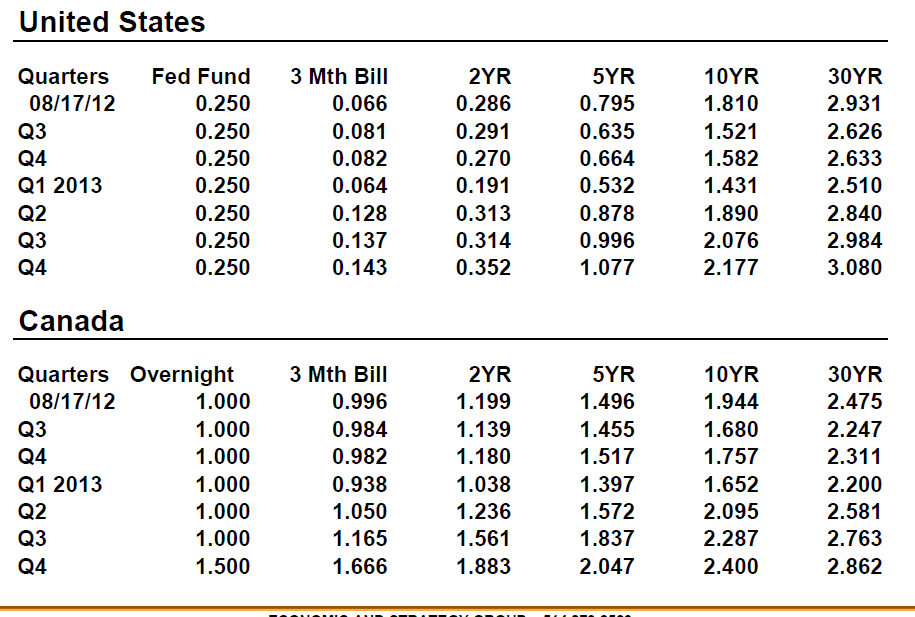

Europe and Asia are still decelerating and U.S. nonfarm payrolls could disappoint in coming months. Finally, the U.S. economy is likely to encounter, not a cliff, but significant fiscal drag in early 2013. In this environment, 10-year Treasurys are more likely to be trading slightly below 1.5% than above the current level in Q1.

The Canadian bond market is now pricing in odds of a modest withdrawal of the present monetary stimulus. Given our view that the output gap will widen in the near-term, we think that despite its rhetoric the BoC will end up staying on the sidelines until late 2013.

U.S. Treasurys: Trend reversal or head fake?

Not so long ago the market was giving high odds that Mr. Bernanke would announce or at least hint at new monetary stimulus before summer’s end. Job creation had been anemic, averaging only 73,000 monthly in Q2. U.S. GDP growth had decelerated from 4.1% in Q4 to only 1.5% in Q2. The sovereign debt crisis in Europe remained quite acute. Yields on Spanish bonds were trending to levels that threatened the fiscal stability of the government.

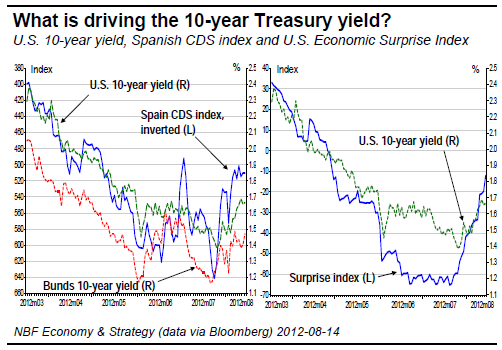

In response to the deteriorating market for the sovereign debt of countries of the European periphery, European Central Bank president Mario Draghi came out strongly, pledging in London to do whatever it takes to ensure survival of the euro. Despite ambiguity about what that meant and about how and when the necessary actions might be taken, the bond market took Mr. Draghi seriously. The cost of insuring against Spanish default (credit default swaps on Spanish bonds) declined significantly.

As fear about Europe subsided in response to the ECB’s conditional commitment to use its balance sheet to support Spain, U.S. economic indicators were finally showing improvement. Nonfarm payrolls surprised investors on the upside with a gain of 163,000 in July. Retail sales gained 0.8% on the same month, reversing trend after three straight months of contraction. Also in July, industrial production rose 0.6%. This gain reflected not only weather-induced utility production but a second straight monthly gain of 0.5% in manufacturing output.

The stars were aligning to pull back expectations of more stimulus from the Fed.

Not enough to call into question the completion of the second leg of Operation Twist, but enough to set the stage for a bond market correction. The yield of 10- year Treasuries, which had fallen from about 1.67% on June 22 to an intra-day low of 1.38% before Mr. Draghi’s late-July intervention, rebounded to 1.81% at the August 17 close.

Over the same period, the yield of 10-year Canadas fell from 1.81% to 1.57% and then rebounded to 1.95%. The July lows of both U.S. and Canadian 10- year yields were significantly below the bullish quarterend forecasts presented in our last issue. Technically, this should have triggered some profit-taking, bringing portfolio duration closer to neutral.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Fixed Income Monitor: September 2012

Published 08/28/2012, 01:54 AM

Updated 05/14/2017, 06:45 AM

Fixed Income Monitor: September 2012

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.