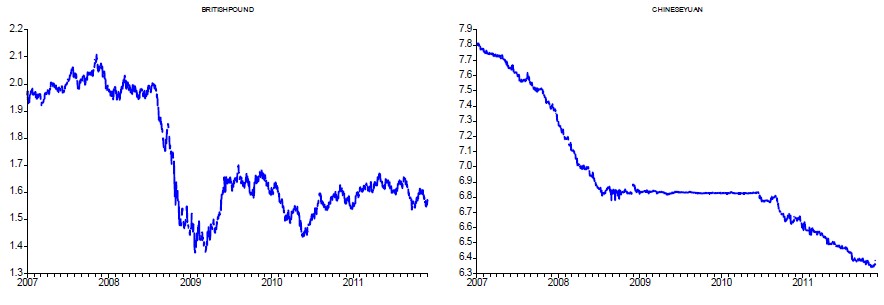

•The euro’s demise is more than just a mere possibility, particularly if the common currency’s main flaw, the lack of fiscal integration, isn’t addressed. But a fiscal union will take years to develop. Short-term solutions are required at this point. ECB-enabled IMF purchases of government bonds may be designed to circumvent the limitations brought by the European Treaty but that action alone is unlikely to stem the crisis. Eurobonds may be the solution, but so far have been rejected by the Germans. Expect Chancellor Merkel to change her tone on that issue in coming months as several too-big-to-bailout European governments find themselves shut out of financial markets.

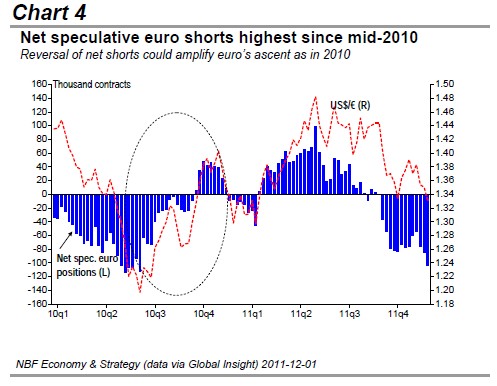

• While the risk of a euro blow-up remains, there is upside potential too. If European leaders manage to present a unified credible strategy to combat the debt crisis, markets should respond favourably. The reversal of net euro shorts would then amplify the common currency’s ascent. A run above 1.40 US$/€ is in the cards should the ECB and European leadership get their act together.

European (dis)Union

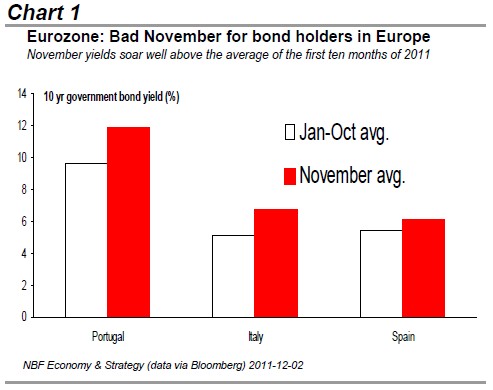

With European leadership seemingly on vacation in November, bond vigilantes ran riot in the month taking sovereign yields to nosebleed levels (Chart 1). The European Central Bank’s refusal to take on the role of lender of last resort and German rejections of proposed options to end the current crisis highlighted the complexity of the problems and the zone’s arguably dysfunctional governance. So much so that even the mainstream media started writing the euro’s obituary, highlighting the possibility of the common currency zone imploding under the weight of sovereign defaults.

To be sure, the euro’s demise is more than just a mere possibility, particularly if the common currency’s main flaw, the lack of fiscal integration, isn’t addressed. Economists have long argued that a monetary union isn’t sustainable without a fiscal one and policy makers are now getting the message, thanks

largely to pressure from financial markets. German Chancellor Merkel and French President Sarkozy are turning more vocal about the need for fiscal integration. Even the ECB, is starting to change its tone, with new chief Mario Draghi, suggesting that the central bank would take further steps to tackle the crisis if eurozone governments could send a credible signal to markets by agreeing to “a fundamental restatement of the fiscal rules”. But a fiscal union

will take years to develop and the eurozone, unfortunately, doesn’t have the luxury of time. The European debt plan crafted in October seems toothless at this point with the EFSF finding it challenging to boost its war chest. So what to do to avoid a eurozone disintegration and hence a global financial disaster?

What next?

One of the proposed short-term options is Eurobonds that would be collectively issued and guaranteed by the zone’s members. While those would help lower the cost of borrowing of the likes of Italy and Spain, they would mean a higher cost of borrowing for others in better fiscal shape. No wonder that the proposal was shot down by Germany. Moreover, joint guarantees always bring forward the problem of moral hazard. A fiscal union, where every participant can be closely monitored by one another, would have helped here. But in our view, even absent a fiscal union, the moral hazard problem can still be addressed with rigorous monitoring by the IMF, ECB or the European Union over the near term. More importantly, the monitor in chief, i.e. financial markets, would work as to encourage fiscal rectitude by borrowing governments.

Another option is to edit the European Treaty as to allow the ECB to buy new bonds directly from issuing governments (currently the ECB can only purchase government bonds in the secondary market). That option presents a political minefield since some of the individual EU governments, may be eager to take that opportunity to tweak other parts of the Treaty. So that option seems unlikely to translate into action.

A third option would be for the ECB to circumvent the Treaty limitations on bond buying and lend money to the IMF who would, in turn, buy the bonds directly from the issuing governments. That seems to be the more likely option to materialize although its chances of success at stemming the crisis on its own are remote. That’s because the $100-200 bn proposed transfer from the ECB to the IMF is too small to cover financing needs of troubled eurozone economies.

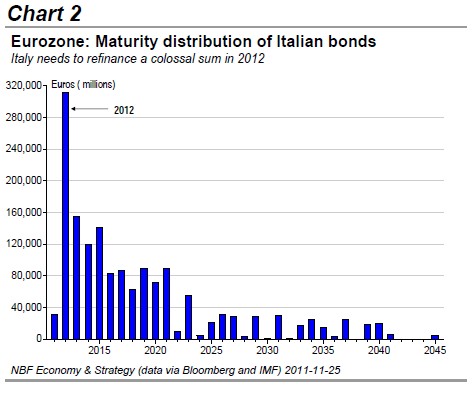

Note that Italy has more than $300 billion of long-term borrowing requirements in 2012, with a massive $200 billion to come in Q1 2012 alone (Chart 2). In light of the recent disastrous German bond auction, does Italy really stand a chance to get a bid on all these bonds? Hard to imagine. So, besides the unpalatable option of paying interest rates north of 6% on its debt, Italy will have to lean on the IMF who incidentally will also have to cater to the needs of Spain and others. Suddenly, the ECB’s $200 bn transfer to the IMF doesn’t look all that impressive nor sufficient.

Should bond buying by the IMF prove insufficient (and preliminary indications are that they will be), then the next best short-term option would be Eurobonds. So, over the coming months, expect a change of tone from Chancellor Merkel regarding Eurobonds. Germany will have to pick its poison to avert a

disintegration of the eurozone, and Eurobonds fit the bill as the least bitter pill to swallow.

Why hasn’t the euro slumped below 1.30 US$?

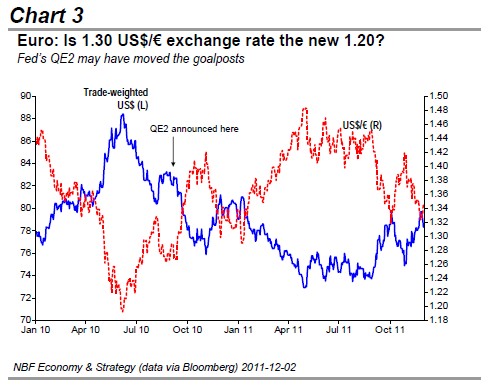

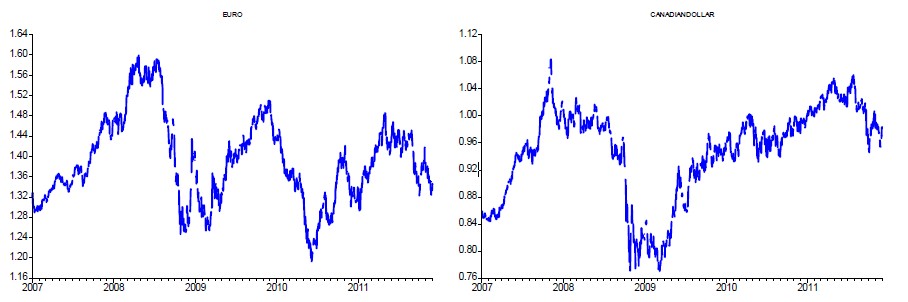

Despite the deterioration of the European debt crisis, and an economy in recession (early data point to a possible GDP contraction as early as Q4 of this year), why does the euro continue to trade stronger than 1.30 US$? Aren’t the problems today more acute than they were mid- 2010 with contagion now being widespread? Note that in June of 2010, net short positions on the euro were similar to today’s levels and the currency then slumped to 1.20. So, why hasn’t

the euro folded as fast this time?

That’s in part because markets continue to expect that European leadership will finally show up, just in time to prevent a eurozone meltdown. The peg by the Swiss National Bank, as well as repatriation of funds by European banks have also helped somewhat. But, in our view, one of the major forces helping support the euro is the massive expansion of the Fed’s balance sheet since last year. The US dollar has depreciated more than 5% since Chairman Bernanke announced QE2 back in August 2010. So, perhaps 1.30 is the new 1.20 for a US$/€ exchange rate (Chart 3).

While the risk of euro blow-up remains, there is upside potential too. If European leaders manage to present a unified credible strategy to combat the debt crisis, markets should show appreciation. The return of risk taking would take some steam out of the greenback and boost the euro. Moreover, the reversal of net euro shorts would amplify the common currency’s ascent. Note that in just four months over the period June-October 2010, net speculative positions went from a record negative to a cycle high, helping the euro to a 15% appreciation over that short time span (Chart 4). While we’re not anticipating gains of such magnitude again, a run above 1.40 US$/€ is in the cards should the ECB and European leadership get their act together.

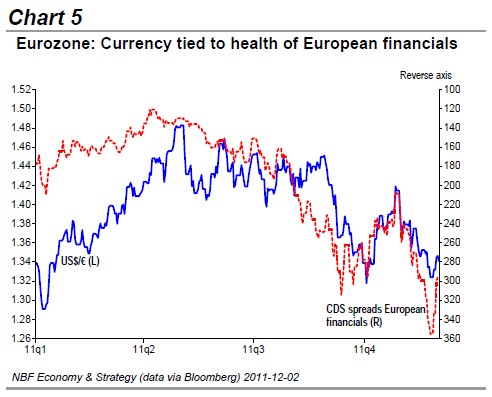

That said, the common currency should remain under pressure over the longer term, as the eurozone recession lingers (we’re anticipating a GDP contraction of 0.2% in 2012) and banks continue to struggle in their recapitalization efforts. Note that the common currency is linked to the health of its financial system (Chart 5).

Part of the euro’s recent rebound was on the back of coordinated action by world central banks to provide US dollar access to banks (particularly cash-strapped European ones). After a brief relief rally, expect the euro to head back downwards as markets notice that banks are struggling to meet new capital reserve requirements and feeling the brunt of bad loans in a contracting economy.

US dollar retreat as “risk on” returns

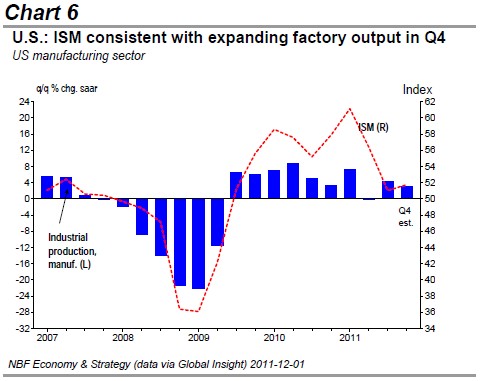

In contrast to Europe, the North American economy is on a much better footing. The US economy has accelerated in every quarter this year and Q4 GDP growth is expected to be the best this year at well over 2% annualized. That’s in part due to factories continuing to ramp up output in light of improving demand both abroad and at home (Chart 6).

Exports remain a contributor to GDP and consumption spending, the major driver of the American economy, remains resilient. The uptrending labour market is clearly helping on that front. November’s non-farm payrolls were better than expected considering the upward revisions to the prior months’ job gains and the four-tick drop in the unemployment rate to 8.6%, the lowest it’s been since March 2009. Momentum should carry through to early 2012 if, as we expect, the payroll tax cuts are extended by Congress.

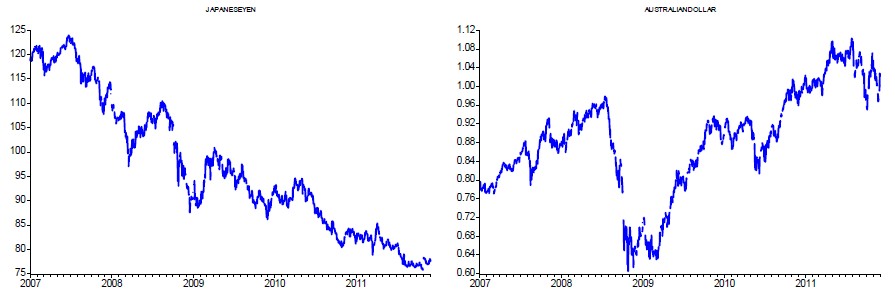

So, barring a eurozone implosion, the US economy should accelerate in 2012, with GDPgrowth of around 2.2% compared to this year’s 1.7%. Decent data from the US and Asia (helped by a loosening of monetary policy in the latter region), should offset dull European data, keeping a bid on risky assets in 2012, hence weighing somewhat on the US$. Commodity currencies like the A$ and the C$ would stand to gain as a result.

Loonie could get a boost in 2012

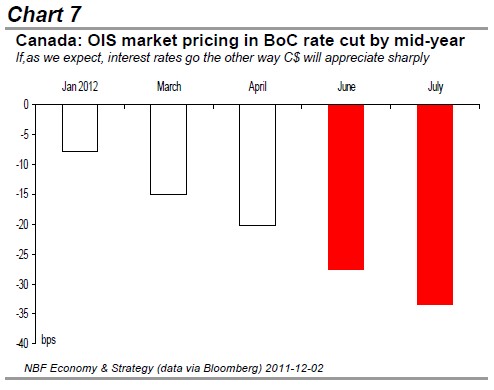

In addition to the return of “risk on”, the Canadian dollar has another card up its sleeves for 2012 – interest rate spreads. Markets are now fully pricing in a 25 bp rate cut by the Bank of Canada by the middle of next year (Chart 7). While a European implosion and hence a global recession would clearly warrant rate cuts in Canada, we’re not forecasting such a dire outcome as yet.

It’s true that Canada is showing signs of slowing down following a hot Q3 when GDP grew 3.5% annualized. The recent downtrend in the labour market suggests that output moderated in Q4. That, however, doesn’t mean that the trend will persist early next year. Again, assuming a European-triggered global financial crisis is averted, Canada will get a lift from an expanding global economy. We expect 2012 global growth to remain above 3%, and together with a strengthening US economy, Canada should manage to post GDP growth close to potential of 2% next year.

So, expect inflation pressures to remain a factor even though the year-on-year comparisons will translate into a drop in the annual inflation rate.

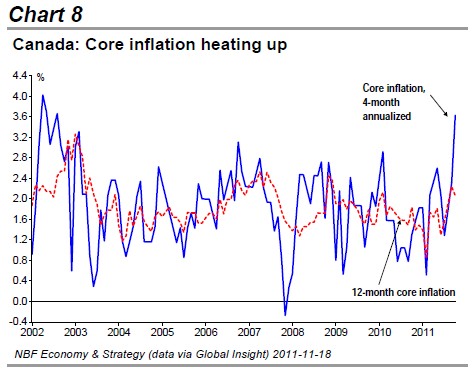

Note that in October, we saw a ramp-up in core prices, with the highest four-month annualized increase since 2002 (Chart 8).

Clearly, price pressures aren’t easing as fast as the Bank of Canada had anticipated and under normal circumstances, it would be raising interest rates from the current extraordinarily low levels. But the threat of a European-triggered global financial crisis is enough to keep the BoC on hold for now.

Should Europe succeed in avoiding a global financial crisis, the outlook for the second half of next year would be much improved, putting inflation back at the forefront of discussions in Canada. We therefore expect the Bank of Canada to resume interest rate hikes in July and take the overnight rate to 1.75% by year end. If we’re correct, markets will be revising their expectations and hence give a boost to the loonie by mid year. We continue to expect the loonie to test 1.05 US$ (i.e. much stronger than parity) by the middle of 2012.

Annex

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Fiscal Integration or Bust!

Published 12/06/2011, 09:31 AM

Updated 05/14/2017, 06:45 AM

Fiscal Integration or Bust!

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.