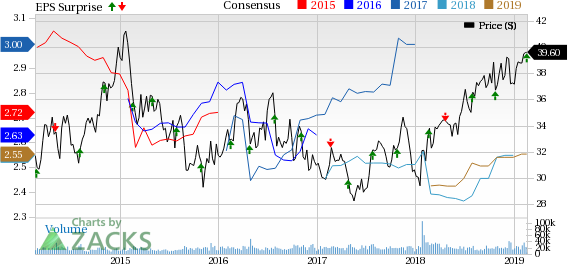

FirstEnergy Corporation (NYSE:FE) delivered fourth-quarter 2018 operating earnings of 50 cents per share, which beat the Zacks Consensus Estimate of 48 cents by 4.17%. Quarterly earnings declined 13.7% year over year.

On a GAAP basis, the company generated earnings of 25 cents, against a loss of $5.62 incurred in the prior-year quarter.

In 2018, FirstEnergydelivered earnings of $2.59, up from $2.17 in 2017.

Total Revenues

FirstEnergy generated total revenues of $2,710 million in fourth-quarter 2018, which beat the Zacks Consensus Estimate of $2,668 million by 1.6%. The figure improved from $2,681 million in the year-ago quarter.

In 2018, FirstEnergy generated revenues of $11,261 million, up from $10,928 million a year ago.

Highlights of the Release

Total electric delivery increased 418,000 megawatt-hours (MWH), or 1.2% year over year. Residential sales rose 0.5% on a year-over-year basis. Commercial and industrial sales rose 1.7% and 1.4% year over year, respectively. Total distribution deliveries increased by 1 cent per share primarily on the back of higher weather-related and industrial usage.

Heating-degree-days were up 7% year over year and 7% above normal/

Financial Update

FirstEnergy's cash and cash equivalents as of Dec 31, 2018 were $367 million, down from $588 million as of Dec 31, 2017.

Long-term debt and other long-term obligations as of Dec 31, 2018 were $17,751 million compared with $ 18,687 million as of Dec 31, 2017.

Net cash provided from operating activities in the last three months of 2018 was $852 compared with $1,046 million in the year ago quarter.

Guidance

The company’ management guided 2019 EPS range of $2.45 to $2.75, whose mid-point of $2.60 is higher than the current Zacks Consensus Estimate for the period of $2.55. Also, the company provided first-quarter earnings guidance in the range of 60-70 cents.

Zacks Rank

FirstEnergy carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Utility Releases

NextEra Energy, Inc (NYSE:NEE) delivered fourth-quarter 2018 adjusted earnings of $1.49 per share, which lagged the Zacks Consensus Estimate of $1.51 by 1.3%.

American Electric Power Co., Inc (NYSE:AEP) generated fourth-quarter 2018 operating EPS of 72 cents, in line with the Zacks Consensus Estimate.

Xcel Energy Inc (NASDAQ:XEL) posted fourth-quarter 2018 operating earnings of 42 cents per share, in line with the Zacks Consensus Estimate.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-holds for the year?

Who wouldn't? Our annual Top 10s have beaten the market with amazing regularity. In 2018, while the market dropped -5.2%, the portfolio scored well into double-digits overall with individual stocks rising as high as +61.5%. And from 2012-2017, while the market boomed +126.3, Zacks' Top 10s reached an even more sensational +181.9%.

See Latest Stocks Today >>

American Electric Power Company, Inc. (AEP): Free Stock Analysis Report

FirstEnergy Corporation (FE): Free Stock Analysis Report

Xcel Energy Inc. (XEL): Free Stock Analysis Report

NextEra Energy, Inc. (NEE): Free Stock Analysis Report

Original post

Zacks Investment Research