Diversified energy company, FirstEnergy Corporation (NYSE:FE) reported second-quarter 2017 operating earnings of 61 cents per share, in line with the Zacks Consensus Estimate. Quarterly earnings were also up 8.9% year over year.

Moreover, the earnings remained in the guidance range of 55–65 cents per basic share provided by the company during first-quarter 2017.

On a GAAP basis, FirstEnergy reported earnings of 39 cents per share, significantly better than the prior-year loss of $2.56 per share.

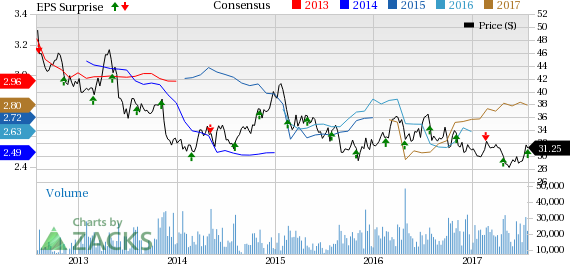

FirstEnergy Corporation Price, Consensus and EPS Surprise

Total Revenue

FirstEnergy generated total revenue of $3,309 million in second-quarter 2017, missing the Zacks Consensus Estimate of $3,415 million by 3.10%.

Reported revenues were also down 2.7% from $3,401 million reported a year ago. The top line declined primarily due to lower capacity revenues from Competitive Energy Services.

Highlights of the Release

Total electric sales decreased by 361 thousand megawatt-hours (MWh), or 32.8% year over year. Residential sales declined by 541 thousand MWh, or 4.6% while commercial sales fell 159 thousand MWh, or 1.5%. Industrial sales improved by 449 thousand MWh or 3.6% primarily on account of higher usage by shale and steel customers.

For the second quarter, FirstEnergy incurred operating expenses of $2,911 million, down 51.2% from $5,969 million a year ago primarily owing to lower unit cost of fuel and cost of purchased power.

Operating income in the reported quarter was pegged at $690 million, up from $618 million in the prior-year quarter.

Financial Update

FirstEnergy's cash on hand as of Jun 30, 2017 was $114 million, down from $199 million as of Dec 31, 2016.

Long-term debt and other long-term obligations as of Jun 30, 2017 were $20,582 million compared with $18,192 million as of Dec 31, 2016.

Net cash provided from operating activities was $1,482 million during the first six months of 2017 compared with $1,472 million provided from operating activities during the first six months of 2016.

Guidance

FirstEnergy has provided operating earnings guidance for third-quarter and full-year 2017 in the range of 75–90 cents and $2.70–$3.00 per basic share, respectively.

Peer Releases

NextEra Energy, Inc. (NYSE:NEE) reported second-quarter 2017 operating earnings of $1.86 per share, beating the Zacks Consensus Estimate of $1.76 by 5.68%.

DTE Energy Company (NYSE:DTE) reported second-quarter 2017 adjusted earnings of $1.07 per share, beating the Zacks Consensus Estimate of 99 cents by 8.08%.

WEC Energy Group, Inc. (NYSE:WEC) reported second-quarter 2017 adjusted earnings of 63 cents per share, compared to the Zacks Consensus Estimate of 59 cents by 6.78%.

Zacks Rank

FirstEnergy currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

WEC Energy Group, Inc. (WEC): Free Stock Analysis Report

NextEra Energy, Inc. (NEE): Free Stock Analysis Report

FirstEnergy Corporation (FE): Free Stock Analysis Report

DTE Energy Company (DTE): Free Stock Analysis Report

Original post