First Solar, Inc. (NASDAQ:FSLR) is scheduled to report fourth-quarter 2017 results after the market closes on Feb 22. Last quarter, the company delivered a positive earnings surprise of 129.41%.

Let’s see how things are shaping up prior to this announcement.

Factors at Play

During the fourth quarter, First Solar unveiled its new photovoltaic (PV) Module — Series 6. Since the company expects to start manufacturing these modules commercially by early second quarter of 2018, benefits from the selling of this product is unlikely to be realized in 2017’s result. In fact, higher cost related to development of this new model is expected to weigh on First Solar’s fourth-quarter sales.

The Zacks Consensus Estimate for fourth-quarter sales is $433.8 million, reflecting an annual decline of 9.7%.

On a bright note, Trump’s walking out of Paris accord in June 2017 prompted U.S.-based solar companies like First Solar to increase their base in international market. With this aim in view, during third-quarter 2017, in Australia, First Solar signed new module supply agreements of 240 megawatts (MW), thereby totaling its contracted delivery pipeline of modules to over 500 MW in the nation. In Japan, the company booked 21-MW DC systems project, which took the total contracted pipeline in Japan to over 240 MW DC.

In December 2017, the company set foot in the untapped solar market of Pakistan, by collaborating with Zorlu Holding, for delivering more than 860,000 of thin film modules. As of Sep 30, 2017, the company had $0.5 billion of net PV solar power systems in service primarily in international markets.

Therefore, we may expect the company’s yet-to-be reported results to reflect its solid growth in the overseas front.

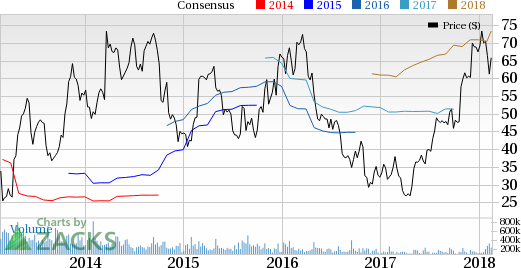

First Solar, Inc. Price and EPS Surprise

First Solar, Inc. (FSLR): Free Stock Analysis Report

Sunrun Inc. (RUN): Free Stock Analysis Report

Canadian Solar Inc. (CSIQ): Free Stock Analysis Report

Enphase Energy, Inc. (ENPH): Free Stock Analysis Report

Original post

Zacks Investment Research