Will central banks get a helping hand from the fiscal policy as talk of deficit spending gains momentum? Chatter of government stimulus from Germany and now talk of tax cuts from the White House are making the rounds. The Washington Post reported that the White House may push for a temporary cut in the 6.2% Federal payroll tax. Trump-backed the idea today. GBP was the second strongest currency of the day (behind CHF) after German Chancellor Merkel said the EU would consider practical solutions regarding the post-Brexit backstop. EUR/GBP dropped back near session lows but GBP/USD clung near the highs.

Both reports from Berlin and Washington highlight the conditional nature of the promises. Both are framed as options governments would only consider in the event of intensifying economic weakness. The trouble with the US report is that it would need to get through Democrat-controlled House without having to give up something the Republican-controlled Senate would agree to.

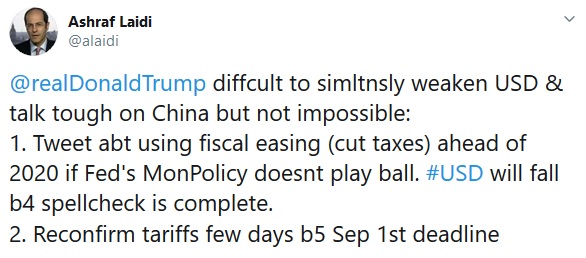

Ashraf predicted two weeks ago in this tweet that below tax cuts would resurface from the White House

In other news (or more of the same), Trump stepped up criticism of the Fed once again, calling for 100 basis points of easing and fresh QE. That chatter is increasingly falling flat in the markets but it highlights the risks for the Fed, including the risks around the FOMC Minutes on Wednesday.

Fed dissenter Eric Rosengren appeared on TV Tuesday and reiterated that he wasn't prepared to ease further because the FOMC is currently on track to meet its objectives. That said, he also indicated he would be willing to switch to cuts if a foreign slowdown was causing enough domestic weakness to significantly weaken his forecast for 2% US growth.