First Solar, Inc. ( (NASDAQ:FSLR) ) just released its second quarter fiscal 2017 financial results, posting earnings of 64 cents per share and revenues of $623 million. Currently, FSLR is a Zacks Rank #2 (Buy) and is up 12.36% to $50.35 per share in trading shortly after its earnings report was released.

First Solar:

Beat earnings estimates. The company posted earnings of $0.64 (excluding $0.14 from non-recurring items) per share, defeating the Zacks Consensus Estimate of -$0.05 per share.

Beat revenue estimates. The company saw revenue figures of $623 million, beating our Zacks Consensus Estimate of $535.50 million.

Restructuring and asset impairment charges in the first quarter were $20 million. Net income increased versus the prior quarter, primarily as a result of improved gross margin and a discrete income tax benefit, partially offset by a decrease in other income. Cash flows used in operations were $168 million in the second quarter.

First Solar edited its full-year fiscal net sales prediction from $2.85 billion to $2.95 billion, to $3.0 billion to $3.1 billion. Additionally, the company updated its full-year fiscal operating cash flow estimates from $350 million to $450 million, to $850 million to $950 million. Finally, First Solar reduced its full-year fiscal capital expenditures projections from $525 million to $625 million, to $400 million to $500 million.

"We are encouraged by the continuing strong demand for our Series 4 product and are focused on meeting our customers' current needs. At the same time, our efforts to ensure the manufacturing and market readiness of Series 6 remains our highest priority. With the first Series 6 equipment being installed at our Ohio factory, and an increasing number of mid-to-late stage Series 6 bookings opportunities, we are pleased with our progress thus far,” said CEO Mark Widmar.

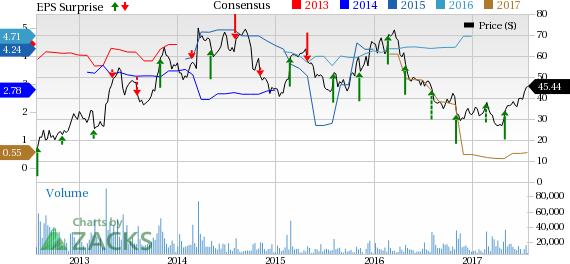

Here’s a graph that looks at FSLR’s Price, Consensus and EPS Surprise

First Solar, Inc. manufactures solar modules with an advanced thin film semiconductor process that significantly lowers solar electricity costs. By enabling clean renewable electricity at affordable prices, First Solar provides an economic alternative to peak conventional electricity and the related fossil fuel dependence, greenhouse gas emissions and peak time grid constraints.

Check back later for our full analysis on FSLR’s earnings report!

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

First Solar, Inc. (FSLR): Free Stock Analysis Report

Original post

Zacks Investment Research