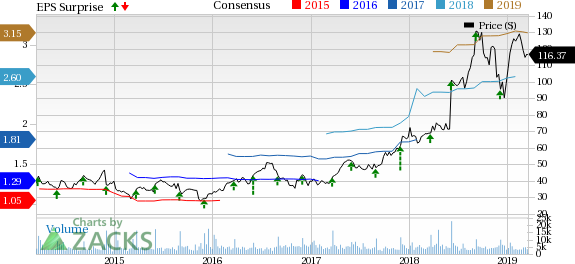

Five Below, Inc. (NASDAQ:FIVE) is slated to report fourth-quarter fiscal 2018 results on Mar 27. In the trailing four quarters, the bottom line of this specialty value retailer has outperformed the Zacks Consensus Estimate by average of 9.1%. In the last reported quarter, the company delivered a positive earnings surprise of 15.8%.

The Zacks Consensus Estimate for the quarter under review is pegged at $1.57 compared with $1.18 reported in the year-ago quarter. We note that the Zacks Consensus Estimate has been stable in the last 30 days. The Zacks Consensus Estimate for revenues is pegged at $601.7 million, up approximately 19.2% from the year-ago quarter.

Let’s delve deeper and take a look at the factors that are likely to influence the results of the to-be-reported quarter.

Factors Holding Key

Five Below’s impressive merchandise assortment, focus on pre-teen customers, enhancement of digital and e-commerce channels, and pricing strategy aids the company to stand tall amid a competitive retail landscape. These along with healthy performance of new outlets and decent comparable sales run help propel the top line. Further, the company remains focused on achieving efficient cost structure, solid average net sales per store, supply-chain initiatives and economies of scale.

Management’s primary focus on teens and pre-teens, aids the company enhance customer base by attracting shoppers. The company is known for its impressive range of merchandise, as it remains committed toward making innovations and refreshing product range per the evolving consumer trends. During the holiday season, management expanded their selection with amazing value toys and games, capitalizing on the toy opportunity.

However, we note that SG&A expenses have been increasing for quite some time now. In the third quarter of fiscal 2018, the same increased 25.8% on account of store and corporate related expenses. Analysts believe that SG&A expenses are likely to increase in the near future due to store growth. Certainly, this will to an extent hurt the company's operating income, unless fully mitigated by substantial increase in net sales.

Decent Holiday Sales form a Perfect Base for Q4

This Philadelphia, PA-based company reported solid sales results for the quarter-to-date period (starting Nov 4, 2018 until Jan 5, 2019). The company’s net sales surged 24.6% to $526.1 million, while comparable sales witnessed growth of 4.9%.

As a result of impressive quarter-to-date performance, management expects fourth-quarter sales to marginally surpass the previously provided view and record earnings at the high-end of the guidance range. Five Below had projected fourth-quarter net sales in the range of $593-$600 million with comparable sales growth of 3-4%. Meanwhile, earnings per share is anticipated between $1.53 and $1.57.

For fiscal 2018, the company envisioned net sales in the range of $1.550-$1.557 billion with comparable sales growth of 3.3-3.7%. Earnings for the fiscal year is estimated to be in the band of $2.60-$2.64 per share.

What the Zacks Model Unveils?

Our proven model does not conclusively show that Five Below is likely to beat earnings estimates this quarter. This is because a stock needs to have both — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — for this to happen. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Five Below has a Zacks Rank #4 but an Earnings ESP of +0.48%. This makes surprise prediction difficult.

Stocks Poised to Beat Earnings Estimates

Here are some companies you may want to consider as our model shows that these have the right combination of elements to post earnings beat.

Darden Restaurants (NYSE:DRI) has an Earnings ESP of +1.07% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

PVH Corp. (NYSE:PVH) has an Earnings ESP of +1.14% and a Zacks Rank #3.

Ollie's Bargain Outlet Holdings (NASDAQ:OLLI) has an Earnings ESP of +1.34% and a Zacks Rank #2.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-holds for the year?

Who wouldn't? Our annual Top 10s have beaten the market with amazing regularity. In 2018, while the market dropped -5.2%, the portfolio scored well into double-digits overall with individual stocks rising as high as +61.5%. And from 2012-2017, while the market boomed +126.3, Zacks' Top 10s reached an even more sensational +181.9%.

See Latest Stocks Today >>

Ollie's Bargain Outlet Holdings, Inc. (OLLI): Free Stock Analysis Report

Darden Restaurants, Inc. (DRI): Free Stock Analysis Report

Five Below, Inc. (FIVE): Free Stock Analysis Report

PVH Corp. (PVH): Free Stock Analysis Report

Original post