U.S. stocks and ETFs fell on Friday and for the week as the clock clicks steadily towards the fiscal cliff and witching hour on December 31, 2012.

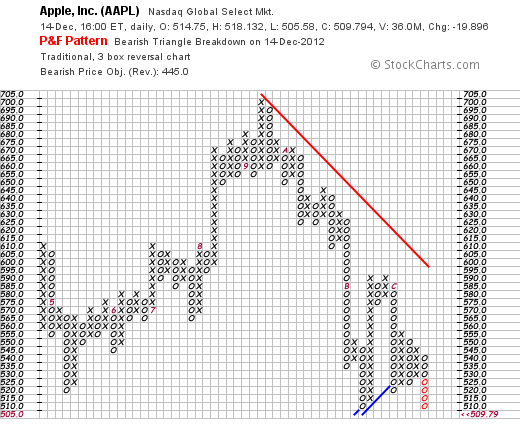

In a volatile week, Apple (AAPL) fell hard again on Friday, down 3.8% on poor analysts reports and ongoing technical weakness.

While most market participants still expect a deal between the White House and the House of Representatives, the prospect of going over the cliff grows increasingly likely with each passing day. The President and House Speaker John Boehner met again this week at the White House but failed again to emerge with a deal in hand.

On My ETF Radar

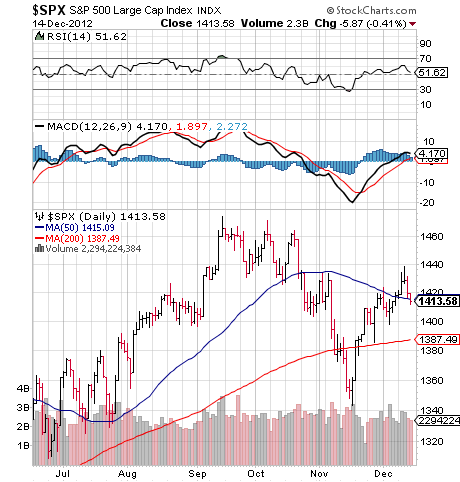

In the chart of the S&P 500 (SPY) above, we can see how the S&P 500 is stuck at major resistance as it struggles with the fiscal cliff. The S&P 500 (SPY) is just below its 50-day moving average but above the 200-day average and momentum and relative strength are in decline, indicating short-term weakness in the U.S. stock market as the fiscal cliff stalemate continues.

The chart of Apple (AAPL) is particularly ugly as it printed a bearish triangle breakdown on December 14th and now has a downside price objective of $509. If reached, this price target would be more than 25% from Apple’s (AAPL) September highs.

ETF News You Can Really Use

For the week, the Dow Jones Industrial Average (DIA) slipped 0.2%, the S&P 500 (SPY) slid 0.3% and the Nasdaq Composite (QQQ) dropped 0.7%.

In economic news, jobless claims, retail sales and industrial production all improved, along with economic reports from China.

Specifically, initial jobless claims fell to 343,000, down from 372,000 and beating expectations and retail sales for November advanced 0.3%, just below expectations and well above the previous month’s reading of -0.3% while China’s HSBC initial PMI report came in at 50.9, up from last month and just above the 50 line between expansion and contraction.

In Europe, Greece received its much needed bailout while Germany PMI declined to 46.3, down from 46.8 in November and still below the all important 50 line and in contraction territory. Europe is officially in recession and the outlook for 2013 shows little hope for improvement.

The Federal Reserve launched “QE4,” another round of asset buying to replace the expiring Operation Twist and pegged its easy money policy to 6.5% unemployment. Generally speaking, markets yawned and it seems increasingly evident that the impact of the Fed’s monetary policy is in sharp decline.

Next week brings a raft of economic reports including the Empire State Index, Home Builders Index, Housing Starts, existing home sales, GDP revision, Philadelphia Fed, Chicago Fed, personal income and spending, durable goods and the University of Michigan consumer sentiment index.

All of that is important, but the fiscal cliff will retain top billing as the clock continues clicking towards the end of the year.

Bottom line: Sometime soon, the market’s complacency regarding the fiscal cliff could give way to panic if a deal isn’t reached and the prevailing confidence in a positive outcome evaporates.

Disclaimer: The content included herein is for educational and informational purposes only, and readers agree to Wall Street Sector Selector’s Disclaimer, Terms of Service, and Privacy Policy before accessing or using this or any other publication by Wall Street Sector Selector or Ridgeline Media Group, LLC.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Fiscal Cliff: T Minus 15 And Counting

Published 12/17/2012, 01:03 AM

Updated 05/14/2017, 06:45 AM

Fiscal Cliff: T Minus 15 And Counting

Fifteen days remain to the fiscal cliff with both sides apparently unwilling to make a deal.

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.