The 5-year to the 3-year portion of the yield curve inverted today. Inversion is typically a prelude to recession.

Yield Curve Produces First Inversion in 7 Years

I have been watching the 5-3 and 3-2 yield spreads for months expecting an inversion would first occur there. Today, that happened.

Bloomberg also caught it, noting Flattening Yield Curve Just Produced Its First Inversion.

The spread between 3- and 5-year yields fell to negative 0.6 basis points Monday, dropping below zero for the first time since 2007. It’s probably not the best-known measure of the curve. The 2- to 10-year gap may have that honor. But Monday’s move could be the first signal that the market is putting the Federal Reserve on notice that the end of its tightening cycle is approaching.

Some analysts cautioned against reading too much into Monday’s inversion.

“It’s a minor part of the curve,” said NatWest Markets strategist John Briggs. “I don’t think it necessarily foreshadows anything.”

3-2 Inversion Coming Up

A 3-2 inversion is now in the batters box. I expect a base hit shortly.

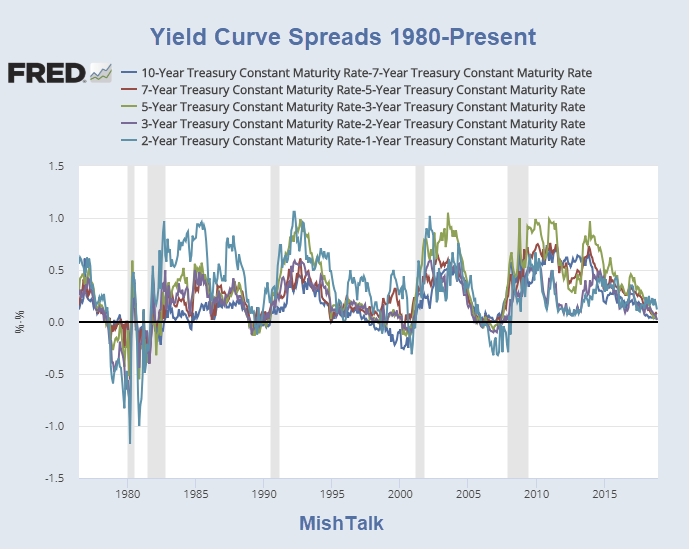

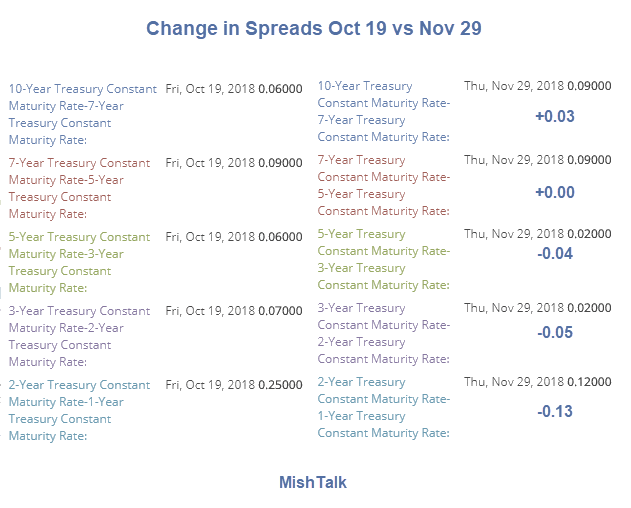

Here are some charts that I have been watching. Fred is a bit behind on posting data so my charts date back to last Thursday.

Yield Curve Spreads 1980-Present

Change in Yield Curve Spreads

Curiously, the 10-7 spread rose since October 19 while the rest of the curve flattened.

I disagree with the opinion of John Briggs. This is a strong recession warning. With the next hike, I expect more portions of the curve will invert.

The classic recession signal that most follow is a 2-10 inversion. I doubt we see a 2-10 inversion before recession hits.

My call: There will not be the warning nearly everyone is waiting for.

Mike 'Mish' Shedlock