The financial sector is the focal point of the global economy. So it’s no wonder that investors pay close attention to its performance within the stock market.

And this is especially true when recession fears rise due to lackluster economic growth.

Kinda sounds like today’s markets, eh?

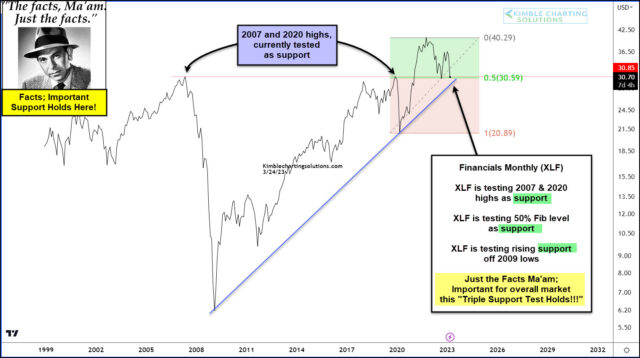

Is there trouble ahead for the economy? And for the stock market? Well, today’s monthly chart of the Financial Select Sector SPDR Fund (NYSE:XLF) is at a make-or-break triple price support level. And what happens next should answer those questions.

To be clear, XLF is testing 2007 and 2020 highs, its 50% Fibonacci level, and its rising trend line support all at once. Seems like this is a historic moment for XLF in both time & price.

Investors will sigh in relief if it continues to hold above this triple support.

However, if it breaks down below this support, the economy and stock market may take a turn for the worse. Stay tuned.