First Data Corporation (NYSE:FDC) is partnering with Chip Ganassi Racing and driver Kyle Larson at Talladega and Martinsville.

On Monday, the commerce-enabling technology company entered into a sponsorship deal with Kyle Larson and the No. 42 Chevrolet SS team for the forthcoming Monster Energy NASCAR Cup Series (MENCS) at Martinsville Speedway and Talladega Superspeedway.

This is an extension of the partnership that started last season when First Data partnered with Jamie McMurray and the No. 1 Chevrolet team for Martinsville race. This year, the company will be an associate sponsor for McMurray’s car at Martinsville.

It also recently reached a three-year agreement with Martinsville to hold naming rights to the track’s MENCS race. The race will now be called the First Data 500 and will start on Oct 29.

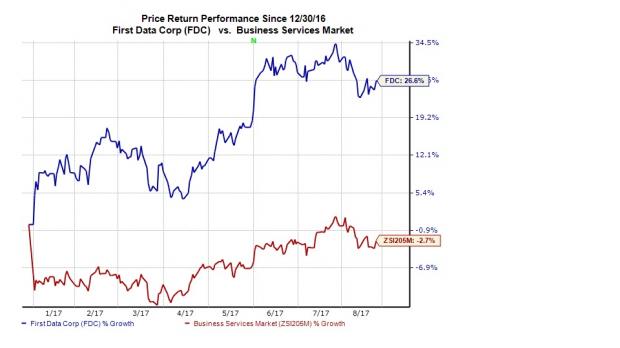

We observe that the First Data stock has rallied 26.6% year to date, significantly outperforming its industry that has lost 3.9% over the same time frame.

Deal Details

First Data will be seen on the hood of Larson’s No. 42 Chevy. The company’s recently acquired advanced payment solutions system CardConnect and Clover point of point-of-sale platform will also feature on the car.

Clover point-of-sale systems will be there at the tracks for fans to use it and purchase concessions. Clover will also be deployed at Phoenix Raceway and Homestead-Miami Speedway.

Our Take

We see the new move as First Data’s way of increasing popularity of its Clover and CardConnect offerings. That makes sense especially with CardConnect because it is First Data’s most recent acquisition, completed just last month.

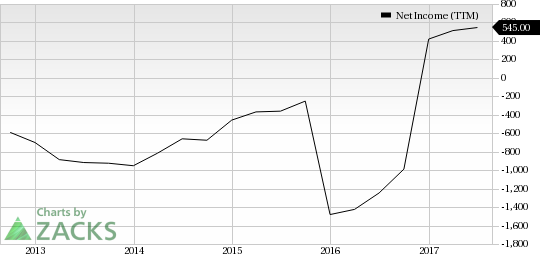

First Data Corporation Net Income (TTM)

Sponsorships do initially act as a drain on cash balance and weigh on margins but can be fruitful in the long term if used tactfully. Given that First Data has a prudent growth plan on track and a healthy business around large and small banks, moves like this could help it attract new customers and keep the existing ones hooked on its services.

The company has been strengthening its balance sheet, expanding margins and improving cash generation capacity through continued focus on innovation and strategic investments. This is required especially when its increasingly facing tough competition from the likes of PayPal (NASDAQ:PYPL) , Square (NYSE:SQ) and Mastercard (NYSE:MA) .

First Data currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

4 Surprising Tech Stocks to Keep an Eye on

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

First Data Corporation (FDC): Free Stock Analysis Report

Square, Inc. (SQ): Free Stock Analysis Report

PayPal Holdings, Inc. (PYPL): Free Stock Analysis Report

Mastercard Incorporated (MA): Free Stock Analysis Report

Original post

Zacks Investment Research