First Solar, Inc. (FSLR) - manufactures and sells solar modules with an advanced thin-film semiconductor technology, and it designs, constructs, and sells photovoltaic (PV) solar power systems. The Company is a thin-film PV solar module manufacturer and a PV solar module manufacturer.

I found this stock using a real-time custom scan. This one hunts for low vols.

Custom Scan Details

Stock Price GTE $7

IV30™ - HV20™ LTE -8 GTE -40

HV180™ - IV30™ GTE 7

Average Option Volume GTE 1,200

Industry != Bio-tech

Days After Earnings GTE 32

The goal with this scan is to identify short-term implied vol (IV30™) that is depressed both to the recent stock movement (HV20™) and the long term trend in stock movement (HV180™). I'm also looking for a reasonable amount of liquidity in the options (thus the minimum average option volume), want to avoid bio-techs (and their crazy vol) and make sure I'm not purchasing depressed IV30™ relative to HV20™ simply because of a large earnings move.

Let’s start with the Charts Tab (six months), below. The top portion is the stock price, the bottom is the vol (IV30™ - red vs HV20™ - blue vs HV180™ - pink).

On the stock side, we can see how FSLR has been declining over the last six months. In fact, the 52 wk range is [$11.43, $142.22], so the drop to $15 is a 92% decline from the annual high. Although it’s hard to see, I’ve highlighted the stock pop on 6-12-2012 when the stock rose from $12.33 to $14.95, or 21%. I’ve included the news snippet from that day, below:

First Solar shares are spiking today on a report that the solar-products maker is ramping up production to meet unexpectedly high levels of demand in Germany.

The stock is up 23% to $15.15, by far today’s top performer in the S&P 500.

Earlier today, Reuters reported First Solar will increase production at its German plants even though those plants are scheduled to close later this year. The decision comes amid an unexpected surge in demand. --

Source: WSJ.com via Yahoo! Finance; First Solar Shares Surge Amid German Output Jump, written by Steven Russolillo and Kevin Kingsbury.

For a slightly longer-term perspective of the ride this stock has taken (a ride down), I’ve included the Charts Tab for twelve months, below.

It’s easier to see the massive stock decline from this chart.

On the vol side, we can see how the implied has been declining of late to now under 80% as the HV20™ has spiked off of that one day move in mid-June. As of right now the implied is depressed to both the short-term and long-term historical realized vols. Specifically:

IV30™: 79.52%

HV20™: 103.20%

HV180™: 89.12%

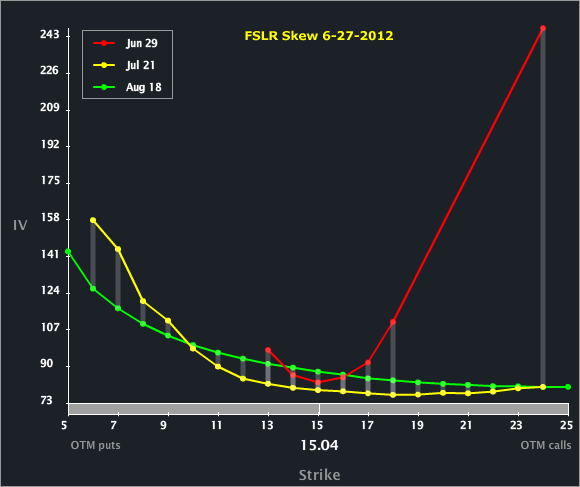

Let’s turn to the Skew Tab to examine the month-to-month and line-by-line vols.

We can see that Aug is priced above Jul (in terms of vol) likely due to an earnings announcement in Aug. The red curve represents the weekly options expiring in 1.5 days, so that wild upside skew isn’t necessarily representative of any great revelation – it’s just a cab bid in the 24 calls. Not a whole lot goin’ on in the skew that I see.

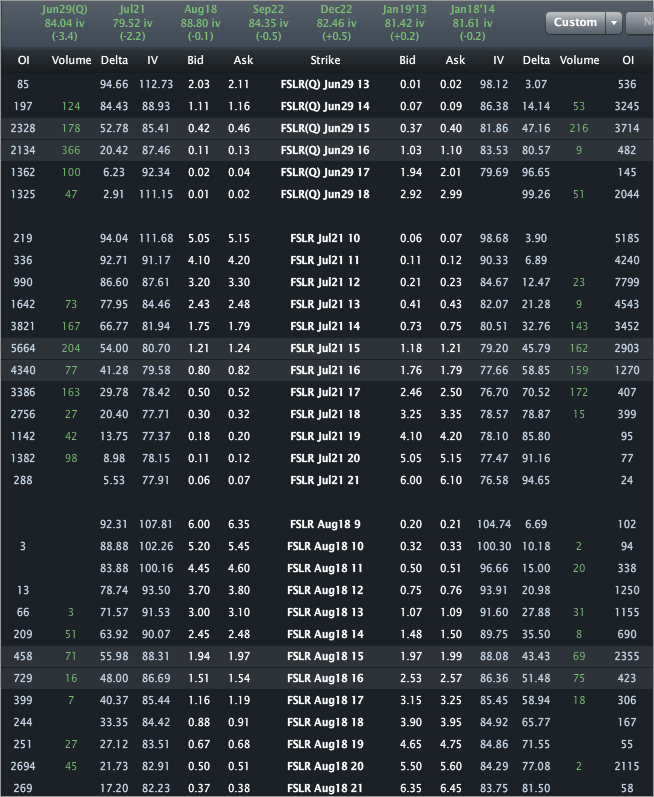

Finally, let’s turn to the Options Tab, for completeness.

Across the top we can see the monthly vols are priced to 79.52% and 88.80% for Jul and Aug, respectively. Again, that Aug vol reflects earnings risk. In terms of a trade, while the implied has been dipping of late and this stock can definitely gap, I do make note of the 52 wk range in IV30™, which is [42.05%, 128.34%],putting the current level in the 43rd percentile. In fact, it was just late Mar when IV30™ was hovering around 60% while the stock was trading in the $26 range. Note that the HV20™ is in fact elevated off of a single day’s move (6-12-2012).

Disclosure: This is trade analysis, not a recommendation.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

First Solar: Depressed Vol In Stock Down 92%

Published 06/28/2012, 02:36 AM

Updated 07/09/2023, 06:31 AM

First Solar: Depressed Vol In Stock Down 92%

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.