Although the primary driving force behind the three day sell-off in the March British Pound has been the threat of the U.S. fiscal cliff, yesterday’s report that U.K. house prices fell for a sixth month in December didn’t help matters. Despite its recent strength against the U.S. dollar, the bigger picture suggests that the U.K. economy is likely to remain weak against the U.S.

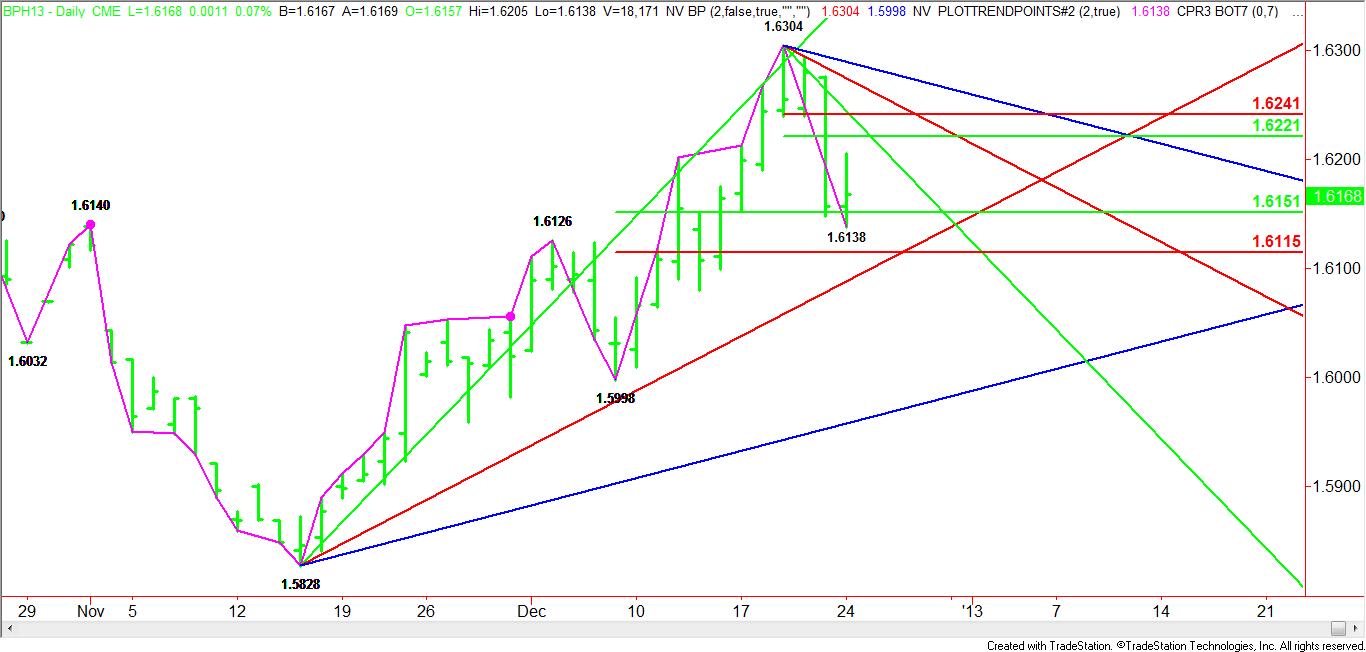

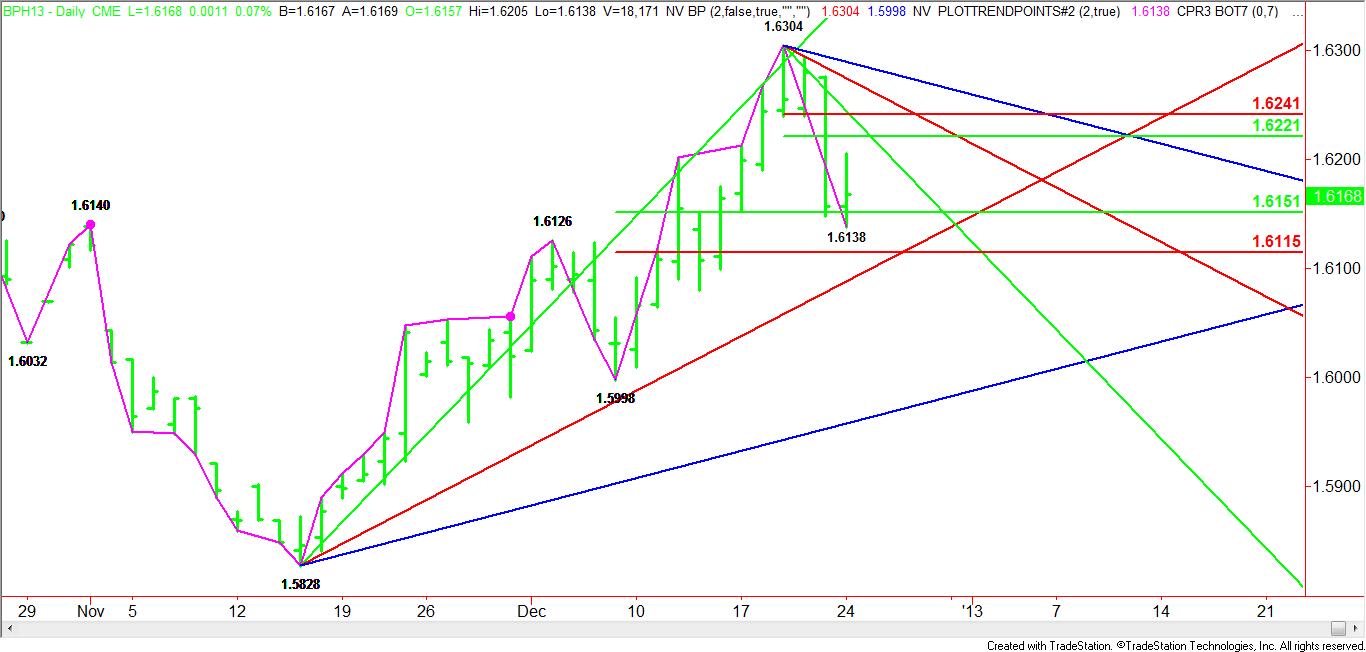

Technically, the main trend on the daily chart is still up. The trend will turn down when 1.5998 is violated. Last week, a new main top was formed at 1.6304. A move through this level will reaffirm the uptrend.

Overnight, the British Pound reached a low at 1.6138. Combined with the top from 1.6304, a new range was created at 1.6221 to 1.6241. Traders should watch for a test of this area. If the next rally stalls inside of this range then a secondary lower top could form, indicating a shift in sentiment. Besides the retracement zone, a downtrending Gann angle from 1.6304 dropped in at 1.6244 yesterday. This forms a possible resistance cluster with the Fibonacci retracement level at 1.6241 to 1.6244.

The market basically bounced off of a 50% level created by the 1.5998 to 1.6304 range at 1.6151. A failure to hold this level could mean a test of the Fibonacci level at 1.6115. This level is likely to be tested on December 26 or 27 when an uptrending Gann angle from the 1.5828 bottom comes in at 1.6098 and 1.6108 respectively.

In summary, due to yesterday’s light volume and today’s holiday, traders should watch for a possible two-sided trade with 1.6221 the potential upside target or 1.6115 on the downside.

Technically, the main trend on the daily chart is still up. The trend will turn down when 1.5998 is violated. Last week, a new main top was formed at 1.6304. A move through this level will reaffirm the uptrend.

Overnight, the British Pound reached a low at 1.6138. Combined with the top from 1.6304, a new range was created at 1.6221 to 1.6241. Traders should watch for a test of this area. If the next rally stalls inside of this range then a secondary lower top could form, indicating a shift in sentiment. Besides the retracement zone, a downtrending Gann angle from 1.6304 dropped in at 1.6244 yesterday. This forms a possible resistance cluster with the Fibonacci retracement level at 1.6241 to 1.6244.

The market basically bounced off of a 50% level created by the 1.5998 to 1.6304 range at 1.6151. A failure to hold this level could mean a test of the Fibonacci level at 1.6115. This level is likely to be tested on December 26 or 27 when an uptrending Gann angle from the 1.5828 bottom comes in at 1.6098 and 1.6108 respectively.

In summary, due to yesterday’s light volume and today’s holiday, traders should watch for a possible two-sided trade with 1.6221 the potential upside target or 1.6115 on the downside.