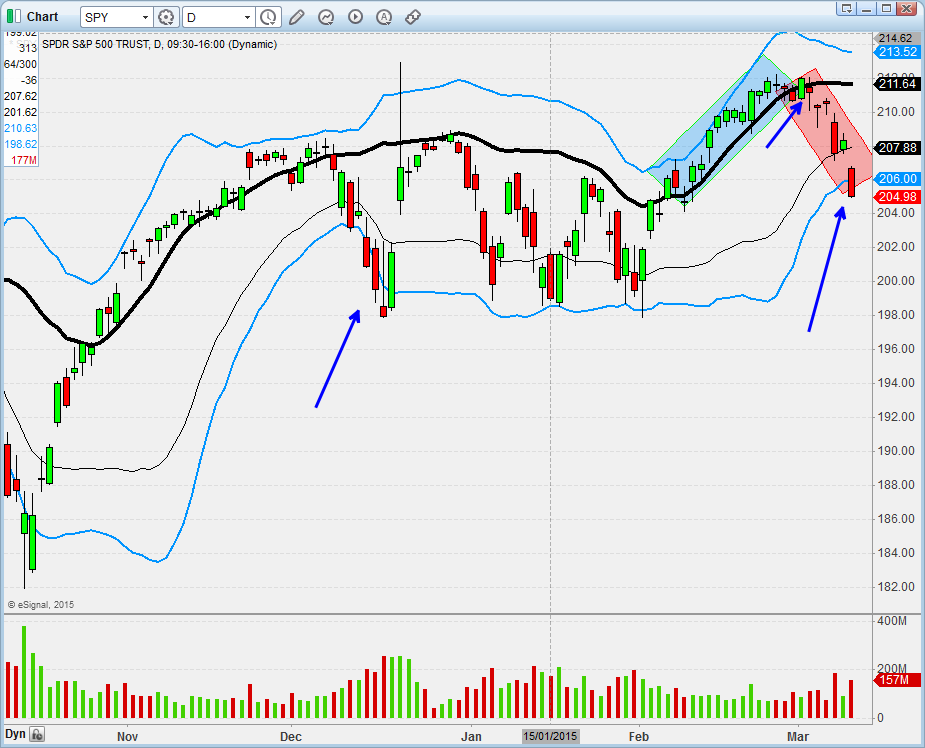

The (ARCA:SPY) finally closed under the standard deviation of 2 Bollinger Bands® for the first time in 2015. Does that make it an automatic buy? Hell no. But it does bear watching for other information, like is this a trend change?

What would be the first sign of that? No buyers showing up at support always a good initial tell. We’ll let SPY go but we do want to see buyers show up for (NASDAQ:QQQ) 104.5 area which coincides to 50sma, bottom of BB®, and horizontal support. Often what happens is one index takes out support but the stronger one bounces as it hits important levels. This means an overshoot of SPY but a hold of QQQ. Anyway, it’s our working theory and we’ll be buyers of the FIRST test of 104.5-105 area — our style usually is wait for reversal candle with stop 0.5 -1% below.

At one point though there will come a time when this bull market ends and support buying will not work — but timing that will be difficult. Until then we’ll keep doing what has paid — buy oversold move into support with a .5-1% stop.

Right now short term trends have crumbled (the sweet spot between Dev 1 and 2 on BB we kept talking about earlier this month) but longer term trends are very much intact. Eventually all trends do end, and when that occurs the trade becomes shorting rallies into resistance rather than buying dips into support. But let’s cross that bridge when we get to it.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.