- As investors, we must glean crucial information about the companies on our radar when repositioning our portfolios.

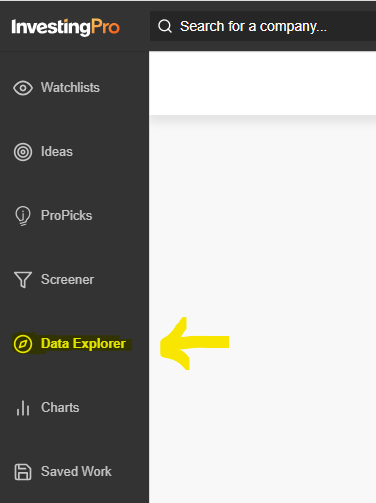

- InvestingPro's 'Data Explorer' allows you to search for all the data you need among hundreds of possible metrics.

- Be it the solvency ratio, basic EPS growth, Piotroski score, or return on assets, you can discover all the value-added information about companies in one place.

- Invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

In the dynamic world of markets, access to the best information is paramount for informed investment decisions.

InvestingPro, the professional tool from Investing.com, available only to premium users, provides a diverse range of value-added information crucial for effectively managing our portfolios.

Among the options offered by InvestingPro, the 'Data Explorer' section stands out, which displays financial information on companies according to a wide variety of metrics.

Source: InvestingPro

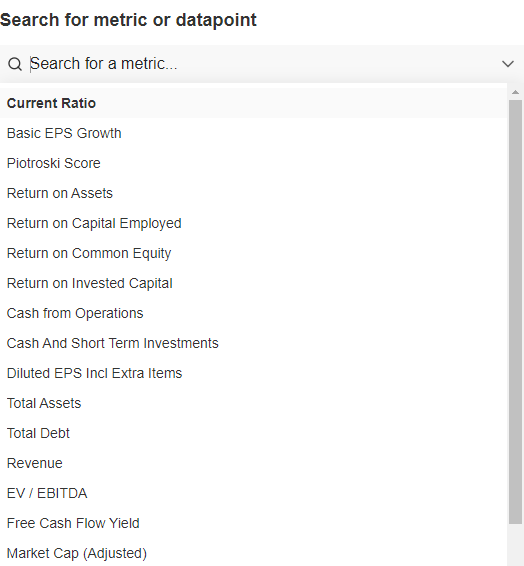

It offers a search engine with several options. These include solvency ratio, basic EPS (earnings per share) growth, Piotroski score, return on assets, return on capital employed, return on common equity, revenue, etc.

Source: InvestingPro

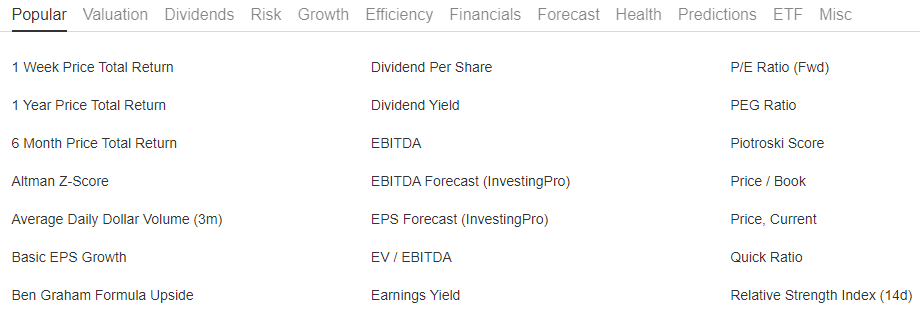

The data explorer also offers information according to the options that may be most useful to the investor: Most Popular, Valuation, Dividend, Risk, Growth, Efficiency, Fundamental, Forecast, Status, Predictions, or ETF, among others.

Source: InvestingPro

In each category, InvestingPro offers metrics sorted in alphabetical order.

The 'most popular' financial metrics are:

- 1-week total price return: total price change (adjusted for dividends and splits where applicable) over the last 1 week.

- 1-year total price return: Total price change (adjusted for dividends and splits where applicable) over the last 1 year.

- 6-month total price return: Total price change (adjusted for dividends and splits where applicable) over the last 6 months.

- Altman Z-Score: Formula used to predict the probability of a company going out of business within 2 years.

- Average daily dollar volume (3m): Three-month average of shares traded each day multiplied by the share price.

- Basic EPS growth: Growth in basic EPS for a quarter versus the previous quarter.

- Ben Graham Formula Increment: Percentage upside (if positive) or downside (if negative) an investor can expect relative to the current stock price based on the Ben Graham formula value. The Ben Graham formula value estimates the intrinsic value of a stock based on a formula inspired by investor and professor Benjamin Graham.

Source: InvestingPro

Under the 'Valuation' tab, you can find more than 170 metrics. Among them, the following stand out:

- Age of quoted price: Indicates the length of time since the last quote. The value is one of the following: delayed, real-time, end-of-day, or unavailable.

- EV/EBITDA ratio: Technique used to measure the level of EBITDA growth in relation to the EV/EBITDA multiple.

- Share turnover ratio: This item represents the three-month average volume divided by a company's outstanding shares.

Source: InvestingPro

In this analysis, we have discussed all the metrics available in 2 tabs, but there are still 10 other tabs that offer comprehensive information about the stock in question.

In a volatile market where strategic decisions can significantly impact our portfolio, possessing the most accurate market information becomes indispensable.

Know what to buy and what to sell before anyone else with InvestingPro!

Our best-in-breed product offering has all tools that will help you outperform the market today. Below is what you're missing out by not subscribing for a meager $9 a month:

- ProPicks: stock portfolios managed by a fusion of AI and human expertise, with proven performance

- ProTips: digestible information to simplify masses of complex financial data into a few words

- Fair Value and Health Score: 2 summary indicators based on financial data, providing instant insight into the potential and risk of each stock.

- Advanced stock screener: Search for the best stocks according to your expectations, taking into account hundreds of financial metrics and indicators.

- Historical financial data for thousands of stocks: To enable fundamental analysis pros to dig into all the details themselves.

- And many more services, not to mention those we plan to add shortly!

Don't face the market alone any longer, join the thousands of InvestingPro users and make the right decisions on the stock market to help your portfolio take off, whatever your profile or expectations.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice or recommendation to invest as such and is in no way intended to encourage the purchase of assets. I would like to remind you that any asset class is evaluated from multiple points of view and is highly risky. Therefore, any investment decision and the associated risk remains with the investor.