Less than eight months ago, in September, 2022, Alphabet (NASDAQ:GOOGL) dropped below the $100 a share mark. The stock was already down by a third from its all-time high of $151.55. With inflation still running rampant and the Fed not even close to the end of its rate hiking campaign, investors were on the verge of panic. A recession looked inevitable and stock prices were widely expected to keep falling.

Alas, if things in financial markets happened as widely expected, everyone would be a billionaire. The fact that most people aren’t billionaires suggests that it pays to be a contrarian from time to time. So, instead of joining the bear chorus right away, we decided to take a look at GOOGL’s 4h chart first. Surprisingly or not, it actually revealed a bullish setup. Take a look.

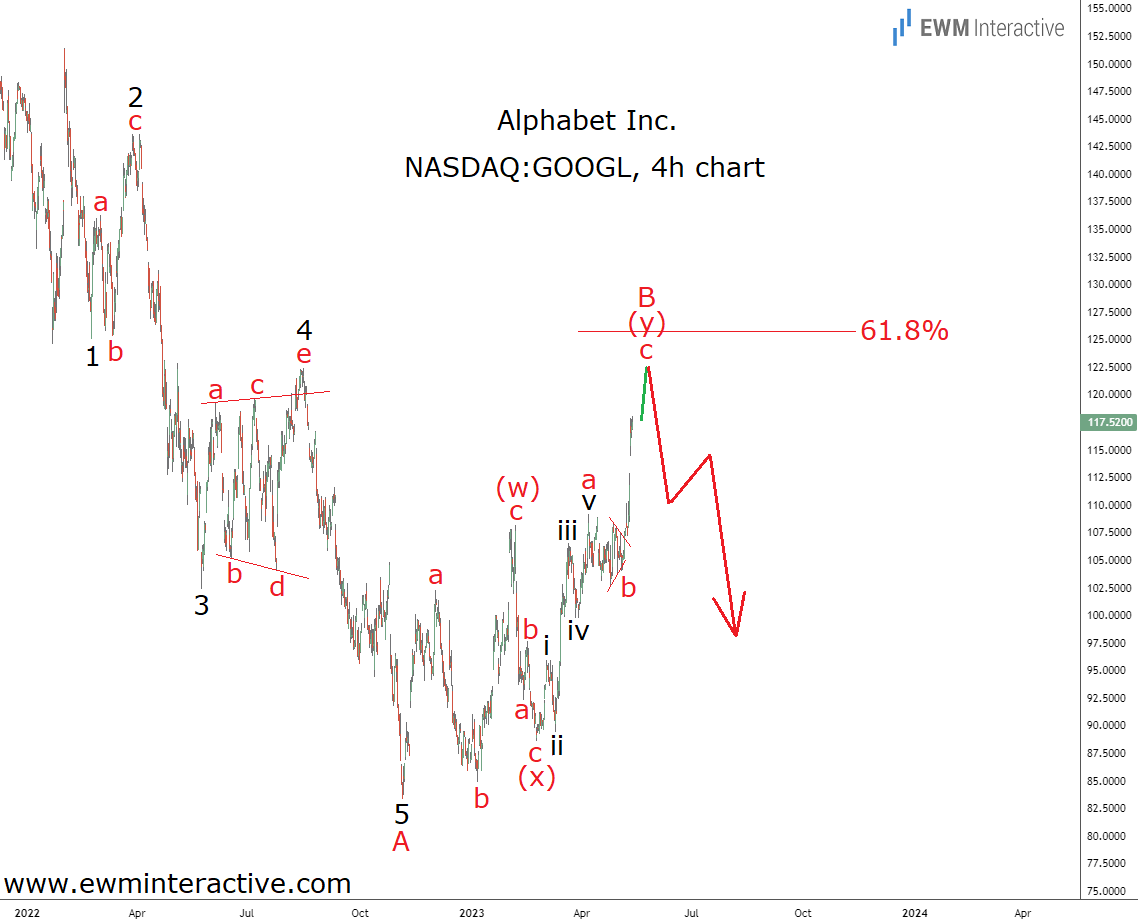

The chart above was shared with our readers on September 22nd, 2022. It showed that the drop from over $151 a share was shaping up as a five-wave impulse. We labeled the pattern 1-2-3-4-5, where wave 4 was an expanding triangle. According to the Elliott Wave theory, a three-wave correction in the opposite direction follows every impulse.

So instead of seeing the drop below $100 as a sell signal, we thought that the bears were likely to allow a notable recovery. A bullish reversal made sense as soon as wave 5 of A was over. Since corrections usually retrace the entire fifth wave of the impulse, the anticipated rally had the potential to lift Alphabet to the resistance of wave 4 near $120. The updated chart below shows the stock’s progress over the following eight months.

Wave 5 completed the impulsive sequence in wave A at $83.34 on November 3rd. Last week, GOOGL closed at $117.51, up 41% from that 2022 bottom. We managed to catch 19% of those. But the structure of this recovery is one reason why Alphabet is no longer part of our portfolio. It looks like a (w)-(x)-(y) corrective combination in wave B. Wave (w) is a regular flat correction, while wave (y) seems to be a simple a-b-c zigzag, where wave ‘b’ is a triangle.

If this count is correct, Alphabet stock’s bearish Elliott Wave cycle is almost complete. Once a correction is over, the preceding trend resumes. Not to mention that the price is now approaching the 61.8% Fibonacci resistance level. This means we should prepare for a bearish reversal for the beginning of wave C down, whose initial targets lie below $80. From the current zone near $120, this decline would erase a third of the company’s market cap.

Elliott Wave analysis is not the only reason for our pessimism, though. 2022 already demonstrated that the almighty Alphabet is still vulnerable in an economic slowdown. The company’s revenue growth rate decelerated materially and there wasn’t even a real recession last year. Unfortunately, we still think there will be one, probably starting in early-2024. At a P/E ratio of 22, the stock seems slightly overvalued, and therefore more risky, heading into it. Hence our decision to sell our GOOGL shares yesterday.