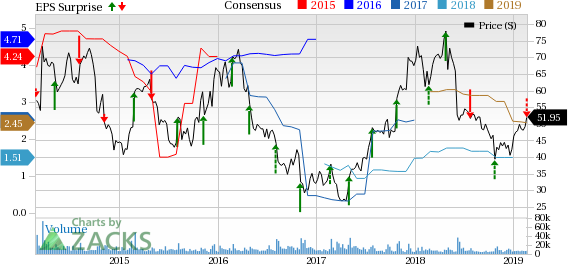

First Solar Inc. (NASDAQ:FSLR) reported fourth-quarter 2018 earnings of 49 cents per share, which missed the Zacks Consensus Estimate of 64 cents by 23.1%. The reported figure, however, improved significantly from the prior-year quarter’s loss of $4.14.

For 2018, the company’s earnings of $1.36 per share lagged the Zacks Consensus Estimate of $1.51 by 9.9%. The full-year figure, however, improved significantly from the prior year's loss of $1.59.

Sales

First Solar’s sales of $691.2 million in the reported quarter fell short of the Zacks Consensus Estimate of $803.5 million by 14%. Nonetheless, the top line improved a massive 103.8% from the year-ago quarter’s figure of $339.2 million.

For 2018, the company generated sales of $2.24 billion, which missed the Zacks Consensus Estimate of $2.36 billion by 5.1%. The reported figure also plunged 91.7% from the year-ago figure of $2.94 billion.

Operational Highlights

In the fourth quarter, gross profit was $98.3 million, up 58.4% from $62.1 million registered a year ago.

Total operating expenses contracted 10.1% to $87.3 million due to lower selling, general and administrative expenses, production start-up expenses as well as the mitigation of restructuring and asset impairments expenses.

Consequently, operating income amounted to $11 million, reflecting a massive improvement from operating loss of $35.1 million incurred in the year-ago quarter.

Financial Performance

First Solar had $1,403.6 million of cash and cash equivalents as of Dec 31, 2018, down from $2,268.5 million at the end of 2017.

Long-term debt was $461.2 million at the end of 2018 compared with $380.5 million as of Dec 31, 2017.

2019 Guidance

First Solar has updated its 2019 guidance, partially. The company continues to expect earnings per share in the range of $2.25-$2.75 on sales of $3.25-$3.45 billion. However, it lowered the full-year operating expenses projections from $390-$410 million to $375-$395 million and gross margin expectation from 20-21% to 19.5-20.5%.

Meanwhile, First Solar continues to expect its shipments in the range of 5.4-5.6 Gigawatts.

The Zacks Consensus Estimates for the company’s 2019 earnings and sales are pegged at $2.45 and $3.25 billion, respectively. While the bottom-line estimate is below the midpoint of the company’s guided range, the top-line estimate matches the lower end of the same.

Zacks Rank

First Solar currently carries a Zacks Rank #4 (Sell).

Recent Solar Release

SunPower Corp. (NASDAQ:SPWR) incurred fourth-quarter 2018 adjusted loss of 21 cents per share, narrower than the Zacks Consensus Estimate of a loss of 38 cents.

SolarEdge Technologies (NASDAQ:SEDG) reported fourth-quarter 2018 adjusted earnings of 63 cents per share, which missed the Zacks Consensus Estimate of 70 cents by 10%.

Upcoming Solar Releases

Canadian Solar Inc. (NASDAQ:CSIQ) is scheduled to release fourth-quarter 2018 results on Mar 21. The company sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

First Solar, Inc. (FSLR): Free Stock Analysis Report

Canadian Solar Inc. (CSIQ): Free Stock Analysis Report

SolarEdge Technologies, Inc. (SEDG): Free Stock Analysis Report

SunPower Corporation (SPWR): Free Stock Analysis Report

Original post