Analysts at BMO Capital Markets began coverage on shares of FireEye Inc (NASDAQ:FEYE) in a research report issued to clients and investors on Wednesday, MarketBeat.com reports. The brokerage set a "market perform" rating on the information security company's stock.

Several other analysts have also weighed in on FEYE. J P Morgan Chase & Co reaffirmed a "hold" rating and issued a $15.00 price objective on shares of FireEye in a report on Friday, November 4th. Bank of America reaffirmed a "hold" rating and issued a $15.00 price objective on shares of FireEye in a report on Friday, November 4th.

Pacific Crest reaffirmed a "hold" rating on shares of FireEye in a report on Friday, November 4th. William Blair reaffirmed a "market perform" rating on shares of FireEye in a report on Sunday, November 6th. Finally, Barclays reaffirmed an "equal weight" rating and issued a $16.00 price objective on shares of FireEye in a report on Sunday, November 6th.

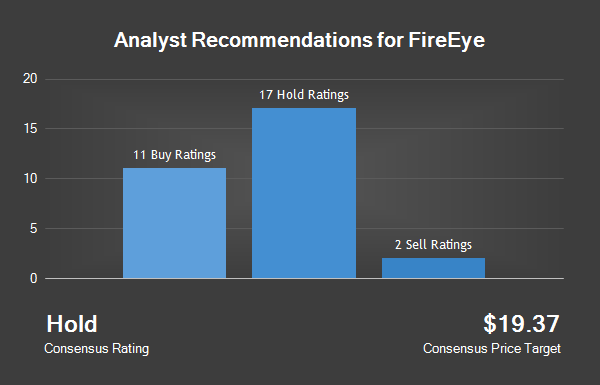

Two research analysts have rated the stock with a sell rating, eighteen have given a hold rating, twelve have assigned a buy rating and one has assigned a strong buy rating to the company. The company presently has an average rating of "Hold" and an average target price of $19.31.

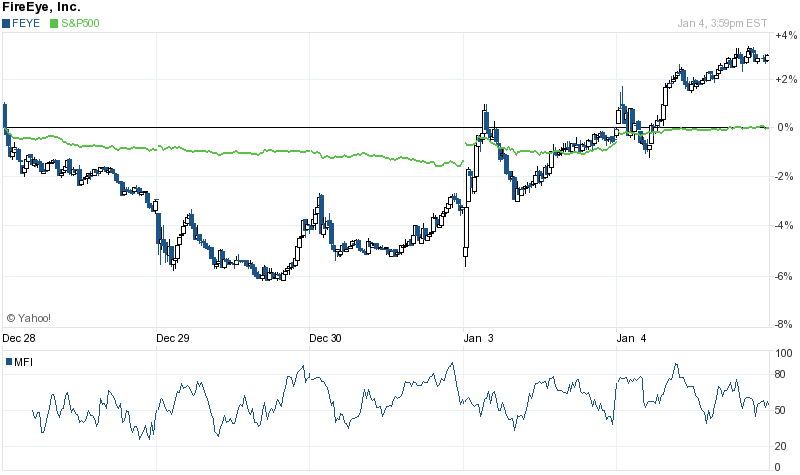

FireEye traded up 3.01% during trading on Wednesday, hitting $12.67. The stock had a trading volume of 5,317,169 shares. The company's market cap is $2.17 billion. FireEye has a 52-week low of $10.87 and a 52-week high of $20.15. The company has a 50-day moving average price of $12.97 and a 200-day moving average price of $14.29.

FireEye last issued its quarterly earnings results on Thursday, November 3rd. The information security company reported ($0.18) earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($0.31) by $0.13. The business earned $186.40 million during the quarter, compared to analyst estimates of $42.65 million. FireEye had a negative net margin of 77.67% and a negative return on equity of 44.91%.

The business's revenue was up 12.6% compared to the same quarter last year. During the same quarter in the previous year, the firm earned ($0.37) earnings per share. Equities research analysts forecast that FireEye will post ($1.13) EPS for the current year.

Several hedge funds have recently made changes to their positions in the company. Shapiro Capital Management LLC boosted its position in FireEye by 51.7% in the third quarter. Shapiro Capital Management LLC now owns 13,846,454 shares of the information security company's stock valued at $203,958,000 after buying an additional 4,717,054 shares in the last quarter. Falcon Point Capital LLC boosted its position in FireEye by 141.7% in the third quarter. Falcon Point Capital LLC now owns 1,134,958 shares of the information security company's stock valued at $13,188,000 after buying an additional 665,442 shares in the last quarter.

Jabre Capital Partners S.A. purchased a new position in FireEye during the third quarter valued at about $9,722,000. Vanguard Group Inc. boosted its position in FireEye by 6.1% in the second quarter. Vanguard Group Inc. now owns 10,553,940 shares of the information security company's stock valued at $173,824,000 after buying an additional 608,009 shares in the last quarter. Finally, Calamos Advisors LLC boosted its position in FireEye by 41.9% in the second quarter. Calamos Advisors LLC now owns 1,887,759 shares of the information security company's stock valued at $31,091,000 after buying an additional 557,213 shares in the last quarter. Institutional investors own 57.52% of the company's stock.

About FireEye

FireEye Inc provides cybersecurity solution for detecting, preventing and resolving cyber-attacks. The Company's cybersecurity solutions combine its purpose-built virtual-machine technology, threat intelligence and security in a suite of products and services. The Company's cybersecurity platform includes a family of software-based appliances, endpoint agents, cloud-based subscription services, support and maintenance and other services.