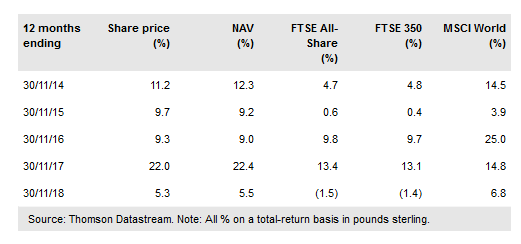

Finsbury Growth & Income Trust (LON:FGT) has a distinguished track record of outperformance – its NAV total returns are above those of the FTSE All-Share index benchmark over one, three, five and 10 years. It also ranks first over these periods when comparing its performance with that of its 10 larger-cap peers in the AIC UK Equity Income sector. Manager Nick Train highlights the trust’s 7.7% dividend growth in FY18, which was fully covered by revenue. He says this growth rate is very encouraging compared to the much lower levels of UK inflation and interest rates, and illustrates the strong cash flow being generated by portfolio companies, which he argues should continue to support FGT’s annual distributions.

Investment strategy: Very concentrated portfolio

Train runs a very concentrated fund of c 25 primarily UK-listed companies. He seeks quality firms, trading at a discount to their perceived intrinsic value, that he can ‘hold forever’. The manager is only invested in four of the 10 available sectors (consumer goods, financials, consumer services and technology), and holdings tend to fall into one of three themes: global consumer brands; owners of media/software intellectual property; and capital market proxies. Gearing of up to 25% of NAV is permitted, and up to 10% may be held in cash (although the manager prefers to remain fully invested); at end-October, net gearing was 2.8%.

To read the entire report Please click on the pdf File Below..