The financial sector is poised for a very strong rally into the end of 2021, and early 2022 as revenues and earnings for Q4:2021 should continue to drive an upward price trend. The Federal Reserve is keeping interest rates low. At the same time, the U.S. consumer continues to drive home purchases and holiday shopping. Strong economic data should drive Q4 results for the financial sector close to levels we saw in Q3:2021. If that happens, we may see a robust rally in the U.S. financial sector over the next 45 to 60+ days.

The strength of the recent rally in the major U.S. indexes shows just how powerful the bullish trend bias is right now. Some traders focus on the downside risks associated with the Federal Reserve actions and/or the concerns related to inflation and global markets. I, however, continue to focus on the strength in the major indexes and various sector trends that show real opportunities for profits.

Comparing Sector Strength

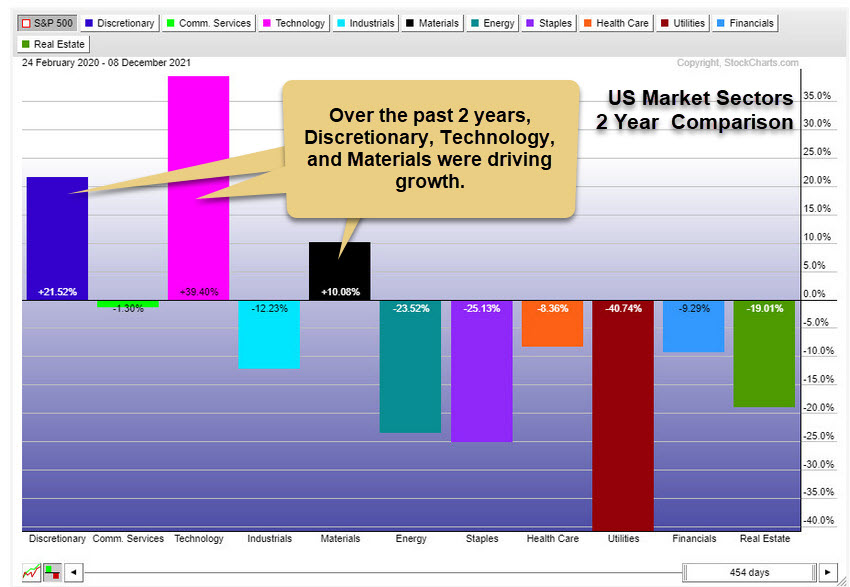

The following two U.S. market sector charts highlight the performance over the last 12 and 24 months. I want readers to pay attention to how flat the financial sector has stayed since just before the 2020 COVID event and how the sector has started to trend higher over the past 12 months. This is because the shock of COVID briefly disrupted consumer activity. Yet, consumers are coming back strong, driving retail sales, home sales and the continued strong U.S. economic data. Therefore, it makes sense that the financial sector should continue to show firm revenue and earnings growth while the U.S. consumer is active and spending.

Over the past two years, discretionary, technology and materials drove market growth compared to other sectors. Remember, the initial COVID virus event disrupted market sector trends over the last 24+ months.

(Source: StockChart.com)

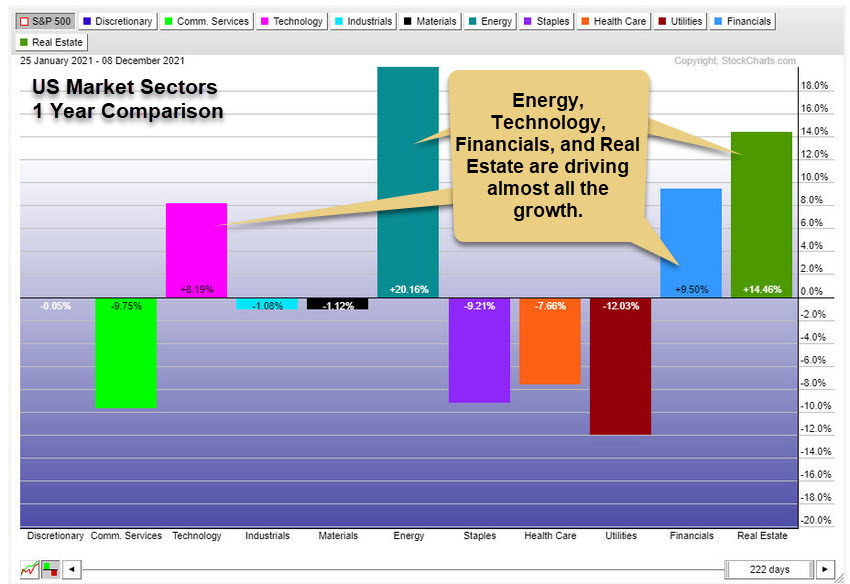

Taking a look at this one-year market sector chart shows how various sectors have rebounded and how the discretionary and materials sectors have flattened/weakened.

Pay attention to how the energy and real estate sectors have been over the past 12 months. Also, pay attention to how the financial sector is strengthening.

I believe that the continued deflation/deleveraging that is taking place throughout most of the world will continue to drive global central banks to stay relatively neutral regarding rising interest rates. This will likely prompt an easy money policy throughout most of 2022 and drive continued revenues/earnings for sectors associated with consumers' engagement with the economy.

If inflation weakens into 2022 while wage and jobs data stays strong, we may see more moderate strength in the financial, healthcare, discretionary and technology sectors over the next 6 to 12+ months.

(Source: StockChart.com)

Financials May Pop 11% Or More Over The Next 6+ Months

This weekly iShares U.S. Financial Services ETF (NYSE:IYG) highlights the recent sideways price trend in the financial sector and the potential for a 9% to 13% rally that may take place as the markets shift into focus for the Q4:2021 earnings. Yes, inflation is still a concern, but as long as the U.S. consumer continues spending and engaging in the economy, the financial services and U.S. banks should show strong returns.

If the markets rally into the end of 2021, possibly reaching new all-time highs again, this trend may carry well into 2022 and drive Q4:2021 and Q1:2022 revenues and earnings for the financial sector even higher.

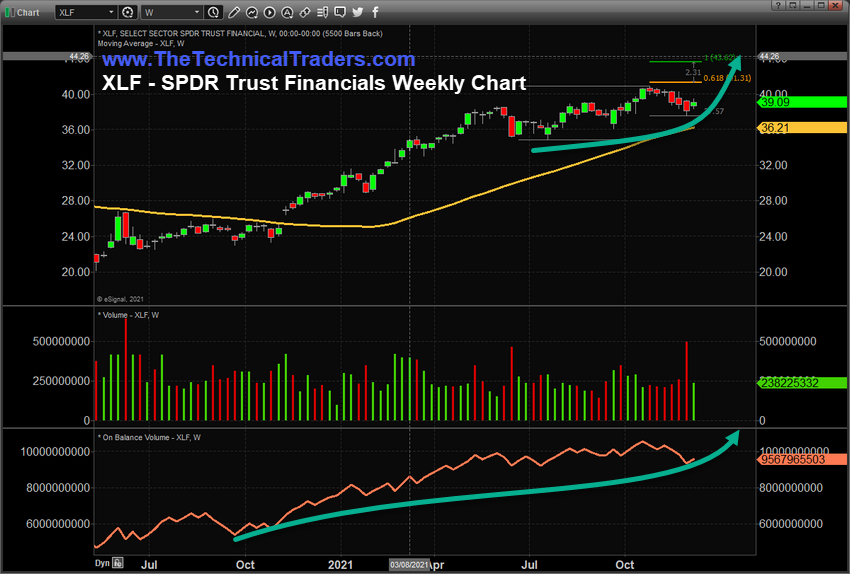

This weekly Financial Select Sector SPDR® Fund (NYSE:XLF) chart shows a very similar setup to IYG. I firmly believe the recent fear in the markets related to the Federal Reserve, the new COVID variants and the global markets deleveraging process is missing one critical component – the strength of the markets and the strength of the U.S. dollar.

As the rest of the world struggles to find support and economic strength, the U.S. markets continue to rebound on the strength of the consumer, the recovering economy and the growth of these sectors. As long as the Federal Reserve does not disrupt this trend, I believe Q1:2022 could be much more robust than many people consider. I also think the deflation/deleveraging process will work to take the pressures away from recent inflation trends.

What Could This Mean For 2022?

Early 2022 may well work as a "rebalancing" process for the global markets – possibly taking the pressures away from the strength in energy, commodities and staple products/materials. This means pricing pressures will decrease, while consumers are still earning and spending. The financial sector should benefit from these trends over the next 6+ months.

Watch for the financials to start to increase throughout the end of 2021 and into early 2022. There are many ways to consider trading this move, but ideally, I think the rally will take place before the end of February 2022.

Q1 is usually relatively strong, so that this trend may last well into April/May 2022. It all depends on what happens that could disrupt the current market sector trends. If nothing happens to disrupt the strength of the U.S. dollar and the strength of the U.S. markets, then I believe the financial sector has a very strong opportunity for at least 10% to 11% growth.