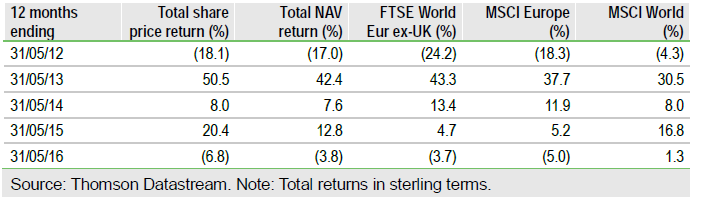

Fidelity European Values (LON:FEV) aims to achieve long-term capital growth through investing primarily in continental European equities. The manager follows a consistent bottom-up approach, seeking to identify companies able to grow dividends over a three- to five-year horizon. FEV’s NAV total return performance has been ahead of its FTSE World Europe ex-UK benchmark over three, five and 10 years, although investments in out-of-favour areas of the market have given the portfolio a slightly contrarian large-cap bias relative to peers, which has been unhelpful during recent small-cap outperformance. The portfolio’s historically high relative dividend yield and superior growth prospects are seen by the manager as a positive indicator for future performance.

Investment strategy: Focused on dividend growers

The manager employs a fundamental bottom-up approach, seeking to identify cash-generative companies able to deliver above-average dividend growth over a three- to five-year horizon. Focusing on structural growth prospects and balance sheet strength, stock selection is guided by comparing market values to an assessment of fair value. Unconstrained by top-down allocations, the manager aims to hold a well-diversified portfolio with sector weightings within five percentage points of the benchmark. Although a total shareholder return (TSR) ranking analysis is used to indicate opportunities for portfolio rebalancing, turnover remains low.

To read the entire report Please click on the pdf File Below