Fitbit Inc (NYSE:FIT) was upgraded by analysts at Vetr from a "buy" rating to a "strong-buy" rating in a research note issued to investors on Tuesday, MarketBeat.com reports. The firm presently has a $6.17 price target on the scientific and technical instruments company's stock. Vetr's target price indicates a potential upside of 21.94% from the company's previous close.

Several other analysts have also recently weighed in on the company. Deutsche Bank AG reaffirmed a "hold" rating and set a $5.50 price objective on shares of Fitbit in a research report on Wednesday, August 9th. Zacks Investment Research upgraded shares of Fitbit from a "hold" rating to a "buy" rating and set a $6.50 target price for the company in a report on Tuesday, August 8th. Oppenheimer Holdings, Inc. reiterated an "outperform" rating and set a $8.00 target price on shares of Fitbit in a report on Friday, August 4th. Benchmark Co. reiterated a "buy" rating on shares of Fitbit in a report on Thursday, August 3rd.

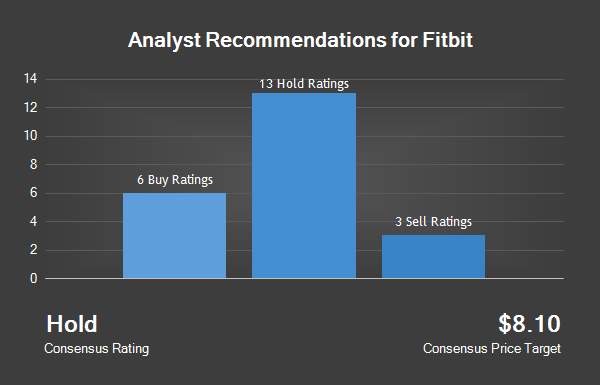

Finally, Longbow Research reiterated a "hold" rating on shares of Fitbit in a report on Thursday, August 3rd. Six research analysts have rated the stock with a sell rating, thirteen have issued a hold rating, seven have assigned a buy rating and one has given a strong buy rating to the company's stock. The company presently has a consensus rating of "Hold" and an average target price of $7.94.

Fitbit (NYSE FIT) opened at 5.06 on Tuesday, MarketBeat.com reports. The firm's market capitalization is $1.18 billion. The company's 50-day moving average price is $5.49 and its 200-day moving average price is $5.62. Fitbit has a 1-year low of $4.90 and a 1-year high of $17.18.

Fitbit (NYSE:FIT) last posted its quarterly earnings data on Wednesday, August 2nd. The scientific and technical instruments company reported ($0.08) earnings per share for the quarter, beating the Thomson Reuters' consensus estimate of ($0.15) by $0.07. The business had revenue of $353.30 million for the quarter, compared to analysts' expectations of $341.24 million. Fitbit had a negative return on equity of 20.67% and a negative net margin of 13.79%. The business's revenue was down 39.8% on a year-over-year basis. During the same period in the previous year, the firm posted $0.12 EPS. Equities research analysts expect that Fitbit will post ($0.34) earnings per share for the current fiscal year.

TRADEMARK VIOLATION WARNING: This story was first posted by [[site]] and is the sole property of of [[site]]. If you are reading this story on another site, it was stolen and reposted in violation of United States and international trademark & copyright law. The original version of this story can be viewed at [[permalink]].

In related news, Director Glenda J. Flanagan bought 18,248 shares of the business's stock in a transaction on Thursday, August 17th. The stock was acquired at an average price of $5.48 per share, with a total value of $99,999.04. Following the transaction, the director now owns 29,753 shares in the company, valued at approximately $163,046.44. The purchase was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this link. Also, Director Steven Joseph Murray sold 500,000 shares of Fitbit stock in a transaction that occurred on Monday, August 7th. The stock was sold at an average price of $5.73, for a total transaction of $2,865,000.00. Following the completion of the sale, the director now directly owns 11,442 shares of the company's stock, valued at approximately $65,562.66. The disclosure for this sale can be found here. In the last ninety days, insiders sold 1,045,000 shares of company stock valued at $5,770,100. 29.10% of the stock is currently owned by insiders.

A number of large investors have recently bought and sold shares of FIT. AlpInvest Partners B.V. increased its stake in Fitbit by 220.6% in the first quarter. AlpInvest Partners B.V. now owns 617,547 shares of the scientific and technical instruments company's stock worth $3,656,000 after buying an additional 424,942 shares during the period. Quantbot Technologies LP increased its position in shares of Fitbit by 36.9% in the first quarter. Quantbot Technologies LP now owns 93,661 shares of the scientific and technical instruments company's stock valued at $554,000 after buying an additional 25,256 shares in the last quarter. Swiss National Bank increased its position in shares of Fitbit by 10.3% in the first quarter. Swiss National Bank now owns 238,200 shares of the scientific and technical instruments company's stock valued at $1,410,000 after buying an additional 22,300 shares in the last quarter. Sumitomo Mitsui Asset Management Company LTD purchased a new position in shares of Fitbit during the first quarter valued at $24,404,000. Finally, UBS Oconnor LLC purchased a new position in shares of Fitbit during the first quarter valued at $1,480,000. 55.86% of the stock is owned by institutional investors and hedge funds.

Fitbit Company Profile

Fitbit, Inc is a provider of health and fitness devices. The Company's platform combines connected health and fitness devices with software and services, including an online dashboard and mobile applications, data analytics, motivational and social tools, personalized insights and virtual coaching through customized fitness plans and interactive workouts.