The fiscal cliff ticked closer last week as U.S. stocks and ETFs rose slightly for the week and political leaders continued their sparring. 22 days remain until the cliff arrives on December 31st, however, this is the last week when Congress is scheduled to be in session with the Christmas break starting Friday, December 14th.

On My ETF Radar

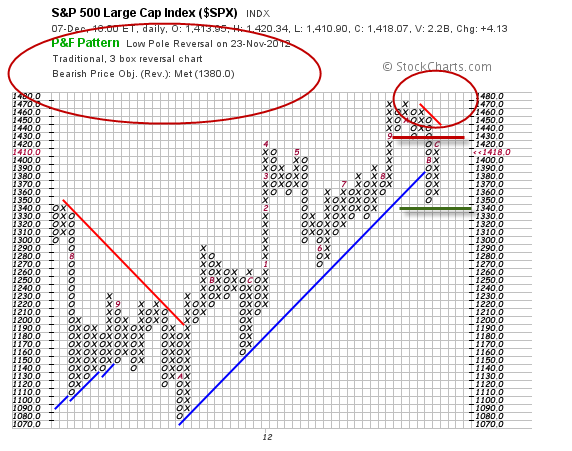

A quick glance at the chart of the S&P 500 (SPY) shows us that the index is still in a bear market, below its red bullish resistance line and with a bearish price objective of 1380. However, the shorter term direction has been up and the index is in a range between 1350-1420 as the sideways action continues and market participants wait for resolution to the fiscal cliff.

Major U.S. stock indexes and ETFs continue their sideways drift in anticipation of a resolution to the fiscal cliff.

Major ETF and Index Update:

For the week, the Dow Jones Industrial Average (DIA) added 1%, the S&P 500 (SPY) gained 0.1%, the Nasdaq Composite (QQQ) fell 1.1% and the Russell 2000 (IWM) gained 0.12%.

Gold (GLD) declined 0.5% and oil (USO) fell 3.2%.

ETF News You Can Really Use

Apple (AAPL) continued making news last week and dragging down the Nasdaq (QQQ) as the largest company in the world declined 8.9% from last Friday’s close and now is 24% below its recent September high.

In economic news, Friday’s nonfarm payrolls report showed that jobs climbed by 146,000 last month and unemployment fell to 7.9%. Both headline numbers beat expectations, however, less widely reported was that the labor force participation rate continued to decline, down 0.2% to 63.6% as another 500,000+ people left the labor force. Also, September and October employment numbers were revised downward.

Friday also brought December’s University of Michigan consumer sentiment index that registered a drop to 74.5 from last month’s 82.7 and missed expectations of 82 by a wide margin. Earlier in the week, November’s ISM declined to 49.5, also missing expectations and putting the index into contraction territory.

On the good news front, ISM services climbed to 54.7 and construction spending for October was up.

This week brings more fiscal cliff debate and the widely anticipated Federal Reserve meeting on Tuesday and Wednesday with Chairman Bernanke’s press conference at the conclusion of the meeting.

Regarding the fiscal cliff, apparently no progress was made this week and the clock continues ticking. Still, markets appear to remain convinced that the stalemate will be broken in time as prices continued to advance for the third week in a row.

Besides the fiscal cliff debate, the Federal Reserve is expected to launch another round of quantitative easing to replace the Operation Twist program that expires at the end of the year. The Federal Reserve is exhausting its supply of short-term securities to sell and replace with longer term securities and so market players are expecting as much as another $50 billion/month in long-term Treasury purchases to replace Operation Twist. The Fed is also expected to leave interest rates near 0% at historically low levels as it continues its efforts to prop up the U.S. economy.

Almost lost in the news flow surrounding the fiscal cliff, Europe continues to slow as the ECB cut its forecast for European growth rates into 2013.

Significant economic data due for the week will be reports about jobs, retail sales, consumer and producer price indexes and industrial production. Retail sales will be particularly closely watched as the effects of Hurricane Sandy should dissipate.

Bottom line: Fiscal cliff countdown continues and markets players expect resolution. The Fed meets and more easing is expected. Any disappointments on either front will change the market tone while resolution could support markets over the short term.

Disclaimer: The content included herein is for educational and informational purposes only, and readers agree to Wall Street Sector Selector’s Disclaimer, Terms of Service, and Privacy Policy before accessing or using this or any other publication by Wall Street Sector Selector or Ridgeline Media Group, LLC.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Fiscal Cliff Countdown Continues With No Progress In Sight

Published 12/10/2012, 01:46 AM

Updated 05/14/2017, 06:45 AM

Fiscal Cliff Countdown Continues With No Progress In Sight

The fiscal cliff countdown continues with no progress in sight and 22 days to go.

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.