Fidelity China Special Situations (LON:FCSS) invests in a diversified portfolio of Chinese equities, seeking exposure to higher-quality companies, primarily in faster growing, consumer-orientated areas of the economy. FCSS provides actively managed exposure to the Chinese market, following a bottom-up investment approach, unconstrained by index weightings, and currently has no holdings in banks or property, which are considered to be higher-risk sectors.

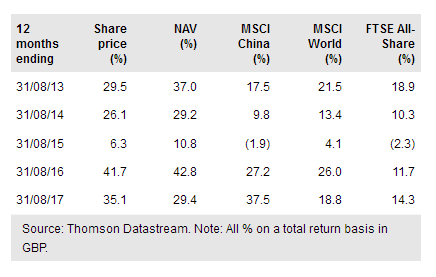

FCSS has achieved a 14.5% pa NAV total return since its launch in April 2010, and its performance is considerably ahead of the MSCI China index and the world market over three and five years.

Investment strategy: Selecting for quality and value

The manager follows a bottom-up investment approach to maintain a diversified portfolio of 130-140 holdings, with a bias to small- and mid-cap stocks, which tend to be under-researched and hence more frequently mispriced. There is a focus on faster growing, consumer-orientated companies with robust cash flows and capable management teams.

Fidelity analysts provide in-depth stock coverage, with site visits and company meetings considered essential to the process, and risk management is viewed as a priority. FCSS has US$150m of borrowing and uses futures, options and contracts for difference (CFDs) to add gearing, as well as to take short positions. Unlisted securities may comprise up to 10% of the portfolio.

To read the entire report please click on the pdf file below:

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.