Financials had a long run higher until August 2015. So just what happened last summer? The story goes that traders and investors started to believe that the Federal Reserve would actually raise rates. With the change in sentiment it was thought that banks would suffer as loan and interest rates rose. Then stocks started a march lower.

In reality, raising interest rates actually relieves some pressure on banks allowing them to create a spread when interest rates are up. Additionally, raising rates should be an endorsement of the strength of the economy. So over a longer view, this should be good for financial institutions. But we all know life does not move in a straight line.

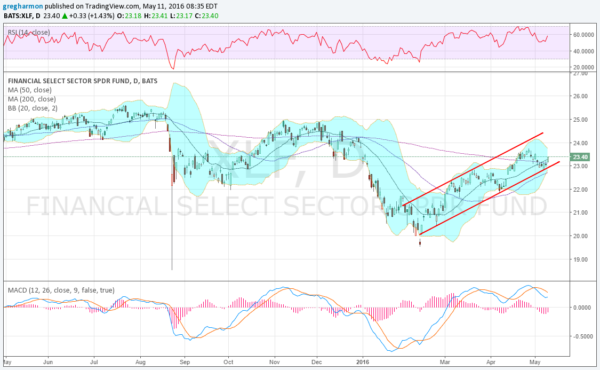

The Federal Reserve did raise rates -- once -- and the Financial Sector ETF (NYSE:XLF) fell to 2-and-a-half-year lows. But since that February bottom, things have been looking up. Signs of recovery in the chart have been adding up, giving promise to the sector. The rising channel of higher highs and higher lows is the first positive.

Bullish Cross

Late in February the ETF moved over its 20-day SMA and then the 50-day SMA to start March. By mid April it had broken above its 200-day SMA, only to pullback. Tuesday saw that recover. The 50-day SMA is fast approaching the 200-day SMA as well for a bullish Golden Cross by the end of the month.

Momentum is also holding up. The RSI is in the bullish zone and making higher lows. The MACD is positive and has held there for 2 months -- not the rollover that happened late last year. Another higher high will close the last gap from January and bring the November and December highs at 25 into focus. A move over 25 would mark a first major higher high and gather many more investors.