One ETF on our radar screen for potential buy entry right now is First Trust Internet Index (FDN). Unlike many of the strongest ETFs in the market that are near-term extended to the upside, $FDN has not yet broken out above its range. As such, one could understandably argue that the ETF has relative weakness and should be avoided. In many cases, that would be true.

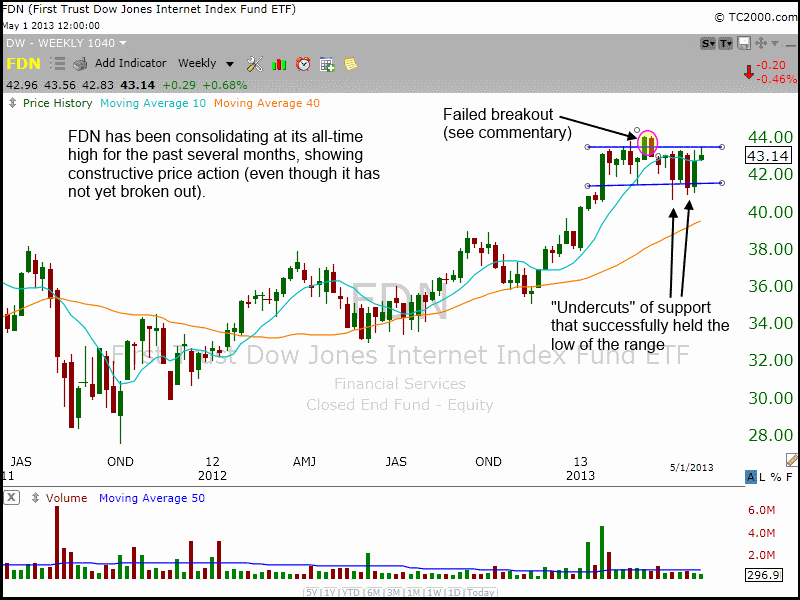

Even though FDN has not yet broken out, the difference here is that the ETF has been forming a constructive base of consolidation at its all-time highs. This is much different than buying an ETF that is trading near its lows and is only now attempting to reverse its downtrend. The weekly chart of FDN below shows how the ETF has been consolidating for the past few months:

On the week ending March 8, notice that $FDN attempted to break out to a new high, but failed the following week. When this happens to an ETF or stock that is trading near its highs, it does not necessarily mean the setup becomes invalid. On the contrary, some of the most explosive upside moves occur when the first breakout attempt fails, but the equity subsequently breaks out and hold. Often, failed breakouts at the highs simply indicate a lengthier period of base building is required.

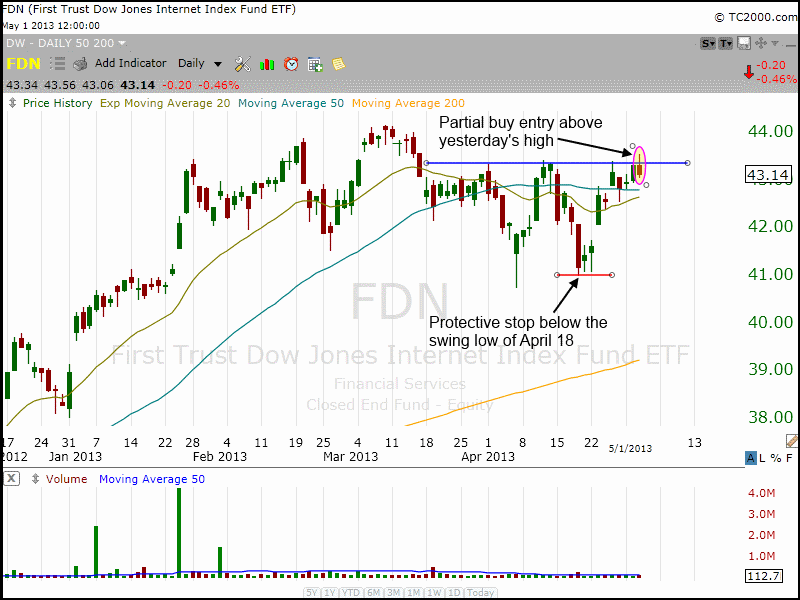

Zooming into the shorter-term daily chart interval, notice that a rally above yesterday’s (May 1) high would present a valid buy entry point for a partial position. Additional shares could be added to the position on confirmation of a breakout above the highs of the range:

Despite the major indices losing 0.9% yesterday, $FDN showed relative strength on the day by slipping just 0.5%. This was aided by shares of LinkedIn (LNKD), which ignored the weakness in the broad market and climbed 1.4% to another fresh record high. $FDN is primarily comprised of mid to large-cap internet stocks like Google (GOOG), Netflix (NFLX), and Yahoo! (YHOO), each of which are trading at or near their 52-week highs.

Speaking of internet stocks, our open position in $LNKD is now showing an unrealized gain of nearly 12% (20 points) since our April 9 buy entry. As we said in yesterday’s The Wagner Daily, “$LNKD is scheduled to report earnings after the close on May 2, so if you are uncomfortable holding through earnings you should exit the position into strength ahead of the report (in today’s session). Because we have a decent profit buffer we do not mind holding $LNKD through earnings.” To further your trading education, check out how we traded around last quarter’s LNKD earnings report for a total gain of 22%.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

First Trust Internet Index ETF: The Next To Breakout?

Published 05/02/2013, 08:11 AM

Updated 07/09/2023, 06:31 AM

First Trust Internet Index ETF: The Next To Breakout?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.