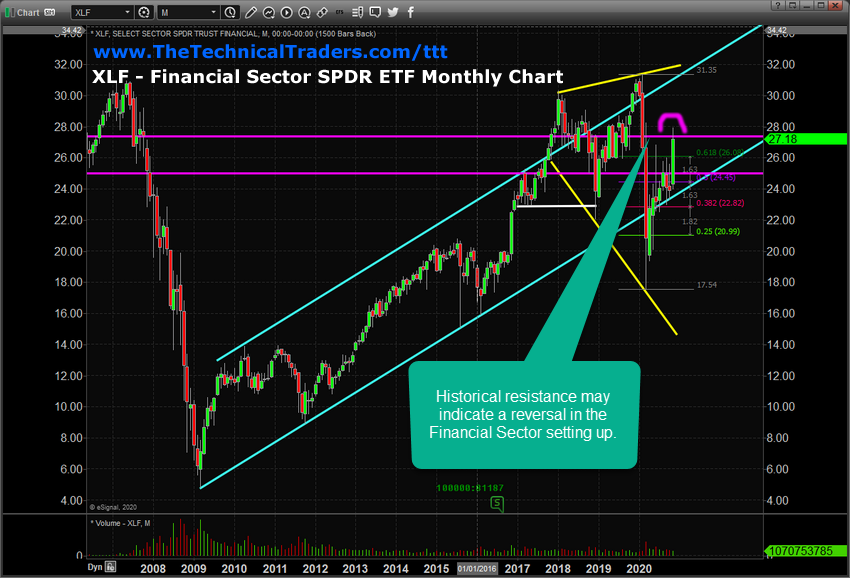

One would think the financial sector would be doing quite well related to the booming housing market and a decline in overall consumer debt and delinquency levels. Historically, the XLF Fund (NYSE:XLF) chart shows that $32 is very close to the 2007 peak levels before the collapse that started in late 2007. Currently, the February 2020 highs represent a similar price peak level (near $32), and the current upside price trend has stalled near $27.50, which is a very strong resistance level.

XLF Monthly Double Top Warns Of Strong Resistance Near $32

This monthly XLF chart below shows over 12 years of historical price data to allow our readers to understand the current market volatility and the current Double Top formation near $32. We've also added some trend lines to help you understand the current price channel (CYAN) and the expanding wedge formation (YELLOW) that has setup recently. The historical price channel (CYAN) shows the XLF is trading near the middle of this channel. The expanding wedge setup shows a moderately deep downside price capacity if the financial sector falls into a new bearish price trend.

Overall, there are two levels that have the focus of my research team – the $27.40 and $25.05 levels (the horizontal MAGENTA lines). We believe these historical support/resistance continue to play very important roles as price attempts to rally above the $27.40 level right now. If it fails to establish a bullish rally above this level, then the $25.05 level becomes an immediate support level for XLF. Below $25.05, the $21 is the next real support level for XLF before even deeper support is sought out.

XLF Weekly Upside GAP Shows Markets Want To Rally

The weekly XLF chart below highlights the island peak in price recently and the huge GAP in price. We believe the $27.40 (the upper MAGENTA line) level must continue to hold as support for this continued upside price trend to rally back above $30. This island peak and the double-top pattern on the monthly XLF chart suggests the financial sector has already reached a peak price level. As such, price would have to rally above $32 to prompt a new bullish price trend above the double-top price levels.

The U.S. stock markets continue to stay fairly strong recently with the news of the COVID-19 vaccines and future expectations that the U.S. may soon start to resume more normal activities. We believe the financial sector may continue to rally higher, but we are still cautious of the current island peak setup and the warning from the double-top pattern on the monthly chart. We may see some time of a Christmas rally into early 2021, then experience a completely different market cycle depending on the new U.S. President and policies.

The financial sector is uniquely exposed to consumer, retail, commercial and global credit/debt issues. We believe the financial sector is a moderately solid “bellwether' for traders to help gauge future expectations and opportunities. Currently, the XLF is showing fairly strong potential for upward trending, but big risks are present because of the island peak and the huge price gap.