Well thank goodness that’s over with – February that is. Now on to March and hoping for something better. This piece will take a look at some sectors that have a history of performing reasonably well in the month of March.

Five for March

The “chosen 5” are:

*FDLSX Fidelity Select Leisure

*FSCHX Fidelity Select Chemicals

*FSNGX Fidelity Select Natural Gas

*FSRFX Fidelity Select Transportation

*FSRPX Fidelity Select Retailing

Our test starts in 1986 as follows:

1986: FDLSX, FSCHX, FSRPX

1987 to 1993: FDLSX, FSCHX, FSRFX, FSRPX

1994 to 2017: All 5

i.e., FSRFX started trading in 1987 and FSNGX started trading in 1994

Figure 1 displays the growth of $1,000 split evenly between these 5 funds and invested ONLY during the month of March every year since 1986.

Figure 1 – Growth of $1000 invested in funds listed above ONLY during the month of March; 1986-2017

Figure 2 displays the year-by-year results

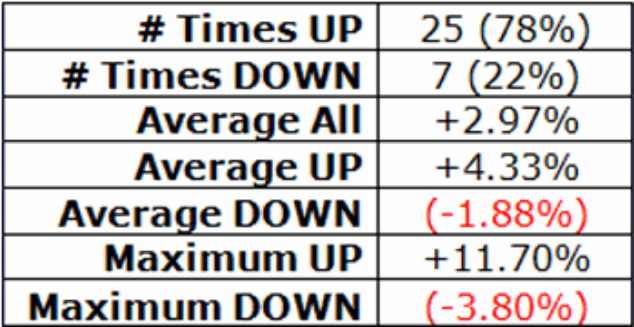

Figure 3 displays some of the relevant facts and figures regarding performance of this 5-fund portfolio during the month March.

Summary

As a result, and as always, I am not offering a “recommendation” here. I am simply highlighting historical facts and figures.

So what does all of this tell us about how things will go in March 2018? Ah, there’s the rub. Unfortunately, past performance – and stop me if you’ve heard this one before – is no guarantee of future results.

Still, investing is a game of odds. Figure 4 displays the monthly % returns during March for this 5-fund portfolio from highest (+11.7%) to lowest (-3.8%). Clearly the odds have skewed towards positive returns.

Figure 4 – March % +(-) for 5-fund portfolio ranked from highest to lowest

Here’s hoping that history is a guide.

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.