On Thanksgiving, for Wall Street, the level of enthusiasm displayed by the participants can sometimes give a good indication of how their favorite retail stocks may perform into the year-end.

Today's Highlights

Not so Quiet

Brexit Bull Trap

No More FUD Please

Please note: All data, figures & graphs are valid as of November 23rd. All trading carries risk. Only risk capital you can afford to lose.

Traditional Markets

Today was expected to be a rather quiet day in the markets yet somehow the Asian session managed to descend into chaos. The China A50 Index dropped 1.5% (left) to the bottom of the range (right) that's been building up for months.

Thankfully, the European session is holding up well with most major indices up more than 0.3%.

Brexit Bull Trap

The Pound Sterling got excited yesterday as it was announced that...

Here we can see the wild surge in the GBP at the time of the announcement (purple circle), but today the tough reality ahead seems to be setting into prices.

Zooming out on the chart, we can see that the Sterling is not having the best year but it does seem like it's somehow hanging in there. The key level of 1.2750 has proved historically significant since the referendum and does seem to be holding for now.

Fight the FUD

Those of you who are active on crypto social media may have run across these images of scrapped mining rigs...

It seemed a bit strange to me so I wanted to investigate a bit more thoroughly before commenting.

The first theory I heard was that these are recycled images from a flood that happened a few months ago. However, once I dug up that story it became clear that though they may seem similar, the rigs above are distinctly different from the ones that were lost in Sichuan Province in the July flood.

Not only that, the original poster above seems adamant that the images are fresh and relevant. Saying that it was posted in a Chinese mining WeChat group.

It all started to make sense when I found this video interview with a Chinese mining-rig supplier, who played down the recent images as FUD saying that this is standard operating procedure when you have ASICs that are no longer cost-effective.

In any case, with the declining prices lately, it's not surprising that some miners are going out of business. The issue here though is that many people in the industry are new and don't fully understand how these things work.

Then you get nonsense like this...

Well, I'm glad they've got questions, because we have answers. This is a healthy part of the Bitcoin cycle, where everyone who got involved a year ago is now learning as much as they can about crypto. During the next surge, they will be the experts.

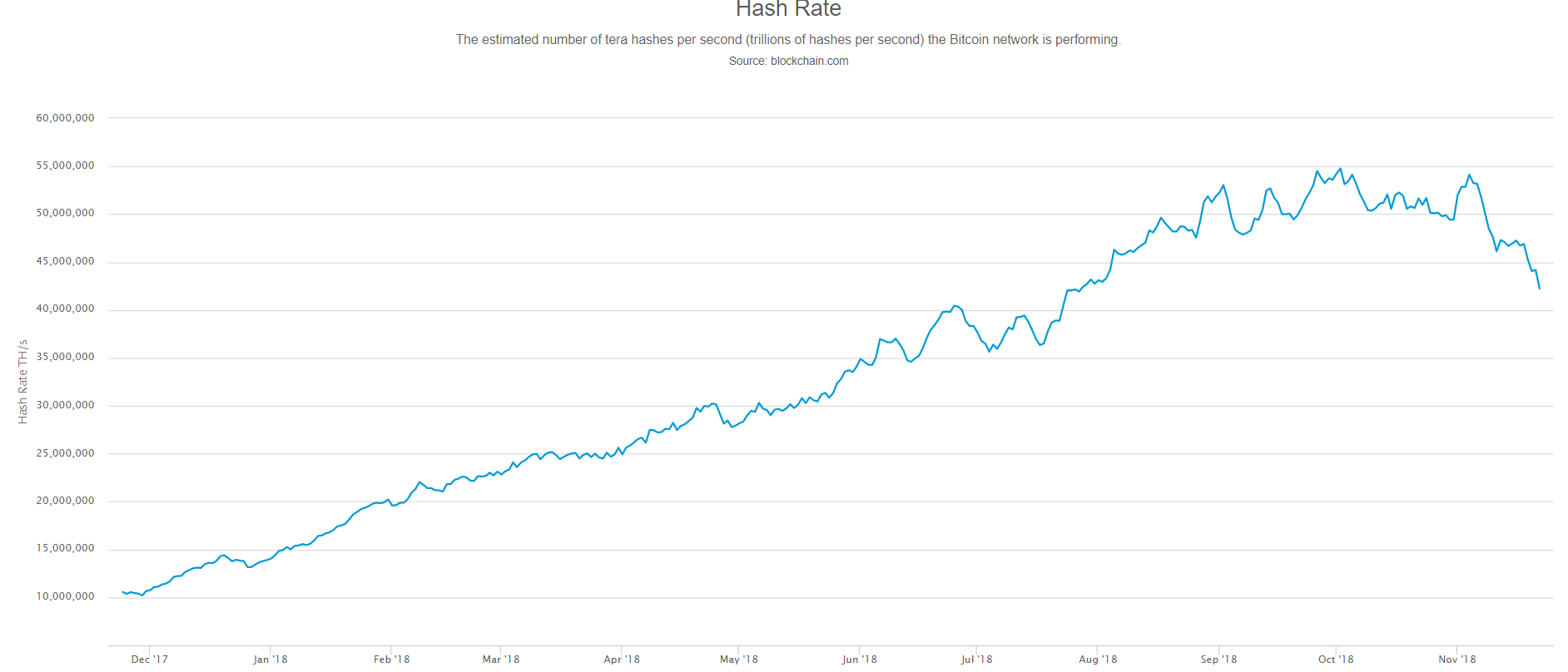

In any case, Bitcoin's hash rate has indeed dropped in the last few weeks but this is not at all concerning. It's actually comforting as the rate has risen so sharply over the course of the year and is now returning to normalized levels.

Also, it should be noted that the hashrate doesn't directly influence supply or demand. Each bitcoin block is still created about every 10 minutes, creating exactly 12.5 new BTC for the miner who creates it.

If there's less hash, it will simply make it easier for the ones who are left to find the blocks.

For all my readers, I would appreciate if you would please participate in a quick one-question poll I put out on Twitter. The results will be published in Monday's market update.

Wishing you a pleasant weekend.

eToro, Senior Market Analyst

Disclosure: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of future results. All trading carries risk. Only risk capital you're prepared to lose.