Fifth Third Bancorp (NASDAQ:FITB) is scheduled to report second-quarter 2017 results, before the opening bell on Jul 21. Its revenues and earnings are expected to grow year over year.

The company boasts an impressive earnings surprise history. It topped earnings in three of the trailing four quarters with an average positive earnings surprise of 19.6%.

In the last quarter, the company delivered in line earnings driven by increase in net interest income and lower provisions. However, lower non-interest income was an undermining factor.

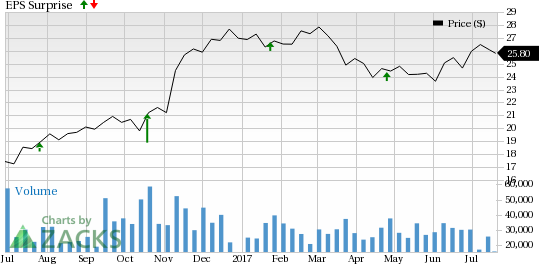

Looking at the price performance, Fifth Third’s shares have gained 3.7% year to date, outperforming the Zacks categorized Banks – Major Regional industry’s decline of 1.7%.

Fifth Third Bancorp Price and EPS Surprise

Why a Likely Positive Surprise?

According to our proven model, Fifth Third has the right combination of two key ingredients — positive Earnings ESP and a Zacks Rank #3 (Hold) or better — to increase the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks ESP: Earnings ESP, which represents the difference between the Most Accurate estimate and the Zacks Consensus Estimate, stands at +2.38%. This is a major indicator of a likely positive earnings surprise.

Zacks Rank: Fifth Third’s Zacks Rank #3 when combined with a positive ESP makes us reasonably confident of an earnings beat.

Factors to Drive Better-than-Expected Results

Expenses Might Remain Flat: Fifth Third’s ongoing strategic investments in several areas, including technology, will increase expenses. However, the company might be successful in offsetting these factors through its North Star initiatives.

Sluggish Loan Growth: Impacted by uncertainties related to the proposed reforms by President Trump, overall loan growth is anticipated to be slow for the to-be-reported quarter. This might curb net interest income growth driven by improved interest rate scenario.

Alleviated Pressure on Net Interest Margin: The interest rate hike by the Federal Reserve in Mar 2017, followed by another in Jun 2017, should ease some margin pressure. However, contraction in the three-month/10-year Treasury spread might offset some benefits.

Fifth Third’s activities during the quarter were, however, inadequate to win analysts’ confidence. As a result, the Zacks Consensus Estimate remained unchanged at 42 cents, over the last seven days.

Other Stocks that Warrant a Look

Here are some other stocks you may want to consider, as according to our model they have the right combination of elements to post an earnings beat this quarter.

Citizens Financial Group, Inc. (NYSE:CFG) is slated to report second-quarter results on Jul 21. It has an Earnings ESP of +1.70% and a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Huntington Bancshares Incorporated’s (NASDAQ:HBAN) Earnings ESP is +4.35% and it carries a Zacks Rank #3. The company is expected to release second-quarter results on Jul 21.

Old National Bancorp (NASDAQ:ONB) has an Earnings ESP of +3.70% and a Zacks Rank #2. It is scheduled to report second-quarter results on Jul 25.

3 Top Picks to Ride the Hottest Tech Trend

Zacks just released a Special Report to guide you through a space that has already begun to transform our entire economy...

Last year, it was generating $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for those who make the right trades early. Download Report with 3 Top Tech Stocks >>

Fifth Third Bancorp (FITB): Free Stock Analysis Report

Huntington Bancshares Incorporated (HBAN): Free Stock Analysis Report

Old National Bancorp (ONB): Free Stock Analysis Report

Citizens Financial Group, Inc. (CFG): Free Stock Analysis Report

Original post

Zacks Investment Research