The five Canadian financial stocks on our list with high ROE have been top performers over the past year

SmallCapPower | December 5, 2017: Year to date, the Canadian financial stocks on our list have returned 19.5% on average, outperforming the BMO Equal Weight Banks Index ETF (TO:ZEB), which returned 14.7% over the same period. The list includes a variety of banking operations, ranging from traditional brick and mortar consumer lenders, to operators of branchless banking platforms. In addition, the listed companies have achieved industry-leading Returns on Equity over the last year.

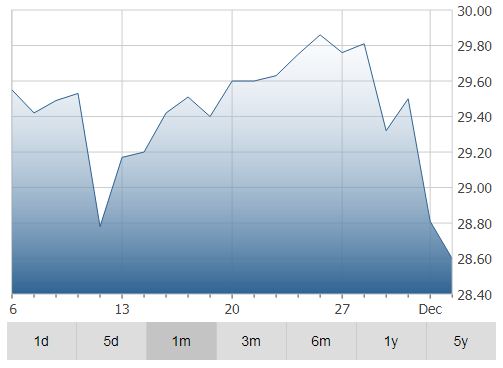

First National Financial Corp. (TO:FN) – $28.81

Corporate Financial Services

First National Financial is the parent company of First National Financial LP, Canada’s largest non-bank lender. The Company operates an investment fund, which provides commercial and residential mortgages. As of June 30, 2017, the Company had ~$100 billion in mortgages under administration.

- Market Cap: $1,728 Million

- YTD Return: 23.9%

- 3 YR EPS Growth: 2.3%

- Return on Equity (TTM): 52.3%

Equitable Group Inc. (TO:EQB) – $67.74

Consumer Lending

Equitable Group operates as a Schedule I bank that offers a variety of residential lending, commercial lending and saving solutions. The Company utilizes a branchless approach, instead working with mortgage brokers, deposit agents and financial planners. Currently, the Company has $22.3 billion in assets and employs 550 individuals across Canada.

- Market Cap: $1,116 Million

- YTD Total Return: 13.4%

- 3 YR EPS Growth: 13.4%

- Return on Equity (TTM): $17.1% Million

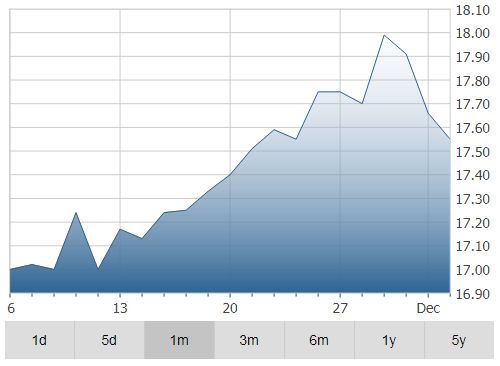

MCAN Mortgage Corp. (TO:MKP) – $17.66

Banks

Publicly listed in 1991, MCAN Mortgage Corporation manages a portfolio of mortgages focused primarily on single-family residential and residential construction loans. The Company issues term deposits eligible for CIDC Deposit Insurance, and pays strong dividend returns (Dividend Yield: 8.38%).

- Market Cap: $413 Million

- YTD Total Return: 31.2%

- 3 YR EPS Growth: 4.4%

- Return on Equity (TTM): 13.5%

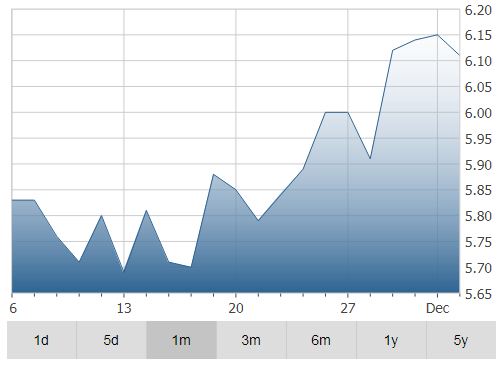

VersaBank (TO:VB) – $6.15

Banks

VersaBank operates as a Schedule I Canadian Chartered bank that leverages the latest FinTech technology to operate a “branchless banking” platform. The Company sources its funding from a network of deposit brokers across Canada, and utilizes its low-cost business model to provide real estate development and commercial loans to clients at competitive rates.

- Market Cap: $130 Million

- YTD Total Return: 20.6%

- Year over Year EPS Growth: 121.43%

- Return on Equity (TTM): 9.5%

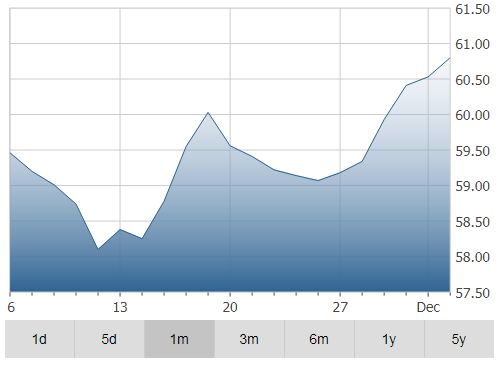

Laurentian Bank of Canada (TO:LB) – $60.53

Banks

Founded in 1846, The Laurentian Bank of Canada operates as chartered Canadian bank serving over 500,000 clients across Canada. Operating a network of 145 branches, the Laurentian Bank employs over 3,600 individuals and has approximately $32 billion in assets under administration.

- Market Cap: $2,351 Million

- YTD Total Return: 8.3%

- Year over Year EPS Growth: 30%

- Return on Equity (TTM): 9.3%

Disclosure: Neither the author nor any of the principals at SmallCapPower, or their family members, own units in any of the companies mentioned above.